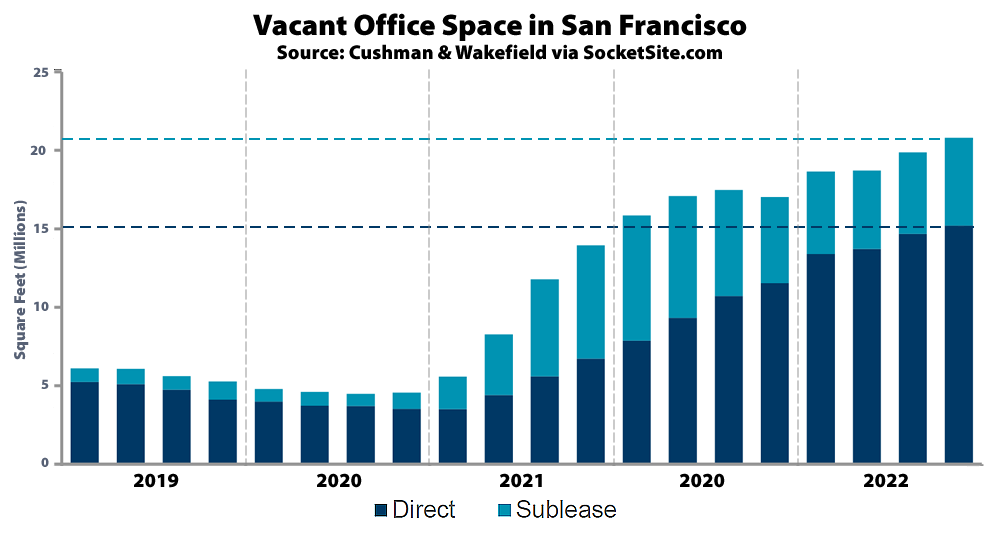

Having hit a pandemic-era high of 23 percent in the third quarter of last year, the effective office vacancy rate in San Francisco has since ticked up another 110 basis points to just over 24 percent, representing nearly 21 million square feet of vacant office space in buildings spread across the city, with 5.6 million square feet of space which is technically leased but unused and being offered for sublet, which is up from 5.2 million square feet of sublettable space in the third quarter, and the amount of un-leased and non-revenue producing space having increased from 14.7 to 15.2 million square feet, according to data from Cushman & Wakefield.

As a point of comparison, there was less than 5 million square feet of vacant office space in San Francisco prior to the pandemic and the vacancy rate in San Francisco has averaged closer to 12 percent over the long term, with a much smaller base of buildings.

At the same time and despite more companies having ramped-up their return to office (RTO) policies in the second half of last year, the estimated active demand for office space in San Francisco dropped 20 percent over the past quarter to 3.8 million square feet, driven by companies “downsizing their office space needs” and future growth plans. That’s compared to over 7 million square feet of demand in the market prior to the pandemic, at which point there was a fourth as much vacant space as today.

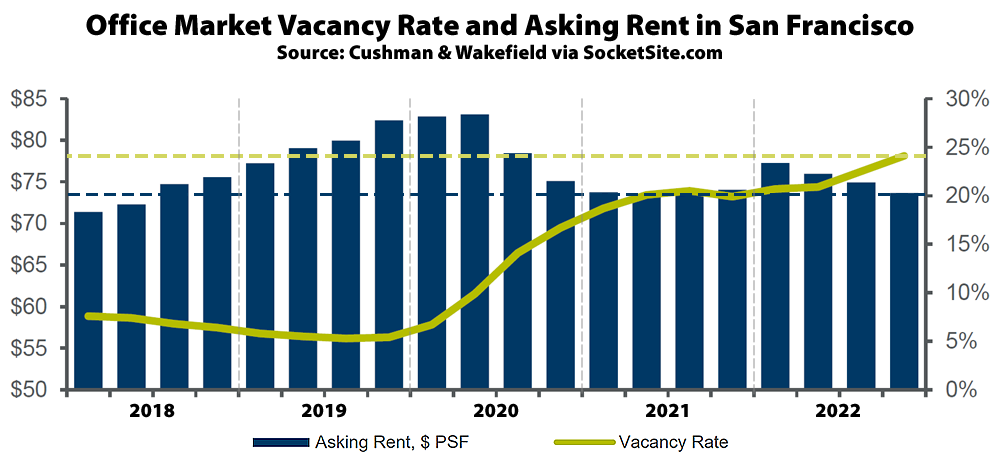

And while the overall average asking rent for office space in San Francisco ticked down another 150 basis points over the past quarter to $73.66 per square foot, and has dropped around 11 percent from its peak in 2020, “rents in top tier buildings remain strong” and the average asking rent hasn’t moved much over the past two years but is poised to take a significant hit, despite the best efforts of landlords to keep the asking price metric up.

request that the editor continue using the established “vacant Salesforce towers” metric rather than reporting as vacant square footage.

Don’t worry, we’ll run our (non) patented Salesforce Tower equivalency metric and visualization, which we first created over two years ago and others have since co-opted, tomorrow.

cool. that one’s very nice. I would also add that i know a lot more companies that are looking to downsize their office footprint and it was part of their year end planning. One presentation at a medium size company with more than 500 SF employees was “how to cut office space expenses by 75%” the goal is to get to that by end of 2023.

UPDATE: Enough Empty Office Space for 160,000 Worker Bees in San Francisco

High rents are correlated with high yield. Low yields must translate to low rents – more to go. Could we extend this graph to use data from 2000 thru now (if the editors have access to such data)?

Guesses as to the month, year and % vacancy where we hit peak vacancy?

I’m going December 2024 @ 35%.

I’m hearing people discussing how one day a week in office is enough to get the desired collaboration vibes. My guess is there will be a lot of chopping up of offices into smaller 2-10K square feet bites with individual teams having a standing one day in office. Maybe it rotates on a quarterly basis.

Many expect a wave of expiring office leases early this year could see San Francisco’s vacancy rate rise to 28% in the first half of 2023. According to JLL tenants are shrinking their footprint by about 14% on average when they renew their leases.

DocuSign just announced it will keep its SF office but significantly downsize its footprint. It’s going to be an ongoing problem over the next few years so a 35% vacancy rate by EOY 2024 seems possible.

The City’s chief economic analyst last year projected the possibility of 40% vacancy rates in certain sub-markets like the mid-Market/Civic Center area.

In keeping an expansive common area for representation, replete with sweeping and unobstructed Bay Bridge/TI views, DocuSign might be a bit of an outlier. I figure they’ll either move their worker drones over into these common areas, enticing with views, or give that up altogether and return the views to the market for somebody else to enjoy.

One wonders what effect the expiring leases will have on office vacancy in 2023-24? I’m told there are “a lot” of leases out there ready to expire in 2023. The “other shoe” are CMBS loans that need to be recast in 2023 and 24. The appetite by the banks and lenders for refinancing vacant office buildings is to put it mildly, “lean”. Commercial loan rates have gone from 4.0 – 4.5 to 6.0 & 7.5 % and some watchers expect to see banks going double digits by the end of 23′.

I guess we watch as this slow motion train wreck begins to take shape in the coming months. By the way, office vacancy in the SoMa and Mission have also reached new highs of 45%. Well that was a month ago.

Other sources are saying 27% vacancy rate.

Other sources include pipeline developments in their vacancy rate calculations, which they shouldn’t. Regardless, it’s the relative rates and consistency of methodology that really matter.

No real surprises here. Before the pandemic, San Francisco had started taking some anti-business measures. The pandemic just gave businesses an opportunity to look into relocating. For example the CEO tax. The vacancy tax. Hopefully the next mayor will look into attracting companies back…..but voters keep passing legislation to discourage them. But maybe that’s what local San Franciscans want….which is unfortunate but if that’s what they want…..

i think a lot of the empties would make nice luxury residential spaces. i like how quiet FiDi is at night.

i’ve tried to get an office but i’ve been working from home for 20+ years. there are sometimes when an office is better (i suppose) but SF+SV are heavily skewed towards a WFH workforce.

COVID showed us with proper network security a lot of people can do their part w/o the commute. i think vacancies will continue to rise and LLs will have to price for the new reality if they want actual cash flow and not just valuations based on theoretical tenants.

“i think a lot of the empties would make nice luxury residential spaces.”

Not a sure thing. You aren’t aware of falling prices for downtown condos in SF?

This is so much the result of all the “progressive” laws politicians have passed that have made working in cities unsafe and undesirable. Most office workers live in safe, stable suburban communities and they see no reason to venture daily into unsafe, dirty, third world-looking downtown areas.

If you think that downtown San Francisco looks like the third world, you’ve never been to the third world.

We all know the rough stretches from the T’loin through mid Market into SoMa. You’re barking up the wrong tree though. FiDi, the Transbay district and over to Rincon Hill are a different story. If you’d bother to look closely, you’d even find improvements over the pre-pandemic days. Muni’s been doing a nice job of keeping their underground stations clean and presentable lately, with capital improvements ongoing. One issue though is getting to these stations: I don’t see ppl willing to go back to packing it into trains and buses like has been.

@Same in NYC

Companies need the equivalent of Amazon’s Elastic compute service for office design, one that scales at peak times

This is the same idea that led Softbank and a host of other investors to fund the company Adam Neumann co-founded in 2010, WeWork. Unfortunately, real estate doesn’t scale down as easily as computer servers on a cloud computing platform do. While he isn’t leading that company anymore, it is still around and in fact has offices for lease in Salesforce Tower.

The problem with WeWork’s strategy was they locked in long-term rental rates at the market’s peak and now have to sublease office space at massively lower rates. This model has been tried over several decades. It works fine when the market is strong but totally implodes in a recession.

What is missing here is a forward looking plan to make downtown SF popular to the new hybrid reality. The optimist in me believes that local design, tech, RE talent can even get the city-gov family to cooperate. If enough companies can sign up to ~2 days per week in-office we can get a buzzing downtown and a healthy city again.

“[…] local design, tech, RE talent […]”

You mean the same people who engineered the let’s-put-all-our-economic-eggs-in-one-tech-basket regime that’s made SF the least-resilient urban economy in the US? The visionary humanitarians behind that “forward-looking plan”?

I’m going to go out on a limb and suggest that we’d get a much more livable city by minimizing the influence of “tech” and real estate tycoons on urban and local economic planning.

And just like that Google lays off 12,000 workers

And Facebook just gave up 435,000 square feet of office space. A very big change is occurring as the best tech workers leave the bay area for good.

Are they leaving the Bay Area or are they not going to the office anymore?

Yes!

Work from home means not going to the office. The west side of San Francisco more appealing if one doesn’t have to go downtown every day.

“The west side of San Francisco more appealing if one doesn’t have to go downtown every day.”

Not if you’re fond of the glowing orange orb in the sky..

Some jobs will be 100% WFH. Some jobs will be a hybrid. Some jobs will be 100% in office. Some coder drones will stay in SF! Some coder drones will explore new neighborhoods on the west side! Some coder drones will leave! As a result, the capacity to support (i.e.”demand for”) exorbitant office and residential space in SF is collapsing in real time, right now, right in front of us.

The demand for office space is collapsing all over the world, not just in San Francisco. We’re still far from the end of the effects of Covid. No one knows its ultimate effect on residential prices.

“Not if you’re fond of the glowing orange orb in the sky..”

The west side is lovely. You should visit sometime. Or maybe not.

The Bay Area is learning the downside of building an economy around an industry that, generally, believes in “moving fast and breaking things.”

Detroit learned the downside of building an economy around an industry that moved slowly and kept selling the same thing over and over.

I hope at least some of the people following this website bought in Q322 or Q422. The comic relief, “the market will completely collapse because of interest rates” crowd for sure didn’t. The, “Let’s pretend the big tech firms didn’t net hire more people 2020 – Q12023” didn’t. But I know there are sensible folks who read this website and don’t say a whole lot. There are still some good deals to be had, now. There were more last fall tho.