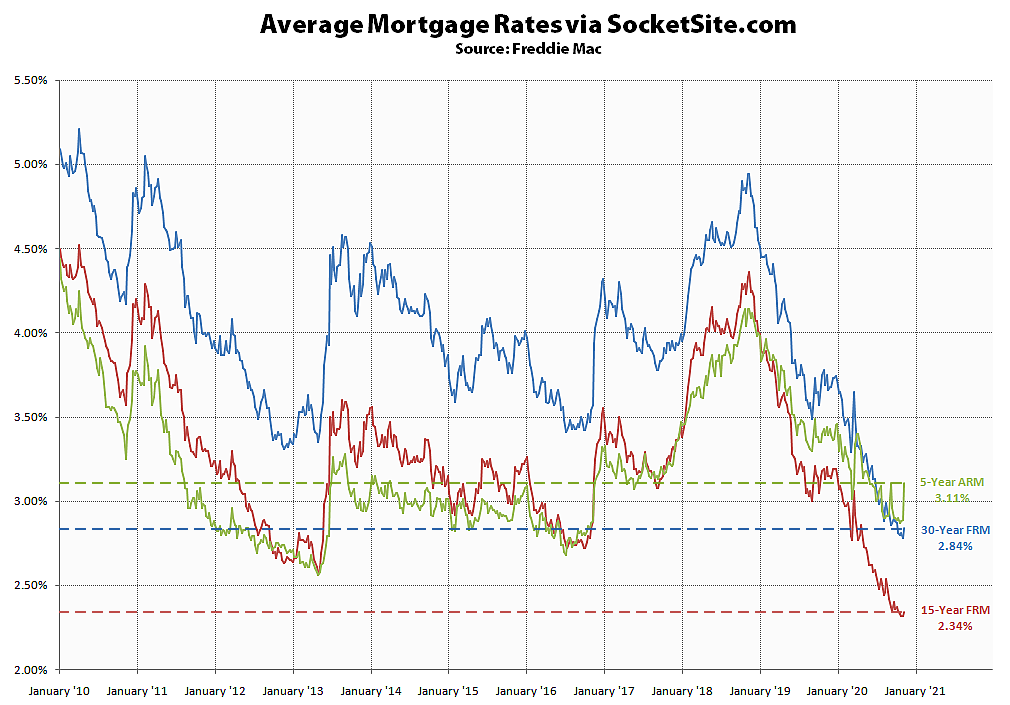

Having dropped to an all-time low of 2.78 percent last week, the average rate for a benchmark 30-year mortgage has since inched up 6 basis points to 2.84 percent but remains 91 basis points below it mark at the same time last year and less than half the average rate of 6.08 percent over the past 30 years, according to Freddie Mac’s Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage has inched up 2 basis points to 2.34 percent, which is 86 basis points below its mark at the same time last year, while the average rate for a 5-year adjustable has jumped 22 basis points to 3.11 percent, which is 33 basis points below its mark at the same time last year and an inverted 27 basis points above than the average 30-year rate.

And while refinancing activity ticked up 1 percent over the past week nationally, and is still running 67 percent higher than at the same time last year, purchase activity slipped another 3 percent to its lowest level since May and slumping, but still 16 percent higher than at the same time last year, according to the Mortgage Bankers Association.

I wonder if this increase is due to the good news or the bad news?

Good news being election results and wall st being bullish on a Biden administration + relative strength of housing market + vaccine progress or, conversely, a rate raise due to the increased risk to banks take on w/ millions of delayed mortgage payments compounding on a virus that is only getting worse + another stimulus that seems like may never come or a shell of what was expected.

I would have thought rates would continue to hold or go down further based the latest spikes and communities likely needing to shut down again.