Having ticked up a percent in February, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – ticked up another three percent in March but with the majority of the uptick (75 percent) having been driven by typical seasonally.

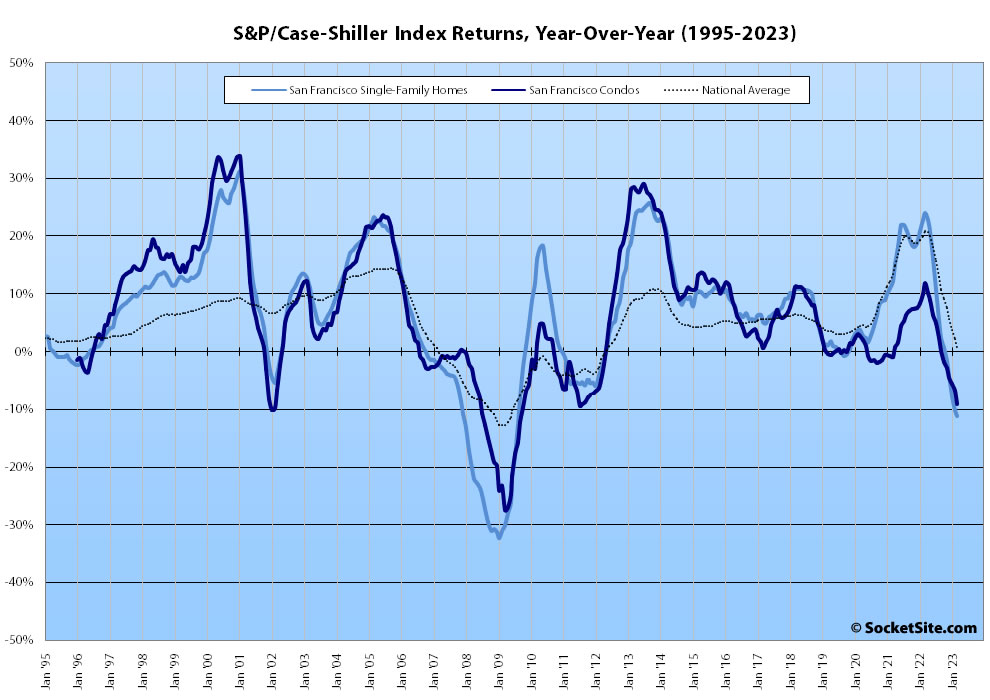

That being said, the “San Francisco” index is still down over 14 percent from last May and 11 percent lower than at the same time last year, representing the largest year-over-year drop for the index, the depth of which is still trending down, in over a decade.

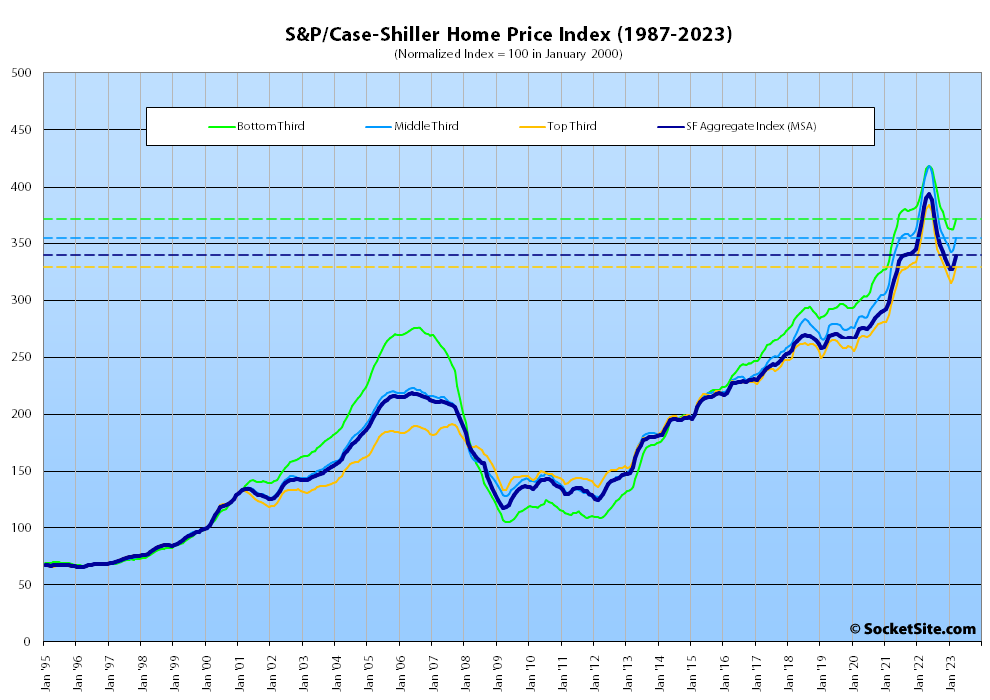

At a more granular level, the index for the least expensive third of the Bay Area market ticked up 2.4 percent in March for a year-over-year decline of 8.5 percent; the index for the middle tier of the market ticked up 3.2 percent with year-over-year decline of 12.2 percent; and while the index for the top third of the market ticked up 3.3 percent, it was down 11.0 percent versus the same time last year, representing the largest year-over-year decline since 2009.

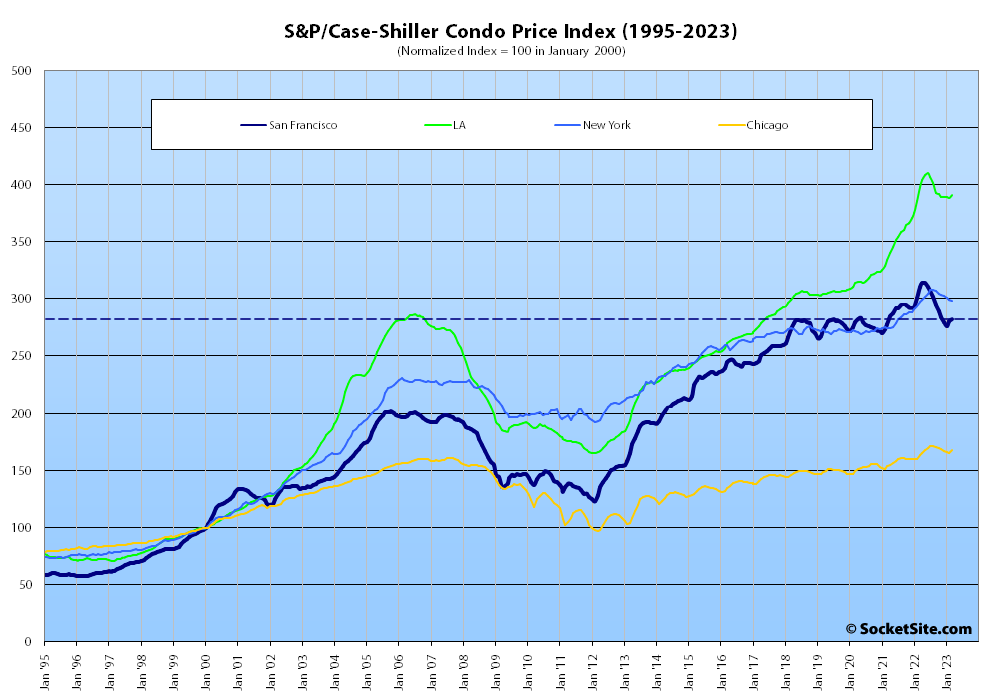

The index for Bay Area condo values, which remains a leading indicator for the market as a whole, inched up 0.6 percent in March but was down 9.2 percent on a year-over-year basis and 10 percent lower than last May, with the first year-over-year drop for Los Angeles since 2019 and New York (up 0.4 percent) poised to go negative as well.

And while the national home price index ticked up 1.3 percent from February to March, the year-over-year gain dropped to 0.7 percent and is poised to turn negative next month, having shed 3.7 percent over the past nine months, with Miami (which remains 7.7 percent higher than at the same time last year) continuing to lead the way with respect to exuberantly indexed home price gains, followed by Tampa (up 4.8 percent) and now Charlotte (up 4.7 percent), but with Washington (down 0.2 percent) and Dallas (down 1.2 percent) having just joined Los Angeles (down 2.9 percent), Denver (down 3.6 percent), Phoenix (down 4.5 percent), Portland (down 4.6 percent), Las Vegas (down 5.1 percent), San Diego (down 5.3 percent), San Francisco (down 11.2 percent) and Seattle (down 12.4 percent) in recording year-over-year declines, all of which were mostly indexed prior to the regional banking meltdown in March.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

there is going to be some serious money made in shorting the Miami real estate market in the near future. I will be evaluating that move post labor day.

How the hell do you short real estate?

If you can’t or don’t want to use the CME housing futures market (because it’s so thinly traded), can you not still short the mortgage bonds concentrated in that area using a credit default swap as described in Michael Lewis’s famous book?

I realize that some of the more exotic instruments in the a collateralized debt obligation world circa 2007–08 no longer exist in the wild. And I assume you’re not going to get very far if you’re not an accredited Investor, but maybe jimbo is.

One word:

plasticshouseboats.Doesn’t shorting assume some advantage of assymetric knowledge ?? Or are you just counting on a high level of general ignorance and denial ??

irrational exuberance.

Po TAY to, po TAH to.

Sounds like a plan !!

I don’t know about the near future, but 100% agree in the long term. With sea level rise, it’s going to be uninsurable.

Looks like Socketsite added the link to sea level rise in San Francisco. A corresponding map in Miami shows half of the place underwater, depending on the exact details. But it will be uninsurable far before then.

And the insurance companies have access to the best modeling software and data collection to be able to project when will be the financially optimum moment to begin denying coverage.

Most of us have already read most of what’s been published along these lines, but for those readers who haven’t, from Yale University, As Miami Keeps Building, Rising Seas Deepen Its Social Divide:

Emphasis mine. It goes on to say that high-end real estate developers have a lot of political power in Miami, but they have little incentive to act collectively in the face of climate upheaval because they often don’t hold onto the buildings they build for more than a few years. Maintaining the glittering towers they’ve built ends up being the responsibility of the condo associations.

It is bizarre that anyone is still building in Miami. No one knows what the general real estate market will look like in 50 years, but we know that without question, in 50 years Miami will be uninsurable, which is to say all real estate there will be worth a lot less. That much sea level rise is already baked in to the atmosphere.

Will there be a tipping point? A big hurricane which floods the whole city? Or will the realization just creep up? I don’t know.