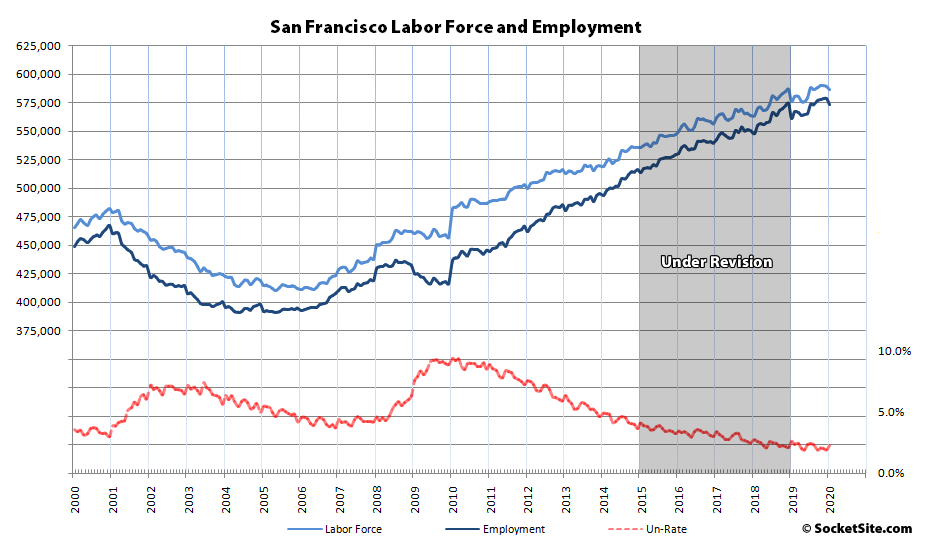

The estimated number of people living in San Francisco with a paycheck slipped from a (downwardly-revised) record 578,100 in December to 573,000 in January with typical seasonality in play. But if the preliminary January figure holds while the State refines its model, the number of employed residents in the city will still be 2.2 percent (12,100) higher than at the same time last year with an unemployment rate of 2.3 percent.

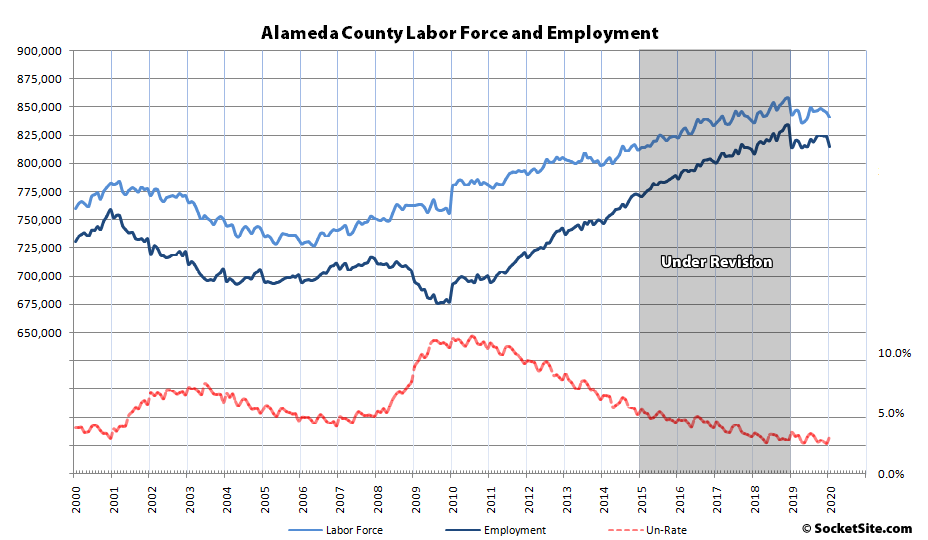

At the same time, the estimated number of employed people living in Alameda County, which includes the City of Oakland, dropped from a downwardly revised 823,900 in December to 814,700 in January, which is effectively unchanged versus the same time last year (up 0.1 percent), with an unemployment rate of 3.0 percent.

Across the greater East Bay, including Solano County, total employment was revised down from 1,573,500 in December to 1,556,000 in January, which is effectively unchanged on a year-over-year basis as well (up 0.1 percent), with a blended unemployment rate of 3.2 percent.

Up in Marin, the number of employed residents slipped from 137,900 in December to 136,400 in January, with an unemployment rate of 2.4 percent, but remains 0.7 percent above its mark at the same time last year. Employment in Napa effectively held at 69,800, which is 1.7 percent higher on a year-over-year basis, with an unemployment rate of 3.5 percent. And employment in Sonoma County dropped from 253,600 in December to 251,000 in January, with an unemployment rate of 2.9 percent, but is still 0.9 percent higher, year-over-year.

Down in the valley, employment in San Mateo County slipped from an effective record of 456,600 in December to 452,500 in January but was 2.1 percent higher than at the same time last year with an unemployment rate of 2.1 percent. And employment in Santa Clara County slipped from a downwardly revised record of 1,035,900 in December to 1,028,700 in January but remains 1.0 percent higher on a year-over-year basis with an unemployment rate of 2.6 percent.

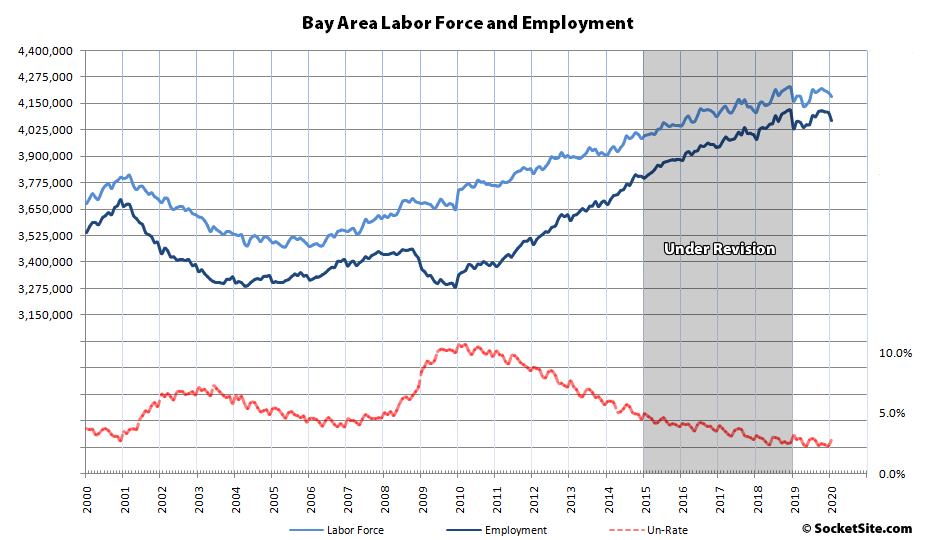

As such, total employment across the Bay Area, which appears to have peaked at a downwardly revised 4,113,700 this past October, slipped from 4,105,500 in December to 4,067,400 in January but still managed to eke out a 0.9 percent gain on a year-over-year basis with an unemployment rate that has inched up to 2.8 percent.

The covid19 hit will be pretty big. Time to start bidding 5-10% under ask. That is, if you can find a lender that will actually complete underwriting right now. They were at the beginning of the week, not so much at the end of the week.

I will be interested to hear if the strategy of bidding 5-10% under starts working.

As folks realize that the gains they have been investing for in the stock market can almost evaporate over a week, and many times years of potential savings, dutifully invested in regular intervals to take advantage of dollar cost averaging, can and does disappear in the course of a three week period, those folks are going to go looking for a safe haven asset like S.F. real estate which retains it’s value and may start bidding up the property on the market.

T-Bills are a safe haven. SF real estate is not. Is SF real estate liquid? A 12% drop in the market is bad if you had to sell today, but what would happen if you absolutely had to sell your home in the next 8 weeks? The rental yield in most SF properties is terrible. If you have a mortgage, you owe that every month regardless if business is good or bad. And right now tech stocks (and thus stock based compensation) are going down the toilet drain. SF real estate is a [high] risk asset not a safe haven.

Uber stock is now at 19. They shut all taxi service, along with Lyft, this morning. 200K in RSUs over 4 years at a share price of 48 before the IPO are now worth about $80K. Your 160K salary is now 120K. A down payment of 80K and a salary of 120K buys you nothing at current prices. And these were the people who were going to eat San Francisco alive. They can’t even nibble San Francisco until prices fall by half.

Juul is flat on it’s back. Facebook is down 25%. Google down 30%. Apple down 20%. And today was an up day. This is going to leave a very drastic mark.

Uber is garbage as a business, but their typical engineering compensation package is more like $200k cash, $200k RSU, plus annual cash bonus 10-20% of salary. This is on the low side compared to other software companies like Facebook, Microsoft, Google, and Amazon.

Agree, T-Bills are a safe haven, however one-years are paying around 0.43 last time I checked. Agreed, real estate is not liquid, and you should never be in a position where you have to sell your home in eight weeks.

However, compared to stocks I say that SF real estate is a safer investment because the 20% decline in values during the so-called Global Financial Crisis was roughly less than half the drawdown in the stock market around the same time.

Like tipster says, today was an “up” day in the stock market, was yesterday the bottom? I think not.

A 20% decline in value means in most cases the bank got all their money back and you lost 100% of yours. Then you took money out of your pocket and paid off the realtors, the transfer tax, etc. How is that better than the stock market?

Just because the market went down doesn’t mean everyone rode it all the way down: you can get out in 30 seconds. Not so for real estate. Case in point: 250 King St #414. Listed December 5 of last year, gets no offers, pulled from the market for the holidays, relisted and 3 weeks later, gets an offer in late January. Yesterday, it fell out of contract (big surprise!) and is now relisted, three months after the offer was accepted and over 4 months after it was first listed for sale. The market has now completely changed, and the seller is screwed. If the seller had wanted to sell stocks, a couple of button pushes and zero commissions later, he’s out.

Lenders are currently swamped and don’t have the liquidity to offer mortgage rates anywhere near where they should be with most North of 4.5% despite the 10-Year Bond suggesting they should be ~3%

It is VERY hard to get a loan around 3% right now even with large down payment and 740+ scores

Has little to do with lenders being swamped. The RMBS market seized up last week and spreads blew out. They’re finally starting to realize that things aren’t rosy and are trying to reprice risk. Until that happens, nothing new goes out.

Which is why simply comparing the average, long-term spread between 10-year Treasury and 30-Year Mortgage rates on a historic basis with the spreads last week, and then concluding that the current 30-year rate was significantly overpriced based on the current delta, was not only misleading but completely missed the real point.