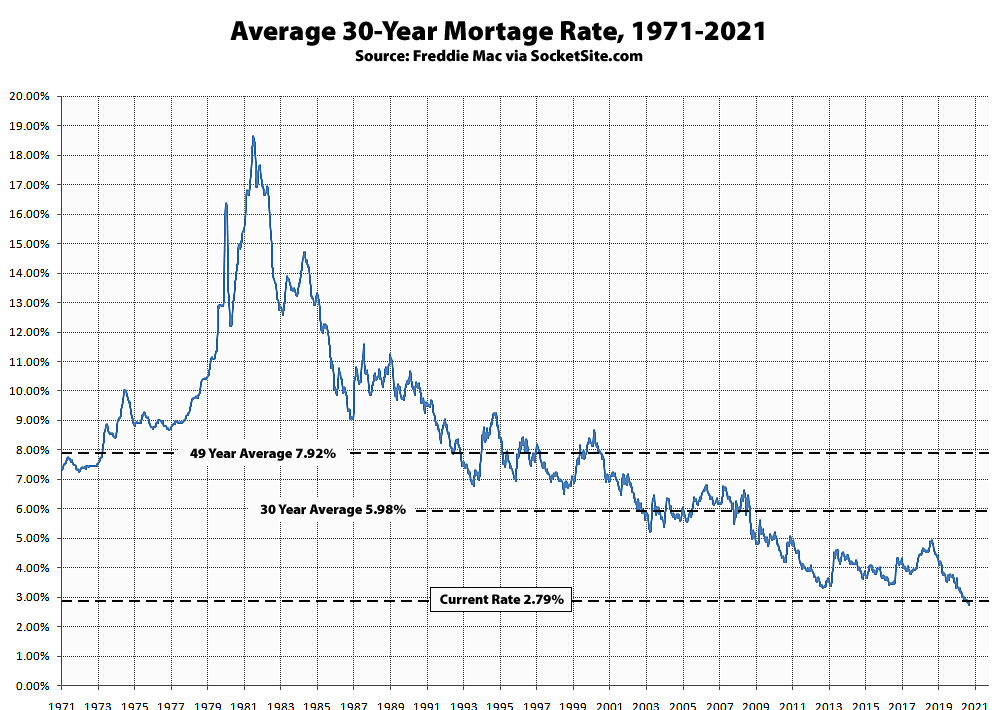

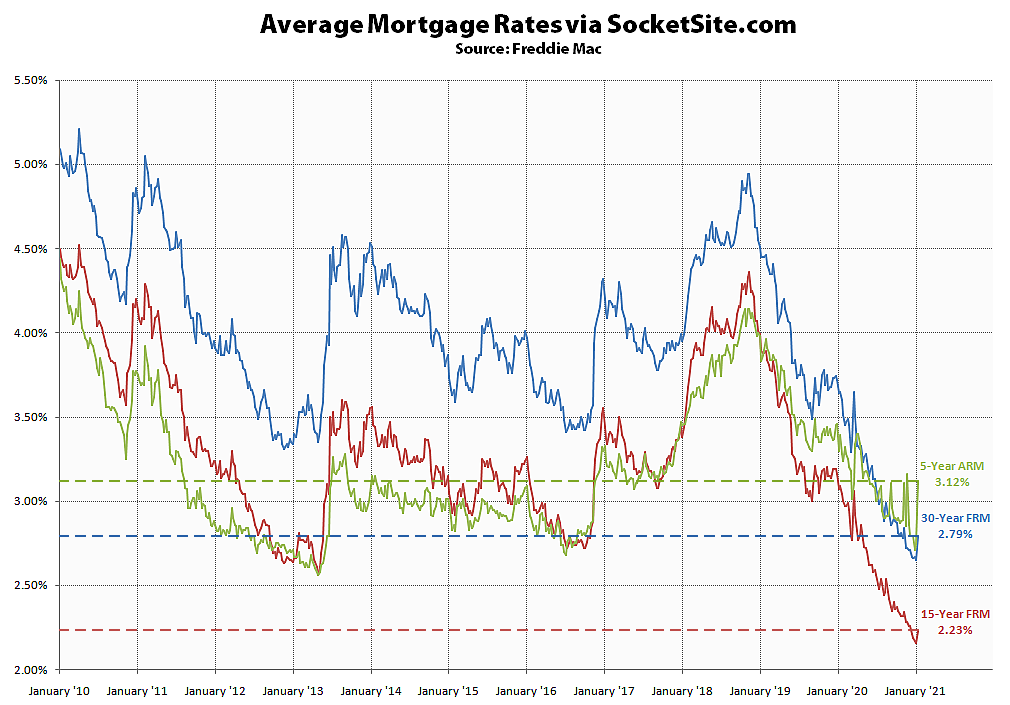

Having dropped to a new all-time low last week, the average rate for a benchmark 30-year mortgage has since ticked up 14 basis points (0.14 percentage points) to 2.79 percent but remains 86 basis points, or nearly 24 percent, below its mark at the same time last year and less than half its 30 year average.

At the same time, the average rate for a 15-year fixed mortgage, which had dropped to a new all-time low as well, inched up 7 basis points to 2.23 percent, which is 86 basis points below its mark at the same time last year as well, while the average rate for a 5-year adjustable jumped 37 basis points to 3.12 percent, which is still 27 basis points below its mark at the start of last year and an inverted 33 basis points above the current 30-year rate.

Back in 2010, I was buying a 2/1 in Russian Hill on Francisco St for $660K on short sale. No bank wanted to underwrite and I ended up taking a loan from World Bank at 9.75%. At the time, it was renting for $2850 and I was losing like $1000 per month, but I was telling myself that if only I could refi down to 6% I would be making money…and it is now 3.5% fixed for 30 years.

I keep wondering, in today’s environment with rates <3%, if you buy something and it does NOT cash flow, how/when/where would it EVER make money?

The two arguments of course are: 1) equity value will go up, and if it does you’re doing so with only 25%ish down (you’ve done ok on your deal) or 2) rents go up. Over time, they always should. But IMO, I don’t see either of those happening in the near term to the degree it warrants putting so much dead money (down payment) into an under appreciating asset and negative cash flow which, frankly tied to unnatural track record of anti-landlord laws, has a lot of future risk included as well.

Why not invest in income properties in high growth cities that already have strong cash flow, pent up demand, better predicted equity growth, and lock in your low rates there. If things ever change here, those assets then help your application here as they’re showing stable passive income.

I wouldn’t be buying here unless I was going to live in it – and if forced to move in sf now, I’d still rent. My friends just got a 4/4 home in Potrero for $8400 that was renting for $13k a year ago. It has to be at least a $3.5m place. That investor is losing quite a nut each month.

UPDATE: The average 15 and 30-year mortgage rates both inched down 2 basis points over the past week to 2.21 and 2.77 percent respectively while the average rate for a 5-year adjustable dropped 32 basis points to 2.80 percent, effectively erasing its inversion.