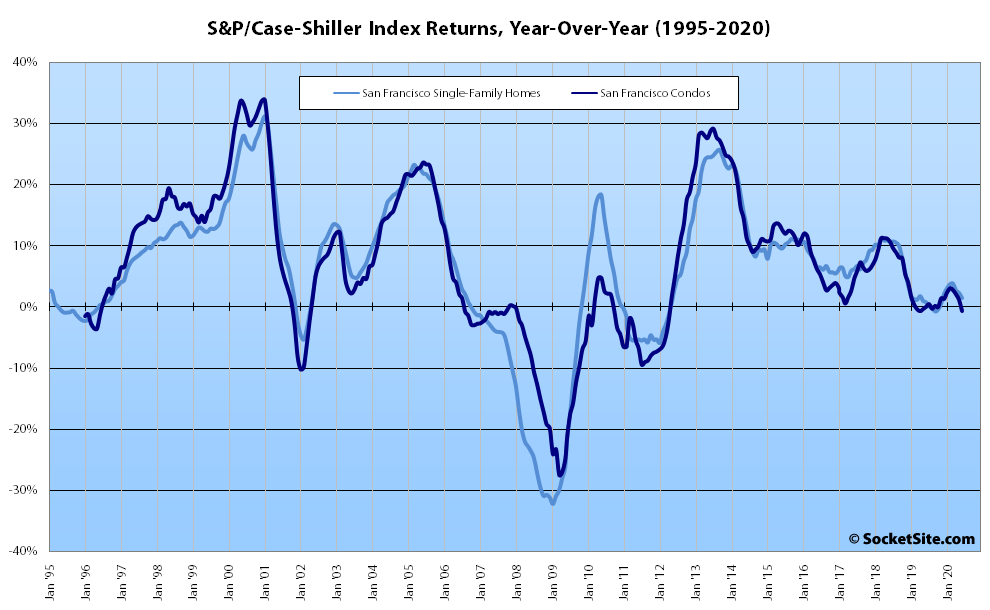

Having slipped in May despite nationwide gains, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – slipped another 0.6 percent in June, versus an average increase of 0.6 percent nationwide, and the year-over-year gain for the index dropped to 1.4 percent.

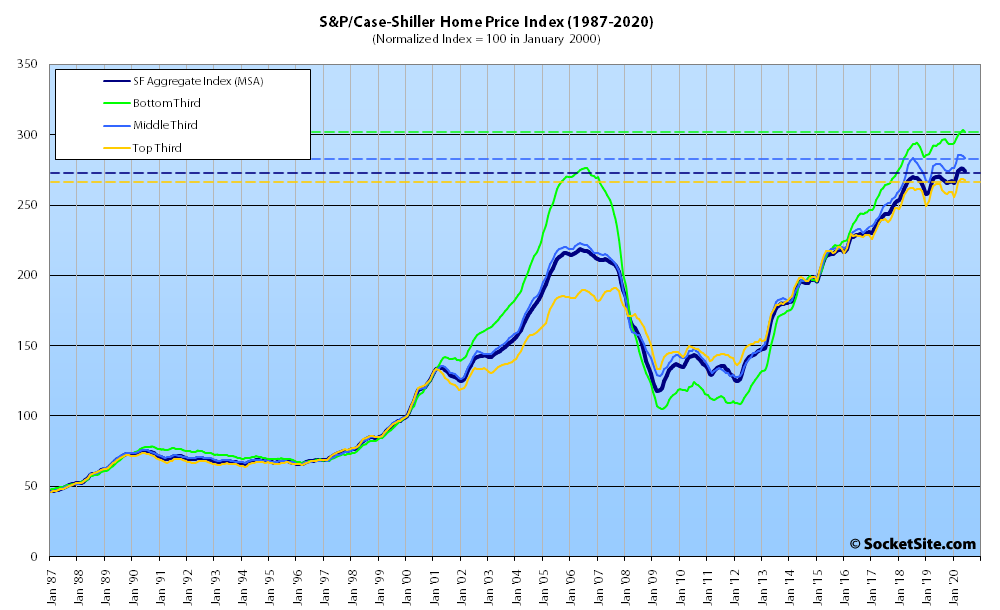

At a more granular level, while the index for the least expensive third of the market slipped 0.5 percent in June but is still up 2.9 percent on a year-over-year basis, the index for the middle third of the market slipped 0.5 percent and its year-over-year gain dropped to 1.6 percent, and while the index for the top third of the market only slipped 0.2 percent and its year-over-year gain is down to 1.0 percent.

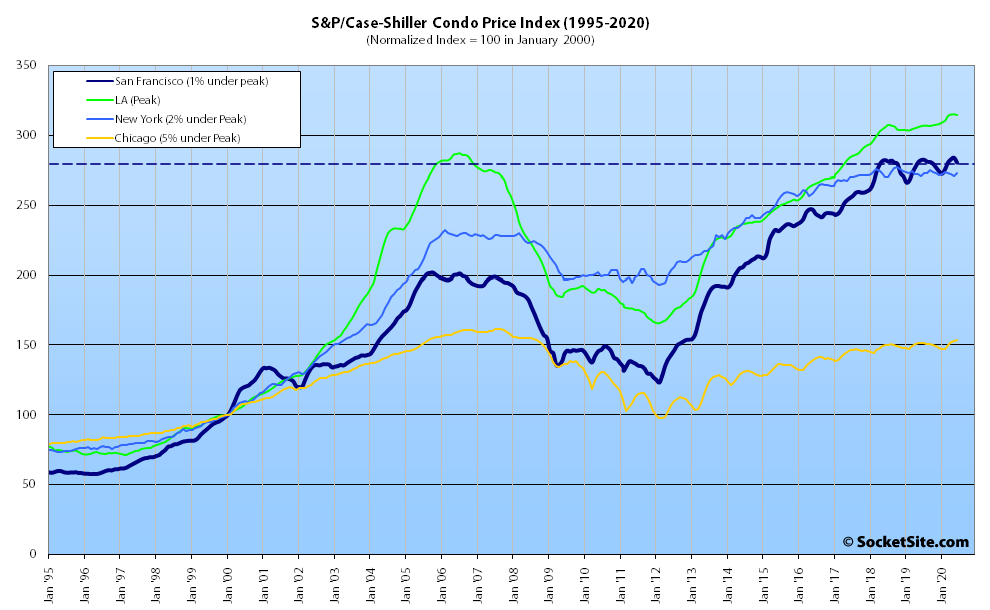

At the same time, the index for Bay Area condo values, which tends to be a leading indicator for the market at a whole, dropped 1.2 percent in June and is now down 0.7 percent on a year-over-year basis.

Nationally, Phoenix still leads the way in terms of indexed home price gains (up 9.0 percent on a year-over-year basis), followed by Seattle (up 6.5 percent) and Tampa (up 5.9 percent), with an average increase of 4.3 percent nationally and only Chicago (up 0.6 percent) lagging San Francisco’s 1.4 percent gain.

And having slipped 0.6 percent, San Francisco was one of only three Metro Areas to record a month-over-month drop. New York (down 0.3 percent) and Las Vegas (down 0.4 percent) were the other two.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus

the actual drop feels like a lot bigger than these 0.5% or 1%…. The houses on my street (South Bay) are down easily 15% from the 2018 peak….

If prices stay flattish for a couple of years, I’m happy with that. This gives a chance for everyone to “catch up.”

This is June data. Once August/Sept data rolls in you’ll see the bigger drop. I agree with you; right now you can easily buy a condo 15% off peak prices. The question is just how much will prices decline.

COVID will be over in 6-9 months and I wonder if property price will continue its drop after that or will start to recover….

it will certainly not be over in 6 months. a vaccine to the masses not likely until at least Q2, and most folks wont get fully until Q3. then we will have plenty of people who refuse to get. things should be much better by May (my guess), but how many businesses will have died by then, how many unemployed and how much debt incurred. its hard to believe the economy will be booming for at least 2 yrs. the stock market is totally disconnected right now, but i think it will correct within the next 9 months

Going forward expect the Bay Area to perform near the national norm in terms of home appreciation. Give or take. In the past few months it has been take – underperforming significantly the national numbers. Of note – Seattle is still near the top in terms of appreciation despite recent events. Also, NYC is just one of the three metros seeing price declines. This coincides with articles that have pointed to NYC and SF as being particularly hard hit by residents moving out post pandemic and with the move to permanent telework. SFGate recently had an article about the exodus from SF being real and Zillow a piece spotlighting SF as one of the cities seeing the biggest increases of houses on the market. At a broader level Susan Wachter of the U of Penn Wharton School was quoted in Bloomberg as saying that there will be the emergence of “neighborhood nodes” where divisions o tech employees will develop up and down the West Coast. SV will still be the hub but its dominance will decline as these new tech nodes emerge.

IMO SF will see a significant population drop over the next few years – 10% plus with the city returning to its more historic norm of about 750K residents. This will drive down SFH prices quite a bit more than the .6% seen so far. These factors will impact residential development in SF. Not only slowing it but likely leading to the cancellation of a number of large projects now in the works. . .

While there are those who are just starting to figure it out, and the pandemic has amplified the trend, the Bay Area has actually underperformed the national market for the past 19 months, not simply “the past few.”

Well that goes along with the “historic norm” of 750K residents…which I believe it had for 2 out of the past 250 years (don’t want to count the ‘Yerba Buena’ days?? OK: “2 of the past 170 years”)

The population of San Francisco, which has averaged around 850K over the past decade, versus closer to 785K the decade prior, actually averaged a little over 750K in the 1950’s having hit the 750K mark in the late 40’s. But having started to slip in the late 60’s, and dropping under 700K in the 70s, the population of San Francisco didn’t re-cross the 750K mark until 1997.

anecdotally I have 6 friends who were in NYC at the start of the pandemic.

#1: moved back 2 weeks ago

#2 moved back last week for a new job that is 3 days office/2 tele

#3 is moving back next week or sometime soon. At their upstate house

#4 is looking to buy a small place in the city but stay Conn., because work from now on will have some in office days.

#5 is in Florida with inlaws until further notice but wants to get back

#6 never left, but is trying to move to CA.

Actually I think we need to upgrade you to “Small Sample Size”, “anecdotally” should be reserved for <5.

That having been said, does "moved back" mean to the BA or just back [from NYC] to where they started from?

It could also mean “moved back to NYC”, assuming they left when the pandemic started… So I was wondering too.

Yes moved back to NYC.

Forgot one:

#7: moving back whenever the kids start in person class.

The latest data still shows the NYC exodus continuing with vacancies hitting a decade+ high: “The number of apartments for rent in New York City has soared to the highest rate in more than a decade, a sign that a notable number of residents have left the city because of the outbreak, at least temporarily, potentially creating a new obstacle to reviving the local economy.”

No real break in the curve either. This doesn’t include August data, so maybe things changed in the last few weeks. We’ll see when the August data comes out. As recently as last week though, the NYT reports that moving companies are still swamped with people moving out and they don’t see that slowing down.

And closer to home: Rents in S.F Continue To Drop, Now Down Over 20% From Peak

None of my friends in NYC are planning to move, at least not permanently. But 3 close friends in SF are moving to OR. All 3 have been in SF for over 15 years, none were planning to move prior to the pandemic.

Why would you start a business or buy a home here if you had other choices?

LG’s transparent OLED displays show the real time system map on subway windows in China. Worth googling. Meanwhile SF Muni shuts down all the trains again for weeks on the first day the system opens because of a downed wire in a tunnel.

If we can’t get it together enough to make basic mass transit work, people are going to vote with their feet and real estate isn’t going to recover. Pessimistic? Sure. But if there was ever a time we needed local government to get it together it is now, and they don’t seem to even be trying….

The main driver of MUNI’s failed re-start was an employee in the Transportation Management Center having testing positive for COVID-19, requiring the quarantine of additional team members and leaving the rail nerve center short-staffed.

The secondary factor was the problem with the new overhead power equipment that was recently installed, a fix for which has been identified and will be implemented during the shutdown.

It’s actually an excellent time for a…”pause”, since few people want to ride anyway!

But perhaps what ‘Pablito’ meant by “work” wasn’t so much in technical terms as financial ones: mass transit, even in SF, well illustrates the maxim of going bankrupt gradually..then suddenly; ever- growing deficits for pensions and healthcare will grow exponentially worse w/ farebox revenue having collapsed. Yeah, sure a blue wave in November may bring a lifeline temporarily, but you can’t put off the inevitable forever…even here. At some point Muni et al will have to think seriously about cost control. People can table their fantasies about undergrounding the 38 and extending the Central Subway, and concentrate on maintaining basic service.

We are 4 -5 months into a pandemic. If the main reason was an an employee with Covid shouldn’t there be a back up plan for specifically that after all this time? Isn’t that basic common sense? Haven’t we had more than enough time to put that in place? Cross training employees, procedure manuals? It’s not running SFO where planes can go everywhere. They are trains that go down the same tracks every day. The stations don’t move. At all.

If the secondary reason is the overhead power equipment, hasn’t MUNI been running trains through that same tunnel for 100+ years using the exact same overhead power technology? Which is basically a block of metal with a couple of bolts in it? No computer chips, no fancy motors, just a solid block of metal with 3 bolts.

It’s incompetence. It’s frustrating.

I wish there were numbers or some reliable data (anecdotal or studied) for price per square foot ($/SF) for the City as an average and also per zipcode/ neighborhood. The$/SF in my mind is the most useful metric for evaluation, rather than price cuts or under/ over asking. Is the average price for a condo 1,000 $/SF today? And I’d be interested in hearing predictions the trend in 2021-2022. Increase, remain or decrease? I understand there are many variables, but it would be good to get a number (with caveats if needed), to get a discussion going.

agree, $/SF seems like the key metric to watch over time. a quick Redfin search shows that SF condos sold in the past month traded for an average $1088/SF. SFH’s sold for $992/SF. Lots of neighborhood variation for both of course.