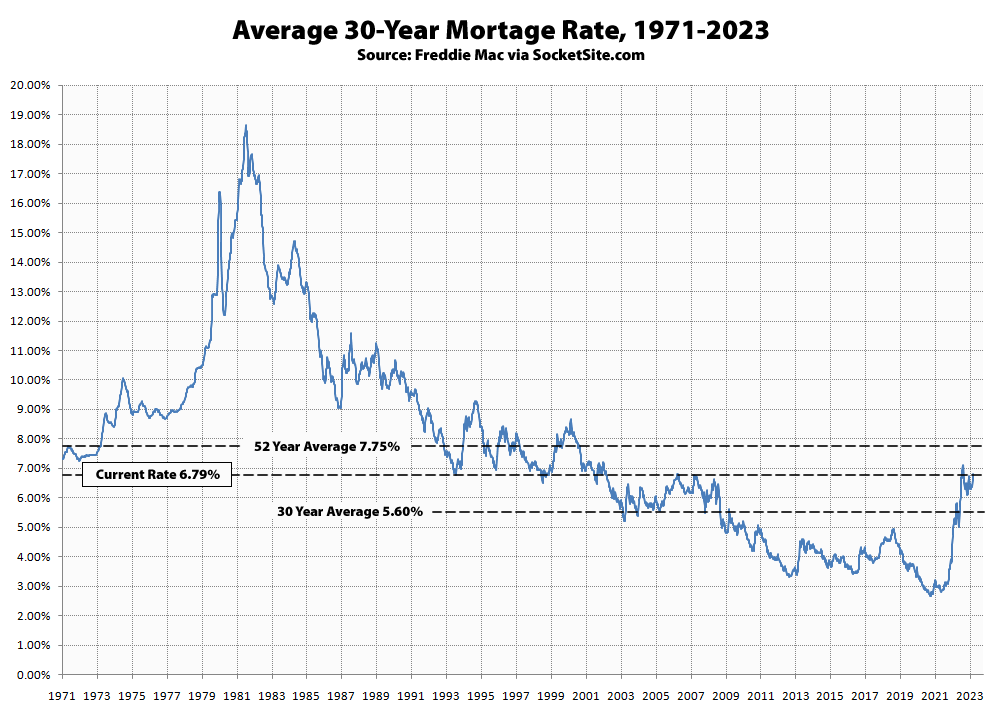

The average rate for a benchmark 30-year mortgage has jumped 40 basis points (0.40 percentage point) over the past two weeks to 6.79 percent, which is 170 basis points and over 30 percent higher than at the same time last year, none of which should catch any plugged-in readers, other than the most obstinate, by surprise.

At the same time, credit availability has dropped back down to a decade low, jumbo-conforming spreads have narrowed with lender appetite having dropped, risk premiums are on the rise, and the probability of an easing by the fed continues to drop as well, with the odds of another rate hike this summer nearing 60 percent.

And once again, for those who have been holding on to some bad forecasting and “reporting” that was making the rounds last year and continues to be regurgitated, keep in mind that Freddie Mac’s updated rate forecast, which didn’t make as much of a splash in the industry press or agent newsletters, calls for the 30-year rate to average over 6 percent through the 4th quarter of this year, a forecast which is likely to be further “adjusted” up in the near future.

The Personal Consumption Expenditures index rose by 6.3% year over year in April, so I think The Fed will hike at least another 25 basis points at the next FOMC meeting. Which will mean that the 30-year mortgage will move higher than the above-mentioned 6.79.

You don’t want to argue that it’s “low enough” that we should just learn to live with it?

Some people

on herea while back were pusing to normalize ~4% inflation…so what’s an extra few points, between friends?Watching the developers, flippers and other hangers-on who operate in the S.F. real estate “game” over the years has taught me that what I think should happen doesn’t matter. What will happen is what people in power want to have happen, and in the case we’re discussing, what will happen is based on what the members of The FOMC want to have happen. I don’t think The Fed is going to accept normalizing 4 percent inflation.

Jerome Powell has already said that they aren’t going to change the 2 percent inflation goal, so unlike some participants in the futures and bond markets, I’m basing my decisions on believing that he’ll do what he says, which is keep hiking until inflation is brought to the target rate.

I used to comment 2011 and earlier. Just discovered thanks to google that I made a guest appearance in 2014 to reiterate my Interest Rate comments/theory. lol that Socketsite still hasn’t changed it’s tune… makes it sound like they know how to predict where rates are going. Back then SS was always pointing to the 30 year trend or avg, as if it would happen any day. Whereas I said “won’t go above 5% for years to come” and that above 5% happens when inflation hits, and that will be the result of a supply shock (pandemic as an example) and/or massive government stimulus (which has nothing to do with the Fed). Well 2020 we got both, and so 6 years after my last comment SS got it’s prediction right, lol.

And now? Pay attention to Gov debt/deficits and ignore the Fed if you want any chance of guessing where rates are going. For now, sideways is most likely. SS can brag about a couple of basis points here or there, but if you want below 5% or much above 7% look guess inflation first, and look to the only factors that really matter to inflation, which again, has near zero to do with the Fed

Not quite. Or more accurately, not at all.

While we’ve consistently tried to drive home the point that sub 5 percent rates weren’t simply a “new normal,” which many were mislead to believe, we didn’t warn of an impending spike in rates until late 2021.

In fact, our message in 2014 was rather different from what you’re representing or recall, none of which, including the key impact (“which should translate into…less purchasing power for buyers and downward pressure on home values”), should catch any plugged-in readers by surprise.

UPDATE: The average rate for a benchmark 30-year mortgage inched down 8 basis points (0.08 percentage point) over the past week to 6.71 percent, which is only 148 basis points and 28 percent higher than at the same time last year. At the same time, the probability of another rate hike this summer has ticked over 60 percent.