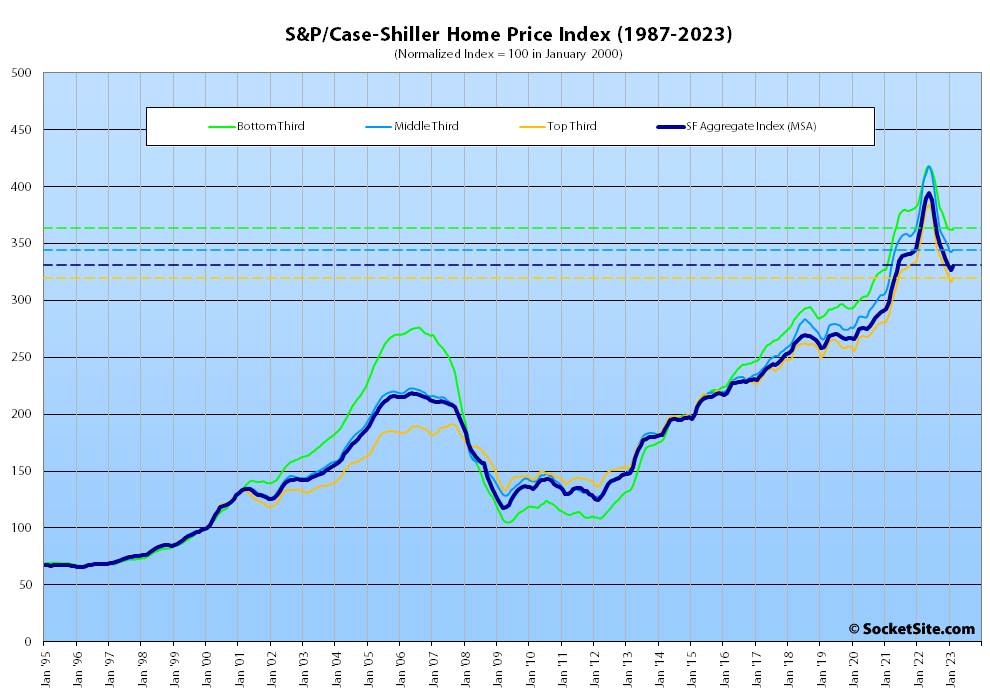

Having dropped for eight months in a row, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – ticked up one (1) percent in February with a pinch of seasonally in play (the index slipped 0.3 percent in February on an adjusted basis).

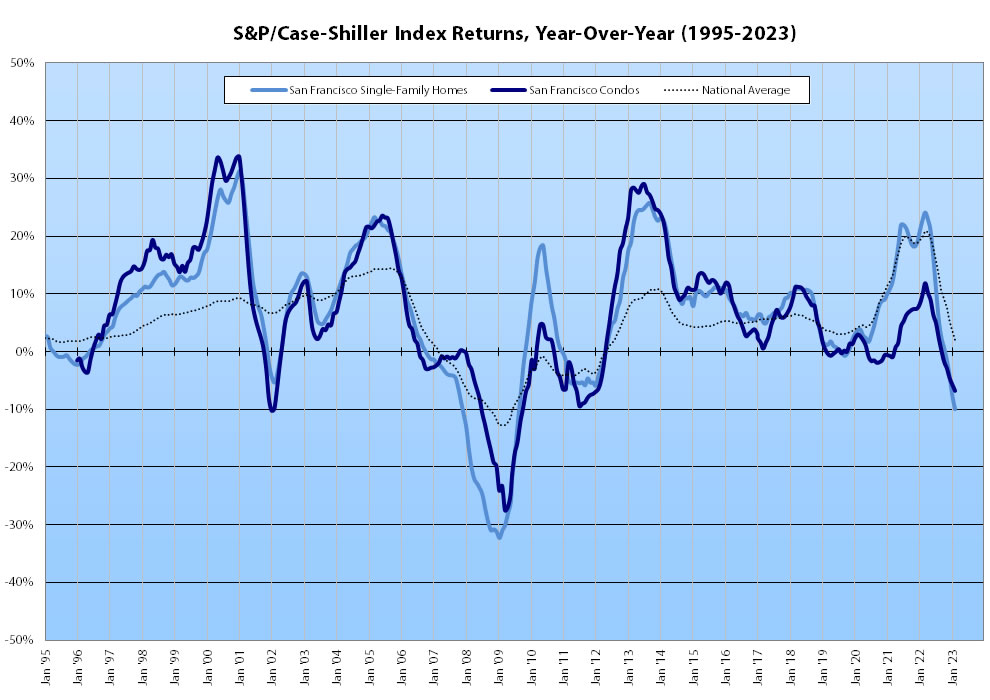

That being said, the “San Francisco” index is still down 16 percent from last May and 10 percent lower than at the same time last year, representing the largest year-over-year drop for the index, the depth of which is still trending down, in over a decade.

At a more granular level, the index for the least expensive third of the Bay Area market slipped 0.1 percent in February for a year-over-year decline of 8.2 percent; the index for the middle tier of the market inched up 0.5 percent but was still down 10.7 percent on a year-over-year basis; and while the index for the top third of the market ticked up 1.3 percent, it was down 9.7 percent versus the same time last year, down from a 7.4 percent drop in January and representing the largest year-over-year decline since 2009.

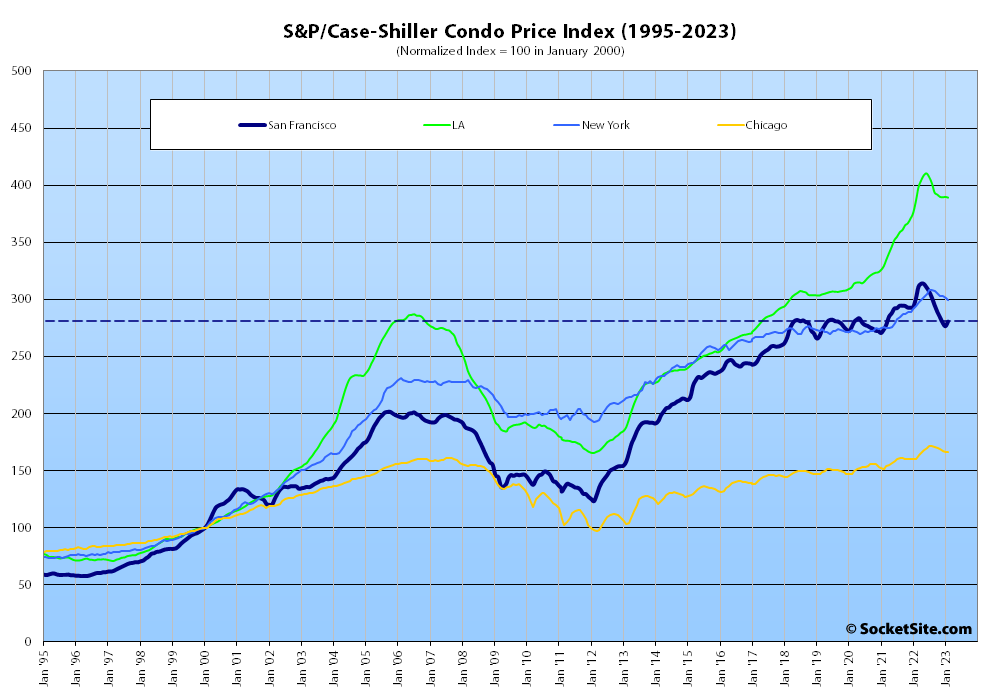

The index for Bay Area condo values, which remains a leading indicator for the market as a whole, ticked up 1.4 percent in February but was down 6.8 percent on a year-over-year basis and over 10 percent lower than last May, with “year-over-year gains” still reported for Los Angeles, Chicago and New York.

The national home price index inched in February as well, gaining 0.2 percent in the absolute and halting a seven month slide. But the year-over-year gain for the national index dropped to 2.0 percent and the index is 4.9 percent lower than eight months ago, with Miami (which remains 10.8 percent higher than at the same time last year) continuing to lead the way with respect to exuberantly indexed home price gains, followed by Tampa (up 7.7 percent) and Atlanta (up 6.6 percent), but Portland (down 3.2 percent), Las Vegas (down 2.6 percent), Phoenix (down 2.1 percent), Los Angeles (down 1.3 percent) and Denver (down 1.2 percent) having joined San Francisco (down 10.0 percent), Seattle (down 9.3 percent) and San Diego (down 4.1 percent) in recording year-over-year declines, all prior to the regional banking meltdown in March.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

-35% adjustment looks highly probable.

A 35% downward “adjustment” would put us in great depression territory. Outside of office real estate and shopping center real estate, *nothing* in the economy portends such a major downward slide.

RE was the last great store of value and source of yield in the West. Which was why so much money was funneled into RE rather than Industrial and human personnel development. As a result RE valuations skyrocketed while real productivity and affordability fell. What is going to transpire /could/ be worse than 2008.

If the Fed (re) invokes QE – inflation will kill the economy. If they continue with QT – then there could be lot of short term distress / withdrawal pains. But maybe that is the medicine needed.

To continue to the QE drip or Not? That is the question.

“A 35% downward “adjustment” would put us in great depression territory.”

Not really. Just look at the last two apples (at vastly different price points in the market): 30% below 2015, $1.3M original price; 35% below 2017 price, $6.1M original price. And considering that cumulative inflation since 2015 has been 27%, the real declines here are massive.

Now of course, two data points don’t prove that the average Case Schiller *will* go down that far. But it does show that it is absolutely possible for sales to occur with a far larger drop than 35% from peak with nothing like the Great Depression going on. After all each sale is just one data point in the CS average, but its a bit more then that for gauging the state of the market. Since sales generally go to the highest bidder, it tells you that *every other* eligible looker in the market passed on these places above the closing price.

So how do you get a 35% drop in the market? The highest bidders in the market simply bid at prices that are 35% or below what valuations were at the peak. Just like what happened here.

And to those who think that people are less levered this time around, remember that in 2020-21 rates were in the 3% range. Compare the purchasing power of taking an IO loan out with rates below 3% vs taking a fully amortizing loan with rates above 6%. (It seems almost a given that SVB, First Republic and others will not be making these types of loans available to any appreciable extent)

And “Great Depression” is hyperbolic, but it does seem very likely that these price declines are going to cause problems somewhere in the financial system. Conforming loans are probably sliced and diced and spread around the system enough that any problems even in the wider SF Bay Area are unlikely to matter much to the global financial system. But many SF Bay Area loans are probably not confining either due to size or other non-standard terms.

Bloomberg is reporting that First Republic alone issued $20B of 10 year IO loans just in 2020-21. A combination of a sharp rise in interest rates, which devalues loans made at lower rates, and a sharp decline in the value of the underlying homes spells financial disaster. The question is who is holding the bag and how concentrated is that risk? I’m sure we’ll find out in the days, weeks and months to come.

I really don’t see this to be honest. Most properties in non crappy hoods are selling fast and at over $1000 / sq ft. This is based on anecdotal personal data of homes I have seen on Sunday afternoons, didn’t really like much, tracked nonetheless and then noted their final sell price. There is just not enough inventory in decent neighborhoods, where supply is suppressed by powerful self interest groups. If I had to live in SOMA or East Cut or Little Hollywood or Lake Merced, I would much rather move back to Chicago.

“… and then noted their final sell price.”

What are you comparing the sell price against?

@ MOD. I was dividng the final sale price when close divided by the square footage per tax records to realize that the price per SF has not dropped in decent hoods like Castro/ Nopa/ Russian Hill / Inner Richmond/ Inner Sunset or Cole Valley.

On an apples-to-apples basis, that’s incorrect.

I think the effect of “supply [being] suppressed by powerful self interest groups”, while not entirely irrelevant, is being outweighed by the simple fact that mortgage interest rates are currently much higher than they were just last year, which is in turn weighing heavily on current selling prices and the trajectory thereof.

People who currently own and want to move up on the property ladder and who don’t have to sell for the usual reasons are sitting tight and waiting until the market recovers and mortgage interest rates return to a somewhat lower level, even if they never return to the levels available during the pandemic. Most of these people who have mortgages are paying at rates < 6 percent.

Perhaps you are counting these people as part of the “powerful self interest groups” because they don’t want to sell their home and then have to buy another property at a price that looks like it’s falling just as fast as a knife toward the kitchen floor. I think most people would call them market savvy.

@ Brahma. I agree, those people not selling now are savvy. I was talking about the fact that due to years of NIMBY ism and flawed approval permit process that takes years, there is never going to be enough supply in the City and I see prices possibly stop rising for the time being, but not falling by any significant amount.

“… I see prices possibly stop rising for the time being, but not falling by any significant amount.”

That’s a good prediction and matches downturns from the last half century. I feel that the duration of the stagnation is more significant than the percentage drop in value, which usually is less than 15%.

As we outlined earlier this week, the average asking price per square foot for a home in San Francisco, which slipped back under $1,000 a square foot last week, has since ticked down another percent and is now 7 percent lower than at the same time last year but still 5 percent above the average price per square foot of the homes which are actually in contract which has dropped under $950 per square foot. But that’s factually speaking, not based on anecdotes.

For real estate, San Francisco is the worst performing metro area in the US. Miami and other areas are at the other end of the spectrum, showing YoY growth.

SF’s problems are huge and each additional bit of bad news speeds up the city’s downward momentum. It’s hard for me to see why anyone would want to move to SF these days, let alone set up a business there.

While it may seem counterintuitive to folks getting their news from the WSJ or Fox, believe it or not, San Francisco doesn’t have to be an advantageous place for people stetting up a business for it to be a desirable destination for people.

Some people will be repelled by the culture and political environment of cities like Miami (most of which will be underwater in our lifetime) and choose to live their lives here even if they would otherwise increase their earnings if they knuckled under and put up with the constraints imposed on them by working a job that requires them to be physically located in alternative locations. Real, living people are not members of the species Homo economicus.

That is basically the real thesis of the L.A. Time’s column from earlier this week, Sorry, San Francisco is not the crime-ridden hellhole the far right claims it is, which another anon should read even though I admit it veers of course and doesn’t really address the crime fears in it’s title (S.F.’s defenders don’t do The City a service when they try to parry claims about widespread crime by repeating the stat about rates for violent crimes like homicide and rape thus far being on par or declining from last year—property crimes do matter, and the author admits this later on).

If the main effect of the barrage of negative news about San Francisco is that we have fewer people moving here in the next few years to make money in “the real estate game” by exploiting people here who will overpay for housing, then that will be a net positive, in my book. The City should fund an internet ad campaign presenting banner ads to people in that demographic that read “don’t move to S.F.; your dreams of being the West Coast’s answer to Fredrik Eklund are highly unlikely to be realized and Malin Giddings isn’t likely to lose any listings to you” to support that.

My favorite part is how you point out San Francisco is actually an okay place to live, and then you take a bunch of shots at people who point out that San Francisco is actually an okay place to live.

There isn’t any question that the “Central Business District” / FiDi is suffering, while residential is holding fairly steady in the face of much higher borrowing costs. What makes the headlines in changes in residential pricing here is a rounding error compared to what is going on in the office market.

To the extent I took shots, it was at people who are asserting that San Francisco can’t be an okay place to live because it’s not some adult amusement park for capitalists, real estate-focused ones in particular, to make lots of money.

Your derision for people who work in real estate is well-documented.

It is also as well-founded as the logic that our food would be cheaper if we had fewer farmers and we would have less expensive health care if we had fewer health care professionals.

Someone with a profit motivation built every home in California. The supposition that we can all simply /live/ here without building more housing and improving what exists is preposterous privilege.

Take note, Brahma: the economics of a perishable, generally inelastic, interchangeable, consumable commodity is identical to that of a durable, generally elastic, heterogeneous speculative asset class.

Brahma, I’ve lived in SF for 23 years in various neighborhoods, so I know what it was like before the tech boom and what it’s like now. Many things have changed in the city, and not for the better.

I have yet to meet someone who likes the “culture” of San Francisco who isn’t also independently rich, or hasn’t figured out to make the required money to live in, or hasn’t figured out a way to take from the local city/state governments. Anyone who desires to live in and lives in SF, must respect the “Laws of Economics” — there is no getting around that.

About ‘exploitation & prospecting’ for riches: San Francisco has always been a city of hustlers regardless of however many dreamy songs that were written in its praise. San Francisco has only ever thrived or withered for the money it can or cannot make (and the cost of culture) for its residents.

Wait a second. You have not met anyone who enjoys SF with a normal job such as let us say a trademark paralegal or a structural engineer or a firefighter or a content editor who lives in a flat? Or are those people taking from the local city / state government because they pay rent based off a type of rent control ? .

Cave dweller doesn’t get out much.

Those jobs that don’t deliver incomes enough to sustain an average American lifestyle while living in SF aren’t normal. But yes people can sleep over and under the bed, time share restrooms and manage to “live” until they find their lottery or leave in disillusionment.

Well, I chose those occupations for a reason. They happen to be people that I know with families and it’s a fairly diverse range of jobs as well. They afford the city. They don’t have roommates. They go on vacations. Sometimes we join them on the vacations. They seem to enjoy life as far as I can tell.

Fredrik moved to the West Coast