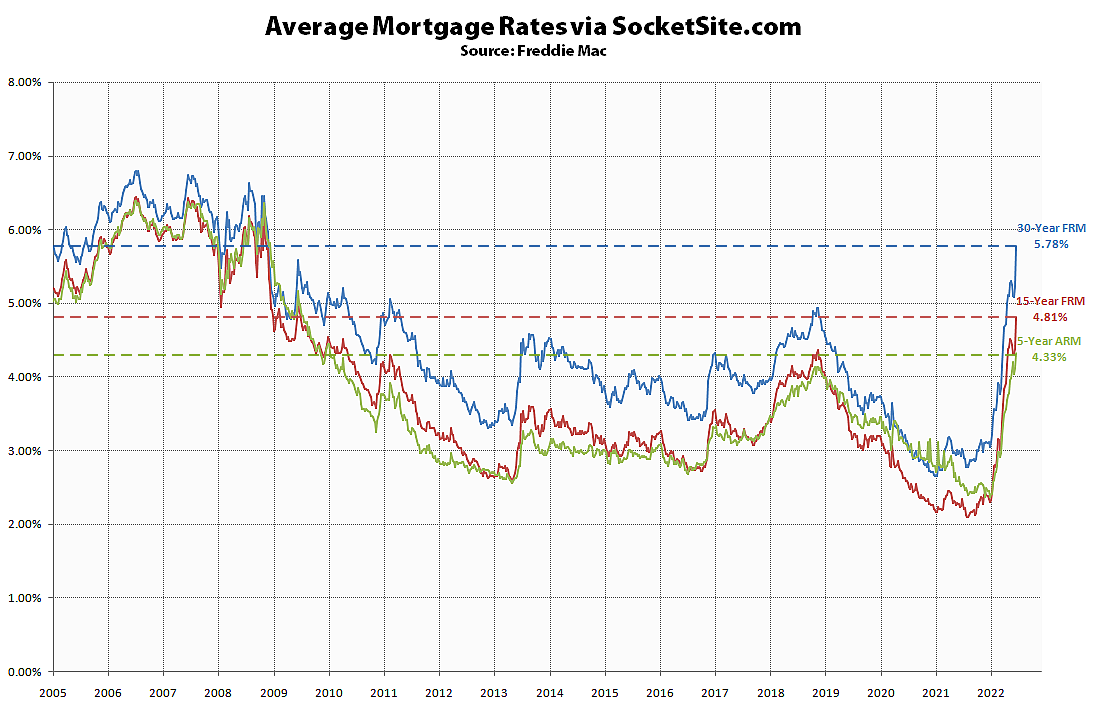

The average rate for a conforming 30-year mortgage rocketed 55 basis points (0.55 percentage points) over the past week to 5.78 percent which is the highest average rate since November of 2008. As such, the current 30-year rate is now 97 percent higher than at the same time last year with the average rate for a 5-year adjustable rate mortgage (ARM) having jumped to 4.33 percent, which is over 70 percent higher than at the same time last year and 63 percent higher than the average 30-year rate in January of last year.

With the rise in rates, mortgage application volume in the U.S. has dropped to a 22-year low, with purchase volume down over 20 percent, year-over-year. Or as we outlined six months ago, when the average 30-year rate was closer to 3 percent, the projected rate hikes, which have since materialized, would translate into “higher mortgage rates, less purchasing power for buyers and downward pressure on home values.”

Keep in mind that the 5.50 percent rate was measured prior to yesterday’s rate hike but that the three-quarter point hike appears to have been proactively priced-in, based on movements in the 10-year treasury. That being said, the probability of the Federal Reserve raising interest rates by another two (2) full percentage points by the end of the year, based on an analysis of the futures market, is currently running around 80 percent, “which should translate into even higher mortgage rates, less purchasing power for buyers and downward pressure on home values.” We’ll keep you posted and plugged-in.

So that’s why Quicken changed its name to “Rocket”…

Name change to “Hockey Stick Mortgage” or “To the Moon Mortgage” pending..

Higher rates, crashing tech RSUs, and accelerating tech layoffs doesn’t bode too well for SF this year. Not the ideal environment to blow 1.2 million on a small condo with no deeded parking and a $600+/month HOA.

SS is a bit behind in it’s reporting. In fact 30yr fixed rates rocketed up to 6.28% a few days ago and have since settled down a bit to close out today at 6.05%. Still much higher that the reported 5.78%.

Still low historically. My first mortgage was a 30-year fixed at 7.75%, 25 years ago. But this has been a rapid change. It will shake up the market for sure.

Were entry level houses $1 million 25 years ago?

Was $1 million $1 million 25 years ago?

I can’t see very well in here. Lets clear the smoke out:

Median SF home price in 1997: $320K

Median SF home price in 2022: $1500K

–> 4.7X increase

Million in 2022 was worth about 550K in 1997

–> 1.8X increase

Now do 1997 vs 2022 salaries.

Well 1997 was not a good comparison year as the Dot Com housing bubble had just started. 1995 was the last kinda flat year after the crash of the early 1990’s.

So using the Sunset as an example a junior 5 sold for around $300K in 1990 but hit a low of $230K ish by 92’/93′ and back to maybe $260K for a nice place in 1995. By 1997 would have be $280K and even $300K and pretty much topped in the $450K/500K range (for a great place ) by the time of the next crash started in 2000. Of course as usual some people grossly overpaid at the top and unless they rode out the full cycle (8 to 10 years) would have lost a lot of money. Bad timing is very expensive in SF

I remember these numbers because 1992 to 1995, maybe 1996, have been the only years it made the slightest financial sense to own rather than rent one of these houses in SF. Which I have done for several extended periods since the 1980’s. For a total of well over 20 years. For reference my landlords were negative equity for most of that time. Having bough around top of precious cycle. One sold at top of next cycle, to someone who paid way over the market price, so made a reasonable return. The others lost money, net.

A friend bough an equivalent house late 1990’s, sold 20 years later. Even though the buyer overpaid when I added up all the costs over the decades and the net sale results my friend would have made a better return by renting and putting the difference in a low risk index fund. That bad. The story of friends up in Marin and down the Peninsula was very different. A much better return. But in SF home ownership is very much a losing proposition financially.

And that’s without the 1 in 30 year risk of having the place red tagged or burned down due to earthquake. For those of us who were living in SF in 1989 thats a very real risk.

Too bad your friend didn’t hold onto the Sunset house until ’21. That market went wild, 1.5M houses got 2M+ with great frequency.

The problem is – if you hold on too long and the next inevitable bust happens..

My friend had lived in SF for many decades and watched the many boom busts over the decades, He did not quiet buy on the mid 1990’s low , but close enough, and given his situation when he sold was close to opium for this cycle. If he had held out a little longer he might have picked up an extra 10% or 20%. Maybe. But that is 20/20 hindsight. But he sold up when he did, was very happy with what he got, and then got on with the rest of his life. Rather than putting everything on hold for maybe years on the hope of making a little extra.

Another friend did very well out of the 80’s and 90’s bubble but overextended himself on next house thinking he could pull if off again. Make the big killing. Waited too long to sell, wanting for that last 5% he just knew was there. Which never happened. Ended up losing 30% on that house when forced to sell almost at bottom of bust.

Just the way it goes.

Well, I note your concept of investing in a low risk index fund, and the avoidance of the concept of optimal market timing there. Yet the several years of Sunset type runups is put down to timing purely. Also I would question broadly stating that Peninsula and Marin houses ran up more than the Sunset. Really? I just looked at only the Parkside district. From 1/1/98 – 6/24/99 sales averaged $366K. From 1/1/21 to today, sales have averaged $1.752M. That’s nearly 480%. Imagine what that looks like in terms of a levered down payment on a mortgage. It’s an astronomical return.

Actually, what would that be? just taking averages of Parkside sales and those cross sections, it would look like this. Down payment on a 366K home with closing costs would be 75K or so. Sale of a contemporary average Parkside house would be 1.752M – 7% closing costs or 1.629M. That would be a 2100+% ROI. Of course there are many other factors and costs along the way. There are also inherent risks to renting a single family home along the way. One was subject to drastic rent increases during various periods of population increase, prior to recent broader rent protection for single family homes, etc. The list goes on. New roof, etc. But I don’t know. I feel like the runup of real estate in the Sunset stands up against anywhere else in the Bay area, by and large.

Also stands up to the S+P 500.

From the same investment mind that thinks private schools are worth every penny… But he has lived here longer than all of us.

Actually live in SF? Got any kids? Why do I strongly suspect you dont. The private school or move question has been a big deal with all parents I have known in SF since the 1980’s. If you want a quality education for them. The City public school system having unraveled in the 1970’s.

Just a fact of life in SF. Got school age kids, and can afford it, private education is just part of the cost of living in the City.

And yeah, buying a house 4 miles from the San Andreas Fault in a very high fire risk zone when the net cost of renting most of that time was less than 50% of the net cost of buying was a good financial decision. To those of us who can do the math. SF is not Peoria . When the next Big One hits my rental is a walkaway. That house of yours in SF, has it got full earthquake insurance? Including cost of foundations replacement? Very few have in SF. And if you know anything about all the lawsuits after 1906 you will know why.

Now LLC real estate investing in SF, that’s a very different story. If you get you timing (and cost of capital) right you can get a very good ROI. Very good. Get either wrong, and you loose you shirt. So not a lot has changed in real estate investing in SF since, well, 1847. Always was a boom and bust town. Always will be.

Call me crazy, but I think that plenty has changed in San Francisco real estate since 1847.

I live in the city and my kid goes to a fantastic public school. You’re biased all up and down the line with a series of overly broad to the point of errant takes.

With regard to whether middle-to-upper class parents interested in a quality education for their children have to shoulder the cost of private education as just part of the cost of living in The City, here’s one Real estate agent’s take. From The Hater’s Guide to the Bay Area real estate market, the week before last:

Emphasis added. The real estate agent quoted there is a graduate of a private High School in the Haight-Ashbury district where Tuition last year was $55,647 for the highest grade offered.

I don’t doubt one of that guy’s private school teachers said something like that. I question the wisdom of repeating it to whichever of the two hacks named Drew wrote that article, though. Either way it doesn’t mean anything to me. There are good public education options in SF if you’re a parent who knows precisely what’s going on.

Does anyone have any thoughts on what rising mortgage rates will do to the local rental market? Will higher borrowing rates for average consumer mean less disposable income mean lower rents, or will higher rates and carrying costs for owners lead to higher asking rents?

Rents are based largely on local employment rates and income. I’ll leave the thought experiment to you what happens when — purely hypothetically — local unemployment rates go up and incomes go down, as happens when bottomless wells of VC funding for profitless scams dry up and the associated sectors start contracting…

VCs have record amounts of capital to deploy. Its crossover and public investors who are in trouble. VCs will hold deployment of large amounts of capital until they see a bottom and then money will flow to startups, although they should be more picky. they have to deploy this capital or LPs will ask for it back. start-up ecosytem should be fine next year, just a much smaller % of new companies in SF vs other places due to poor city governance

Higher interest rates mean more condo buyers drop out and become renters. It increases demand for rental units and drives up rents.

Fun with zero sum tautologies!

Current renters who consider buying, but are then priced out by higher rates, don’t suddenly become additions to the renter rolls, as they are already renting. They have not increased demand, at all, as they can just continue to pay the rent they have been paying all along.

Current owners who consider buying a new place to live, but are then priced out, will likely stay in the current home and not move, thus not increasing rental demand, but if they decide to sell and become renters, the old unit may be bought by a prospective landlord/speculator, thus increasing supply, or the old unit may be bought by a former renter thus decreasing rental demand.

RE moves at the margins, right? Higher rates squash speculation, taking a huge mover of the margin out of the picture, leaving organic demand as the primary demand determinant. The margin recedes, although, as we all know, prices for an illiquid speculative asset are “sticky” on the way down (so again, your S&D doesn’t tell the whole story).

Fact: using simplistic S&D theory used as a cudgel to explain price movements in an illiquid speculative asset class can provide misleading and contradictory insights.

people who move to SF (if there are many) may choose to rent vs buy with mortgage rates. Not sure if there are enough people coming to impact prices, but a future possibility

Renters who were looking to buy at 3% might be less motivated to buy at 6%, and keep renting.

But who knows there might be some buyers willing to over-pay for that same condo after the kitchen cabinets have been re-painted white. You sound smart.

Today was a good day for buyers as 30yr fixed rate mortgage rates dropped to less than 6%. Today 30yr fixed closed out the day at 5.88%. Let’s see how long rates remain below 6%.