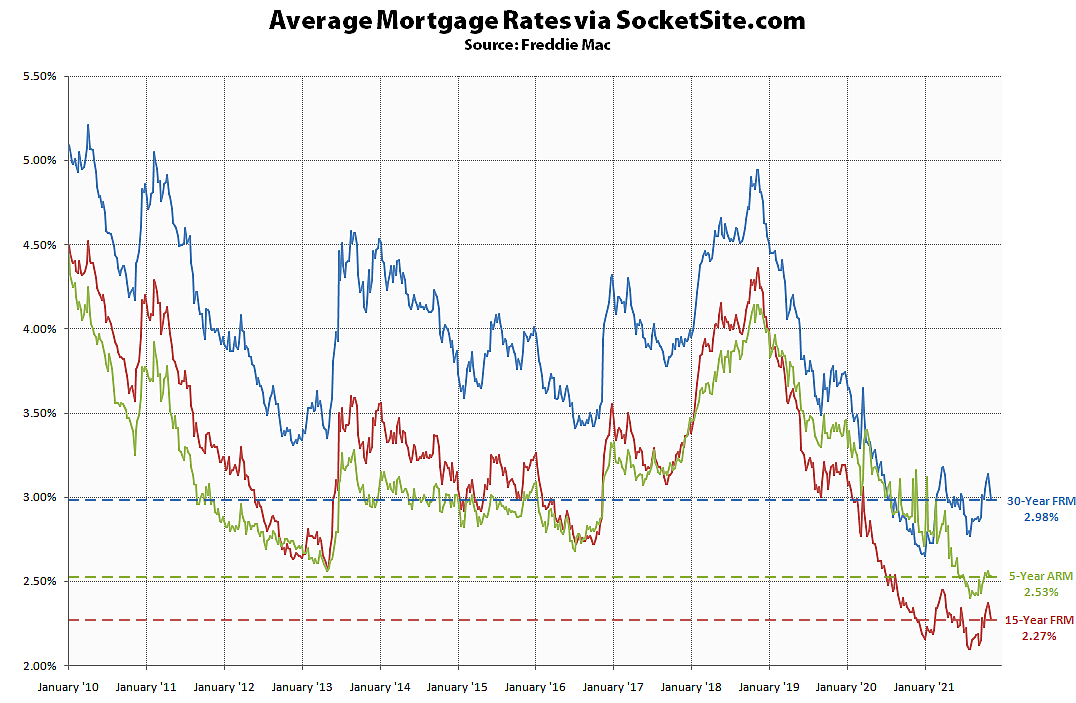

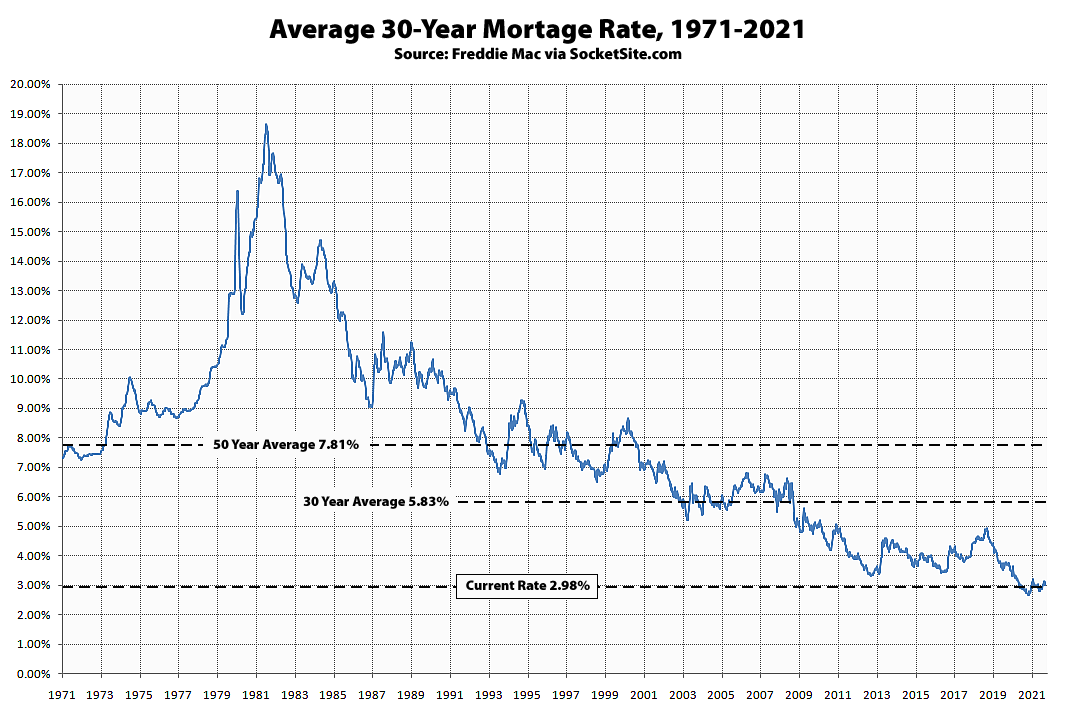

Having dropped 16 basis points (0.16 percentage points) over the past two weeks, the average rate for a benchmark 30-year mortgage has inched back down to 2.98 percent, which is 14 basis points above its mark at the same time last year but within 33 basis points of its all-time low in January of this year (and versus a 30 year average of closer to 6 percent).

That being said, with inflation in the U.S. having just hit a 30-year high, pressure on the Fed to raise rates sooner, rather than later, is continuing to build and the yield on the 10-year treasury, which drives the 30-year mortgage rate, jumped 12 basis points yesterday, after the latest mortgage rate survey was taken.

The coupon on the state tax exempt series I inflation adjusting US treasury bonds for the next 6 months is over 7%. But one can’t purchase more than 10k per year.

I just recently finished refi on my 3 rental properties, at 2.99% for 20 year fixed. During the refi process, it became so apparent that the UW was trying so hard to exclude some expenses reported on my tax return, just so my ratio came within the guidelines. In the past, UW takes the tax return as is, and maybe give you one “exception” at the most. I feel like there is just too much money flowing around these days.

For as much as I believe in RE investing, I am NOT buying any more properties now. Instead, I am positioning myself for a 20% drop in the stock market in the next 1-6 months.