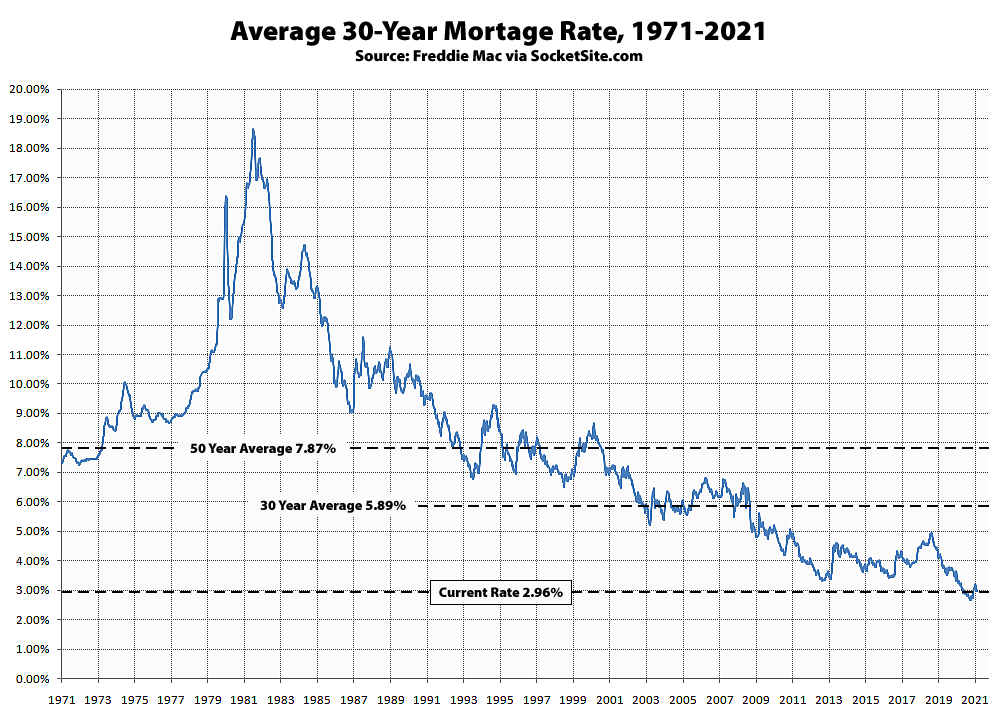

Despite concerns that Treasury Secretary Janet Yellen’s recent comments hinted at the need for the Fed to raise rates sooner rather than later, in order to keep the economy from “overheating,” the average rate for a benchmark 30-year mortgage inched back down 2 basis points (0.02 percentage points) over the past week to 2.96 percent.

And while the average 30-year rate remains under 3 percent and 30 basis points lower than at the same time last year, and listed inventory levels have ticked up, mortgage application volumes in the U.S. have slipped for the second week in a row and for the fifth time in six weeks.

The supply of greater fools is thinning. The Fed’s preferred tool to preserve high value assets is to push rates lower, but it’s running out of room, so it takes these mincing 2 basis points steps, while all the fiscal scolds are screaming inflation. The Fed’s deluded that there’s a magic number that bestows price stability, but asset bubbles either inflate or deflate, they never stay still. Equilibrium is a neo-classical conceit that doesn’t occur in debt-fueled speculative markets. What a train wreck. Blow, bubbles, blow.

No idea if it’s built into the mortgage application (refinance). I have a jumbo loan with Chase. Someone told me to request a payoff amount and chase will lower the rate. Went from 4.5% to 3.875% to 2.97%. Pretty much no paperwork, just 1 signature. Everything stayed the same just the rate was lowered. 30 year fixed. I assume Chase does this if they own the loan and want to keep you. Lots of my friends have had the same experience.

Well that’s interesting. Anyone tried this with Wells Fargo?

I had a jumbo loan on an SFR with Wells Fargo at 3.75% (30-year fixed). Contacted them repeatedly last fall to ask about refi options. They responded with an offer in the 3.5% range when I was seeing alternatives from other lenders below 3%. My conclusion was that Wells had no interest in keeping me as a borrower. Went through JVM lending and got a 2.75% refi with no closing costs or points.

How exactly did you do this? Did you just call up and ask for a payoff or did you just do it online? Or did you start a refi elsewhere where they asked for the payoff? I have chase and would love to learn more about this. thanks!

First time I was trying to refinance with Wells Fargo from Chase. 1 morning a fedex envelope was on my doorstep, no notification or anything. Second time I got an email telling me what was coming. I did ask for a loan payoff every 3 months for the fun of it.

Makes sense if they own the loan. If you’re at 4% and market is 3%, why do all this paperwork. From their angle it makes sense to just drop you to market and keep you as a customer . Refis are a pain.

thanks this helps. I’m at 3.125 so hopefully they’ll dip me to 2.875 or something. Do you think my current rate on a jumbo loan is too low for them to do it?