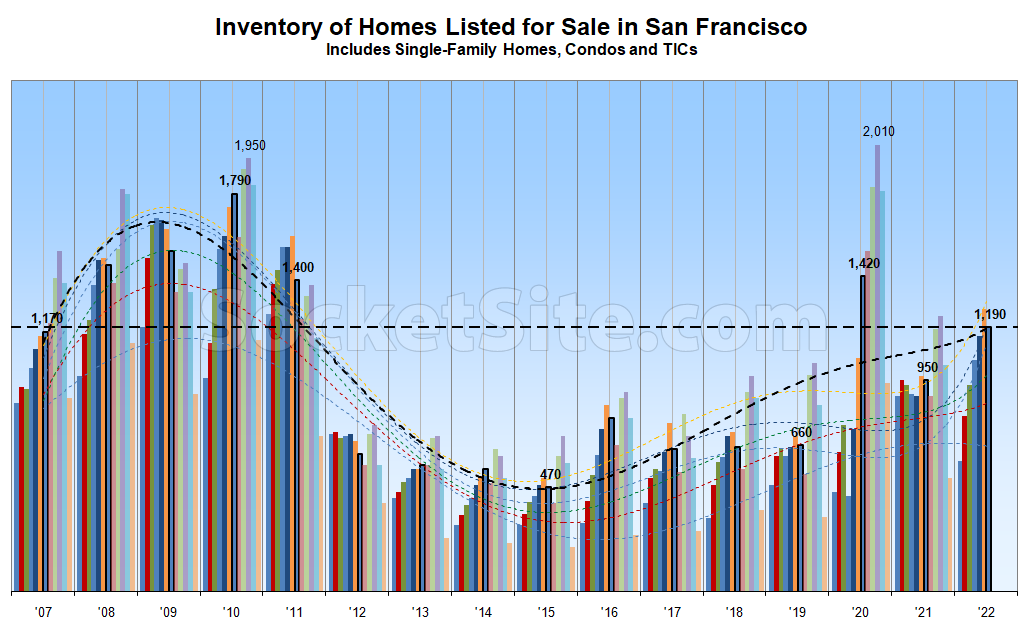

Driven by a slowdown in new listing activity rather than an uptick in sales, the net number of homes on the market in San Francisco (i.e., inventory) dropped 9 percent over the past week to 1,190 but is still 25 percent higher than at the same time last year, 45 percent higher than average over the past decade, 85 percent higher than prior to the pandemic and 175 percent higher than in July of 2015.

At the same time, the percentage of homes on the market in San Francisco for which the asking price has been reduced hast ticked up another 3 percentage points to 33 percent, which is 12 percentage points higher than at the same time last year and 13 percentage points and roughly 65 percent higher than prior to the pandemic

Expect inventory levels in San Francisco to continue to drop over the next month before jumping in September, hitting a peak in October and then trailing off through the end of the year with an increase in price reductions as well. We’ll keep you posted and plugged-in.

I am considering selling, but with a 2.5% loan that is almost paid off and where the tenants more than cover the mortgage, I can wait. A SFH in the Fab 7×7 is prime, baby!!!!

Owners are going to freak out when they realize how much their condos have depreciated.

Year over year July ’21 vs July ’22? Looking at it price is barely down ($~10/ft or so) despite multiple economic headwinds.

Pretty sure that sale prices of existing homes is a lagging indicator.

U.S. GDP shrank for the second straight quarter this week, which means that the country has just had two consecutive quarters of negative growth, the consensus criteria for a technical recession. So you shouldn’t expect condo owners to freak out yet, it’s too early for much depreciation to have taken place thus far.

Of course it’s a lagging indicator. That’s why I chose July, as it is post when all the bad news started occurring, mid June. Yes the GDP shrank two quarters in a row by the Fed’s count. First it was down 1.6% in a quarter marked by supply line issues. Then it was down -.9% in a quarter marked by out of control gas prices. This is off robust pandemic emerging highs, you know. And no, I don’t expect condo owners to freak out. This is nothing at all like the blowback condos faced in the spring and early summer of 2020.

There is no such thing as a “technical recession.”

From San Francisco ‘Froth is Gone’ as Wealth Fades, Housing Slumps, posted earlier today:

Emphasis mine.

Any of the real estate agents here who have their ears to the ground know which home this was? Inquiring minds want to know.