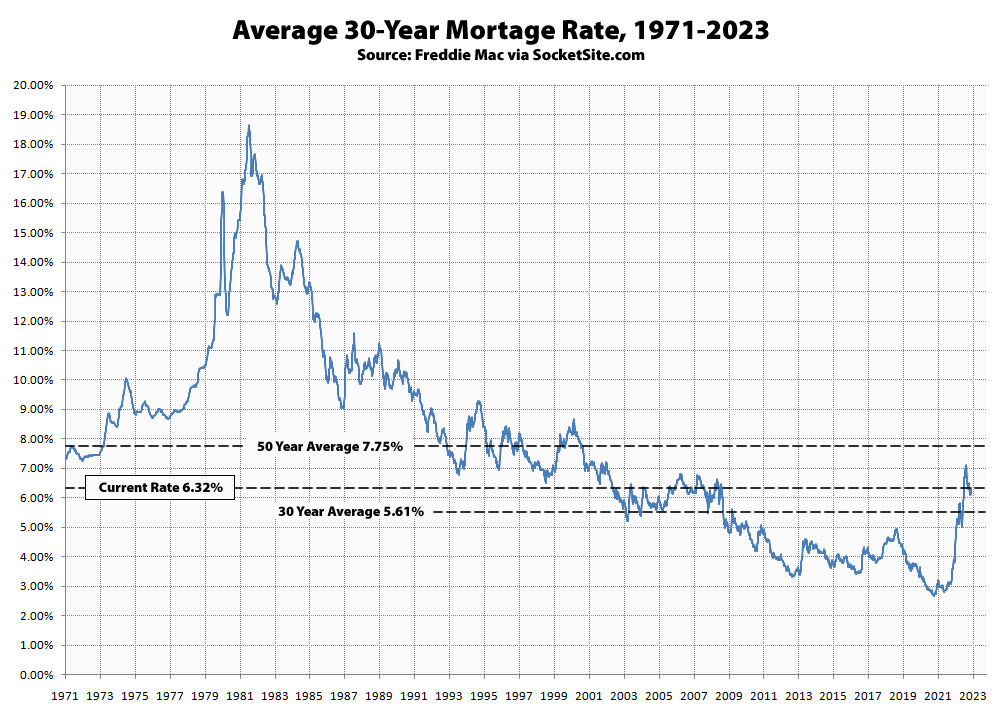

The average rate for a benchmark 30-year mortgage ticked up another 20 basis points (0.20 percentage points) over the past week to 6.32 percent, which is 240 basis points higher than at the same time last year and 367 basis points, or nearly 140 percent, higher than its all-time low of 2.65 percent in early 2021 but still well below its long-term average of 7.75 percent.

At the same time, the probability of the Fed hiking rates by at least 50 more basis points over the next couple of months has now ticked over 80 percent, with nearly zero chance of any easing by the end of the year, despite some misanalysis that’s been making the rounds, which should further depress purchase mortgage activity/demand and home values, right at the start of the spring selling season, none of which should catch any plugged-in readers by surprise.