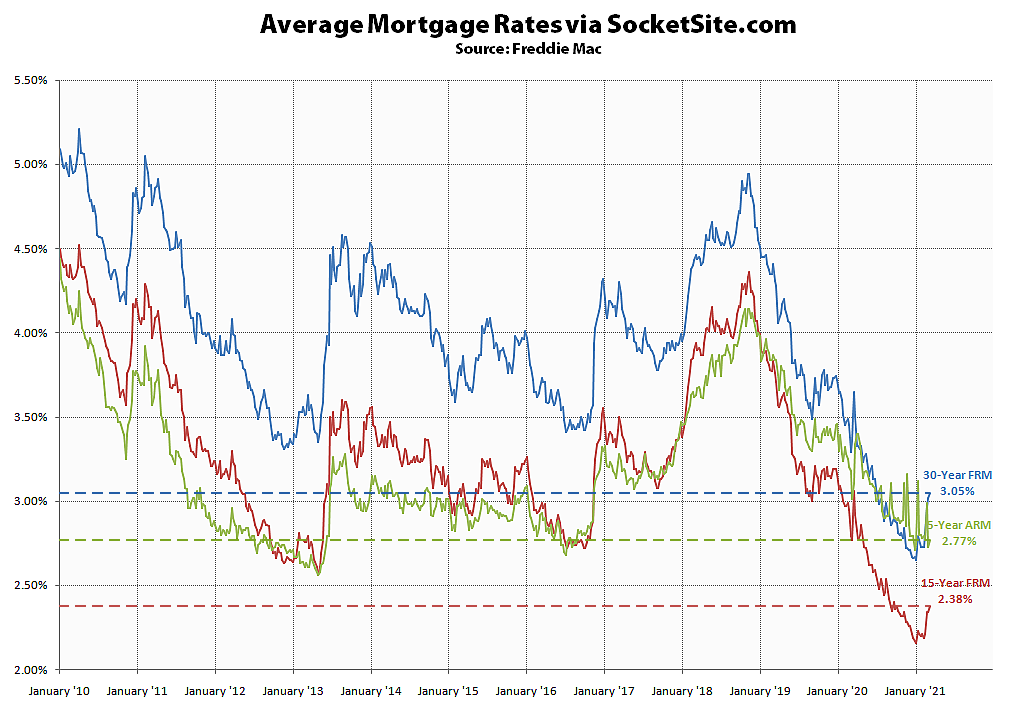

Having inched over 3 percent for the first time in seven months last week, the average rate for a benchmark 30-year mortgage has since inched up another 3 basis points (0.03 percentage points) to 3.05 percent.

That being said, the average 30-year rate is still 31 basis points below its mark at the same time last year, only 40 basis points above its all-time low of 2.65 percent two months ago, and around half the average rate on offer over the past 30 years.

At the same time, the average rate for a 15-year fixed mortgage has inched up 4 basis points to 2.38 percent, which is still 39 basis points below its mark at the same time last year, and the average rate for a 5-year adjustable has inched up 4 basis points to 2.77 percent, which is 24 basis points below its mark at the same time last year.

And while the nominal increase in rates appears to have slowed the pace of sales nationally, the refinancing market has already taken a much bigger hit.