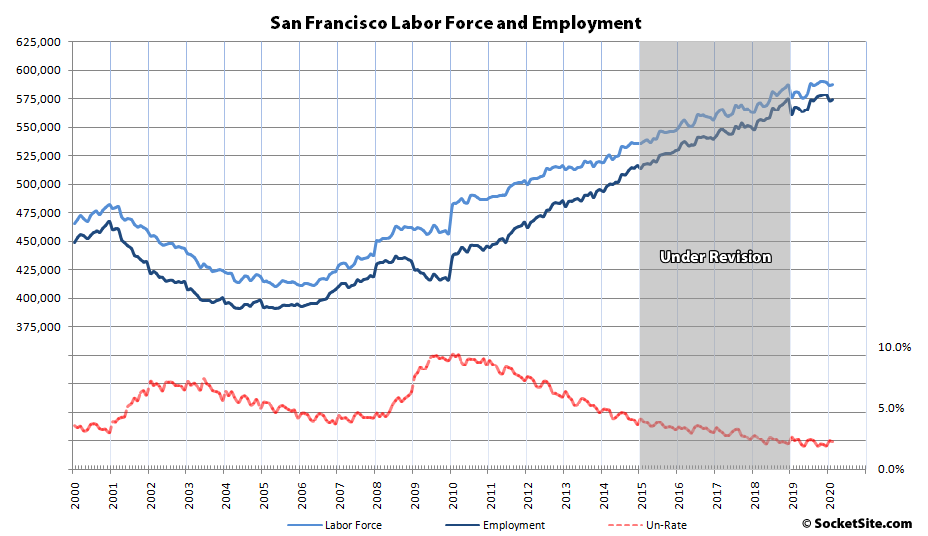

Having been downwardly revised by the State at the start of the year, the estimated number of people living in San Francisco with a paycheck inched up by 1,100 in February to 574,100, which was 7,400 more employed residents than at the same time last year, with an unemployment rate of 2.2 percent.

But the numbers above, along with those for the rest of the Bay Area counties below, were compiled prior to the COVID-19 hit. And while we don’t have the early numbers for each county, unemployment filings in California have nearly tripled over the past three weeks and were running 363 percent higher on a year-over-year basis at the end of last week.

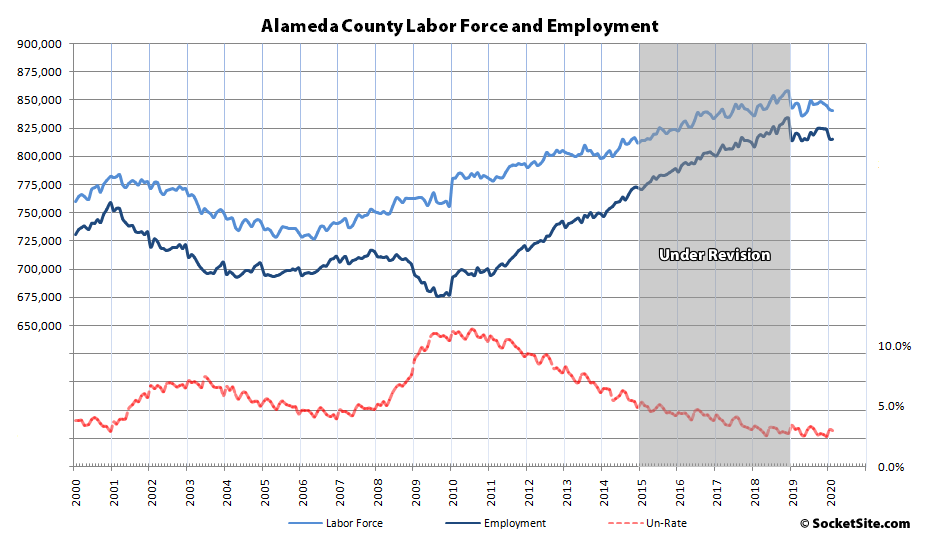

Over in Alameda County, which includes the City of Oakland, the estimated number of employed residents slipped by 300 in February to 815,200, which was 5,300 fewer employed people than at the same time last year with an unemployment rate of 3.0 percent.

Across the greater East Bay, including Solano County, total employment effectively held at 1,556,500 in February but slipped by 10,000 on a year-over-year basis with a blended unemployment rate of 3.2 percent.

Up in Marin, the number of employed residents held at 136,500 in February, which was 500 higher than at the same time last year, with an unemployment rate of 2.3 percent. Employment in Napa ticked up by 1,000 to 71,000, which was 400 more versus the same time last year, with an unemployment rate of 3.3 percent. And employment in Sonoma County inched up by 1,000 in February to 251,600, which is 1,200 higher than at the same time last year with an unemployment rate of 2.8 percent.

Down in the valley, employment in San Mateo County inched up by 700 in February to 453,600, which was 5,500 higher than at the same time last year, with an unemployment rate of 2.1 percent. And employment in Santa Clara County inched up by 2,400 to 1,030,400 in February, which was up by 4,000 versus the same time last year, with an unemployment rate of 2.6 percent.

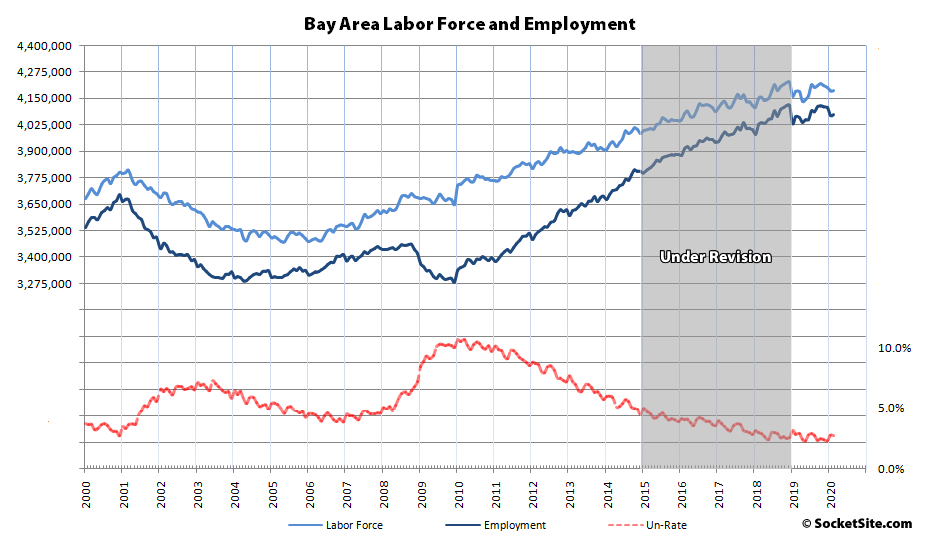

And as such, total employment across the Bay Area, which appears to have peaked at a downwardly revised 4,113,700 this past October (which shouldn’t catch any plugged-in readers by surprise), was effectively unchanged at 4,073,400 in February, which was 0.2 percent higher than at the same time last year, with an unemployment rate of 2.7 percent.

But once again, the numbers above were collected prior to the COVID-19 hit and unemployment claims in California have nearly tripled over the past three weeks alone.

Please stay safe, for both yourself and others. We’ll keep you posted and plugged-in.

The forecasts are beginning to trickle in – predictably with the kinds of declines we’re used to seeing in those ‘asked $60M, sold for $15M” transactions – and at least one of them had SF faring slightly better (even if the headline to the story actually said something else); that seems rather hard to believe: SF is enormously dependent on tourism – tho admittedly less than a place like Vegas or Miami – and it’s hard to picture another industry that’s collapsed so completely right now.

We might not do as bad as some other cities, but the economic effects of COVID-19 are going to be so disastrous that Bay Area will not escape. This will reverberate through the tech industry and housing.

Oh, no doubt !! the choices open are ‘bad’, ‘worse’ and ‘worst’ (orders currently accepted but take out only).

The subhead of the (linked) article tho was that Silicon Valley would fare a little better, and then it proceeded to throw out numbers that had SM best, SF a little behind that… contradicting the premise and contrary to what I would expect.

Re: “SF is enormously dependent on tourism…and it’s hard to picture another industry that’s collapsed so completely right now.” Uh, haven’t you kept up to date? According to the in-the-knows, The City is not dependent on tourism. From seven months back on ss:

Of course, the reason that it isn’t instantly and verifiably true is that the The U.S. Bureau of Labor Statistics doesn’t have a category for “tourism” unless you conflate that with Tour and Travel Guides, which of course nobody on socketsite remarking about the dependency of S.F. on tourism does.

We have already begun a huge natural experiment that will establish whether or not “Anonymous” or “Notcom” is correct in less than a year. I strongly suspect that the people filing unemployment claims over the past three weeks already know the answer.

The economy may not be “dependent” on taxes but the hotel tax alone can blow a 5% hole in the city budget. The hotel tax has double the revenue of the city sales tax. Add in cratering real property transfers and you’re missing 15% of city revenue.

Exhibit A

Some of the most expensive real estate markets in the country will see significant drops in demand. Huge impacts on construction. A lasting effect will be a relook at living in densely populated, hugely expensive areas like the Bay Area. Look for a significant effect upon high-income earners in places like the Silicon Valley. High cost real estate in the Bay Area will not escape this downturn as it did, more or less, in the Great Recession. People will leave, companies will leave. To less dense and less expensive areas. Especially lower tier workers. The population will see a significant drop in coming years.

The economy was in trouble before the virus. Hence the massive infusion of money into the Repo market starting last fall. Many companies are zombie companies. Basically losing money. A lot of that exists in the Bay Area. Uber and others. Much of the Bay Area’s economy lived on the hit of cheap money. That is gone and that is good. A major realignment will occur because of this crisis. It will have huge impacts on the Bay Area. Those luxury condos coming on line – good luck to the developers. The market for them has collapsed and will not come back for a long time.

Uber is a zombie company, says Dave. Wow. Too much.

“Much of the Bay Area’s economy lived on the hit of cheap money. That is gone….”. Cheap money is not gone. The feds are hell bent to make sure cheap money keeps flowing precisely because of the crisis.

Exactly. Past injections of liquidity have inflated the Bay Area even as they were unable to stop the rest of the country from deflating. This is deplorable but it’s hard to see why this time would be different.

Is there any evidence that expensive real estate markets like the Bay Area or Seattle will fare any worse than less expensive markets?

Expensive real estate is usually the least hard hit. Last time around the big drops were in place like Las Vegas, or the bottom quarter of Bay Area prices.

Las Vegas. Now there’s a place that is dependent on tourism. Housing prices in Vegas are going to get slaughtered.

It is way too early for evidence at this point, only predictions and conjecture. And to add my own, I think it will be interesting to see if the pandemic causes any sort of demand shift out of urban cores and back into the suburbs. Being cooped up in a downtown condo for a 2 month lockdown gives one plenty of time to reconsider life choices and priorities. A backyard and a spare bedroom can go a long way to keeping one’s sanity in these dire times.

Of course, the elephant in the room is whether we even have a functioning economy after this mess. If the mortgage market seizes up, or if unemployment grows to +20%, or if stocks come crashing down how does that impact the housing market? And in terms of SF, how the tech sector weathers this storm is probably going to play an outsized role on how the local real estate market fares. Google, Facebook, Apple etc… were for the most part unaffected by, if not prospering, during the 2008 recession. I personally think that the tech sector is fairly mature at this point, and is heavily exposed to the broader economy, so I am not sure that they will fare as well this time around. But on the other hand, Netflix, Youtube (owned by Google), Amazon and some others are probably going to do very well so I guess we will just have to wait and see how this shakes out.

UPDATE: Bay Area Employment Dropped by at Least 77,000 in March