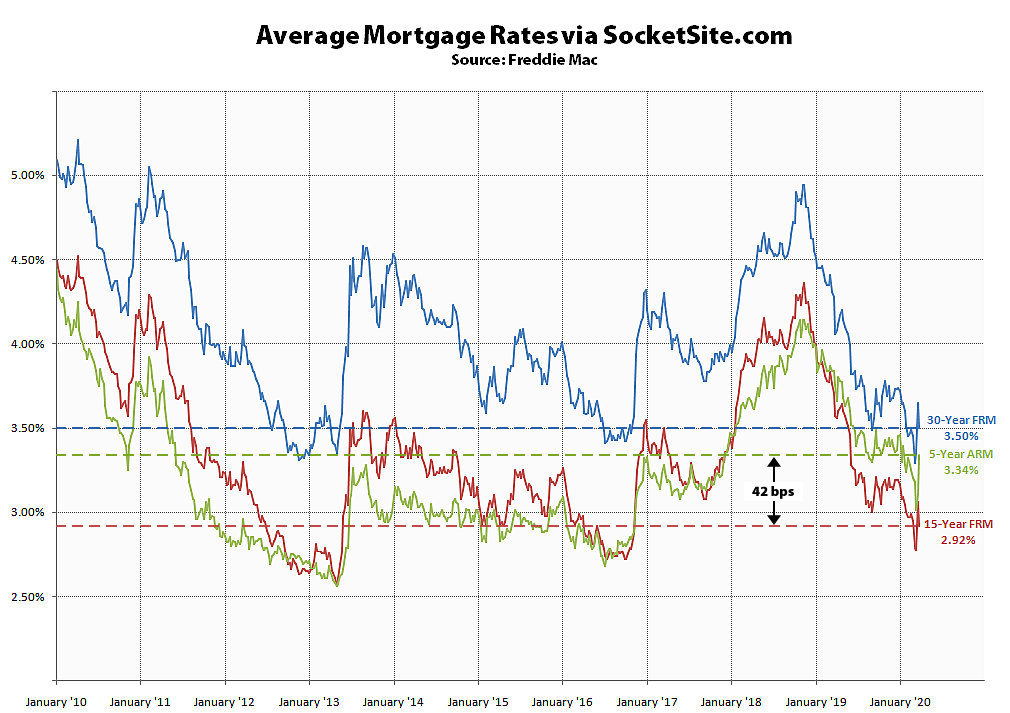

Having spiked last week, the average rate for a benchmark 30-year mortgage has since shed 15 basis points for an average rate of 3.50 percent, which is 56 basis points (0.56 percent) below its mark at the same time last year, according to Freddie Mac’s latest Mortgage Market Survey data, driven by the Fed having further ramped up its efforts to stabilize and inject more liquidity into the mortgage and credit markets.

At the same time, the average rate for a 15-year fixed mortgage has shed 14 basis points to an average rate of 2.92 percent, which is 65 points below its mark at the same time last year, while the average rate for a 5-year adjustable has jumped 23 basis points to an average rate of 3.34 percent (but remains 41 basis points below its mark at the same time last year).

As such, the “inverted spread” between 5-year and 15-year rates has jumped from 5 to 42 basis points, which is the largest inverted spread since the second week of February, 2009.

Keep the rates dropping! We need it!