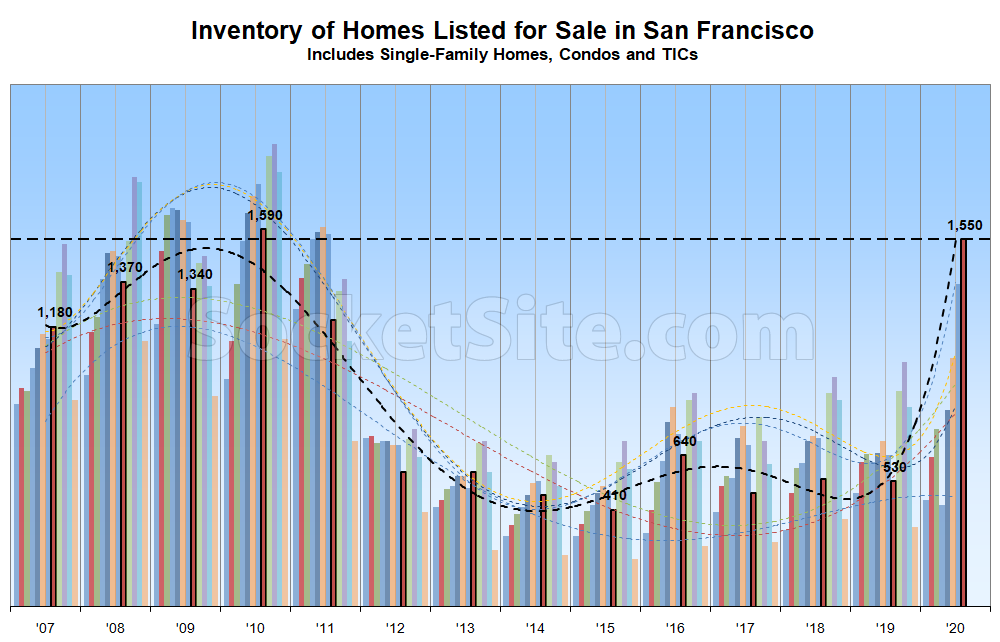

While the rate of increase in inventory levels has slowed to a seasonal crawl, the number of homes on the market in San Francisco, net of all new sales and contract activity, has ticked up another 4 percent over the past two weeks to 1,550, representing roughly three times as many homes on the market than there were at the same last year (530) and over 10 percent more active listings than there were in either 2008 or 2009 at the same time of the year.

And while the number of condos on the market (1,160), which tends to be a leading indicator for the market as a whole, is up by 230 percent on a year-over-year basis and holding, the number of single-family homes on the market (390) is now running 110 percent higher and climbing. At the same time, the number of homes on the market with an asking price that has been reduced at least once is up by 400 percent versus the same time last year.

Keep in mind that inventory levels will likely start ticking down over the next week or two, at least in the absolute and overall, before jumping again in September.

We’ll keep you posted and plugged-in.

Those 4-5k per month carrying costs can be brutal when you have no job or other cashflow coming in…

Waiting for some real capitulation trades to happen. I think I said three or four months ago we would be down 25%. Stock market has been propped up. I don’t think the same will happen in SF. Bargains coming, but not yet.

Just warming up?

The National Campus and Community Development Corp., a nonprofit that finances dorms, sold the nearly $90 million in junk-rated bonds for the California College of the Arts dorm in 2019. Rooms with two beds and a mini fridge were slated to cost about $1,400 per month, a price marketed as an affordable option for students in a city with notoriously high real estate prices, according to bond documents. But because of Covid-19, the school has had to limit one student to a room. The dorm was only 29% pre-leased at the end of July, according to a regulatory filing.

Prices on thinly traded bonds sold for the dorm that come due in 2039 had plunged almost 15% in a year by mid-August, according to data compiled by Bloomberg.

(Deserted College Dorms Sow Trouble for $14 Billion in Muni Bonds)

Need to be specific in this conversation re: “bargains”, imo.

Condos SOMA will almost certainly see a 25% hit, or something around that level. SFH, particularly in the A+ location, are down ~10% from theoretical asking peak a year ago, by my estimation. These properties probably flat line from here, in a decent stock market, and maybe fall 5%-10% further in a drawdown.

History tells us, however, significant Bear markets, withing cyclical Bulls, particularly following a 30%+ sell-off like we had in March are extremely rare, at least absent terrible policy decisions.

Last time inventory was this high there was a significant Bear market. I think it’s going to be worse this time. Last time there was an economy hit, but people wanted to stay. This time the economy hit is bigger and people don’t even want to stay.

It will be interesting to see what the impact of the numerous new taxes on income and assets of the wealthy will do to the market if passed. Will they retain their homes here as second homes (under 6 month occupancy) and run their businesses here, or move their businesses and associated jobs out of state? If the latter, things could get quite ugly at all levels of the market. Homes would get cheaper, but if your job leaves (and you income with it) house prices have to approach zero to be afforded. Reportedly the top 1% pay 47% of total California taxes, so if the wealthy leave, who’s left to pay? You and me, I think. Unless I leave too, then it’s just you. You’ll need to come up with ~$25 million per hour to run the State.

we will be leaving if all taxes on the ballot in Nov pass. will keep my business here (in south San Francisco) and move to incline village

Hope you’re ready to pass California’s “facts and circumstances” test, since you still may owe California resident taxes even if you don’t have your primary residence in California. Keeping your business in south San Francisco doesn’t help.

As I said on the other thread I’ve never heard of people who completely and legitimately left California having a problem with CA taxes. But with one foot in and one foot out you need to tread carefully. Of course that is under current law.

The proposed wealth tax (AB2088) is absolutely crazy in that it would tax your worldwide wealth for a decade after you are no longer a CA resident. Even staying in CA for more than 60 days would make you a “Temporary Resident” under the bill and subject you to a pro-rated tax on your worldwide wealth. The exemption at $15M is large, but the precedent it sets would scare off very many entrepreneurs and wealthy families if this gets even close to passing. People with liquid assets such as pre-public stock options would need to negotiate deferred tax contracts with the FTB. Total nightmare.

I hope this is just show boating and has no real chance of passing. But the budget situation in CA due to COVID is going to get very bad and either services will need to be cut or taxes raised to fix the problem.

What an idiotic move this would be.

People have been predicting the death of silicon valley as an economic engine for years (most recently due to a rosy view of remote work). AB2088 is the first thing I’ve seen that could actually decapitate SV and move the hub of US tech innovation elsewhere.

A federal wealth tax might be a good idea. A state wealth tax would be suicidal.

I don’t think this can be constitutional. How can California tax out of state wealth?

It wouldn’t be taxing “out of state wealth” it would be taxing as “in state person” who has assets all over the place. But which specific section of the Constitution do you feel it would violate?