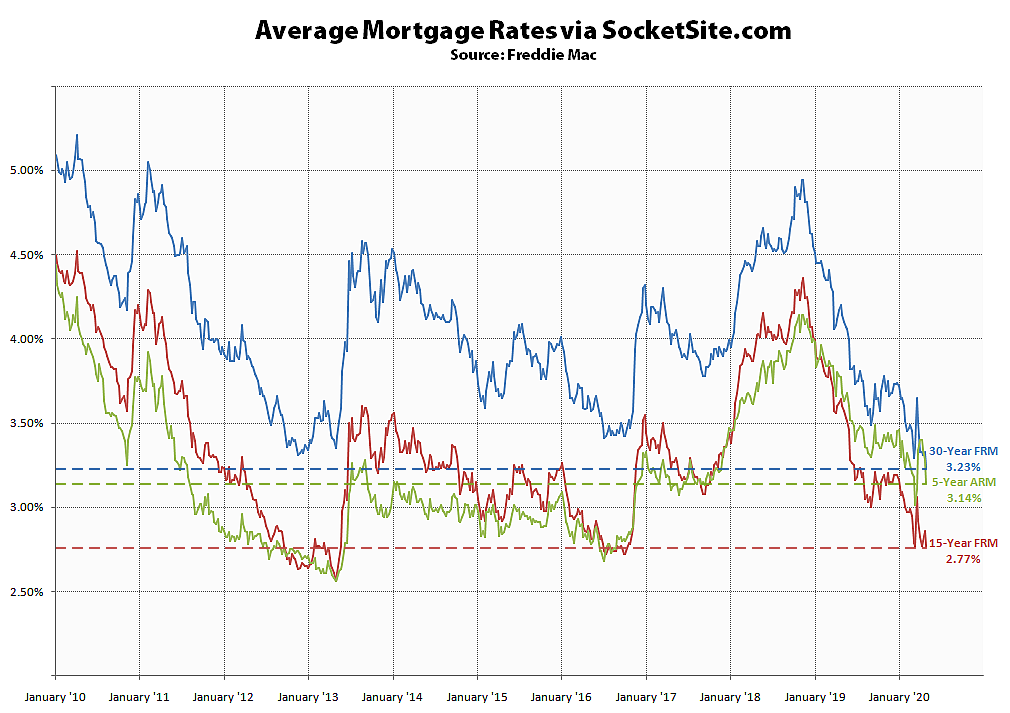

Having inched up last week, the average rate for a benchmark 30-year mortgage has since dropped 10 basis points (0.10 percentage points) and now measures 3.23 percent, which 91 basis points below its mark at the same time last year and a new all-time low by 6 basis points, according to Freddie Mac’s latest Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage has dropped 9 basis points to 2.77 percent (which is 83 basis points below its mark at the same time last year but still 21 basis points above its all-time low of 2.56 percent it hit back in 2013), while the average rate for a 5-year adjustable shed 6 basis points and now measures 3.14 percent (which is 54 basis points below its mark at the same time last year but 58 basis points above its all-time low of 2.56 percent it hit back in 2013 as well).

And while mortgage market activity is currently up over 200 percent versus the same time last, it’s being completely driven by applications to refinance, with pending home sales activity across the U.S. having dropped over 20 percent, purchase loan activity down 20 percent, and purchase activity in San Francisco proper currently down nearly 50 percent versus the same time last year.

The jumbo market is starting to show (feint) signs of life. That’s what matters the most for the Bay Area.