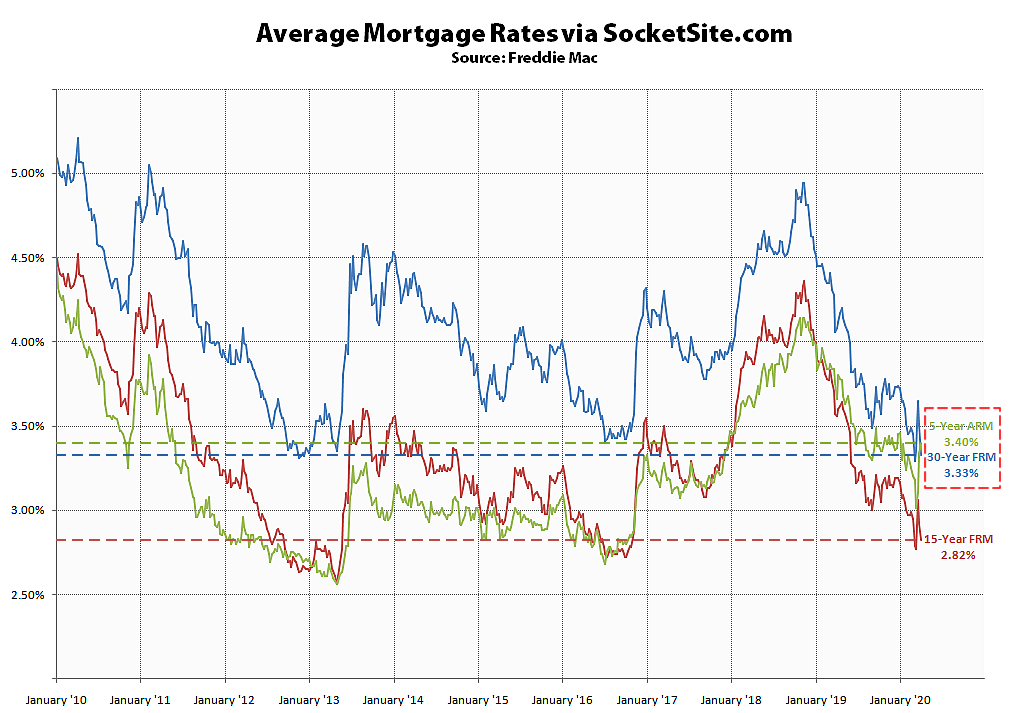

In a move which shouldn’t catch any plugged-in readers by surprise, the average rate for a benchmark 30-year mortgage has dropped another 17 basis points over the past week for an average rate of 3.33 percent, which is now 75 basis points (0.75 percent) below its mark at the same time last year, according to Freddie Mac’s latest Mortgage Market Survey data, and back to within 4 basis points of an all-time low.

At the same time, the average rate for a 15-year fixed mortgage has shed another 10 basis points for an average rate of 2.82 percent, which is 74 points below its mark at the same time last year, while the average rate for a 5-year adjustable ticked up 6 basis points to an average rate of 3.40 percent but remains 26 basis points below its mark at the same time last year.

As such, the inverted spread between the 5-year and 15-year rates is up to 58 basis points. And for the first time since the second quarter of 2009, the benchmark 30-year fixed rate is now lower than the 5-year adjustable rate as well.

Hallelujah!

UPDATE: While the average 15-year rate has inched down another 5 basis points to 2.77 percent, the average 30-year rate has held at 3.33 percent and 3.4 percent for a 5-year ARM.