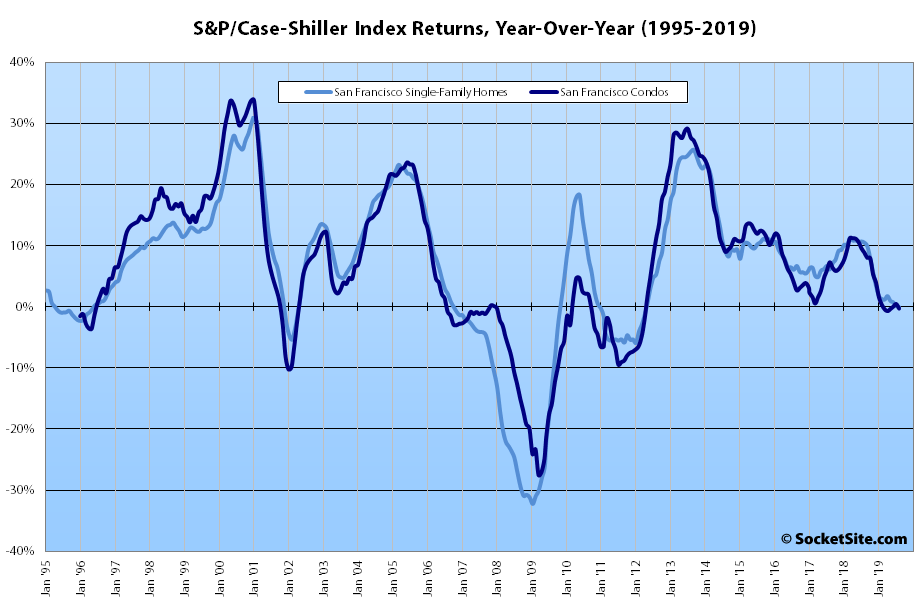

For the first time since early 2012, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – has dropped on a year-over-year basis, an outcome which shouldn’t catch any plugged-in readers by surprise.

Granted, it’s a nominal drop of 0.1 percent. But that’s versus a 10.5 percent year-over-year gain at the same time last year and despite a dramatic drop in mortgage rates over the same period of time, plenty of IPO related hype from industry folks since the start of the year and a stock market which is still hovering near its all-time high.

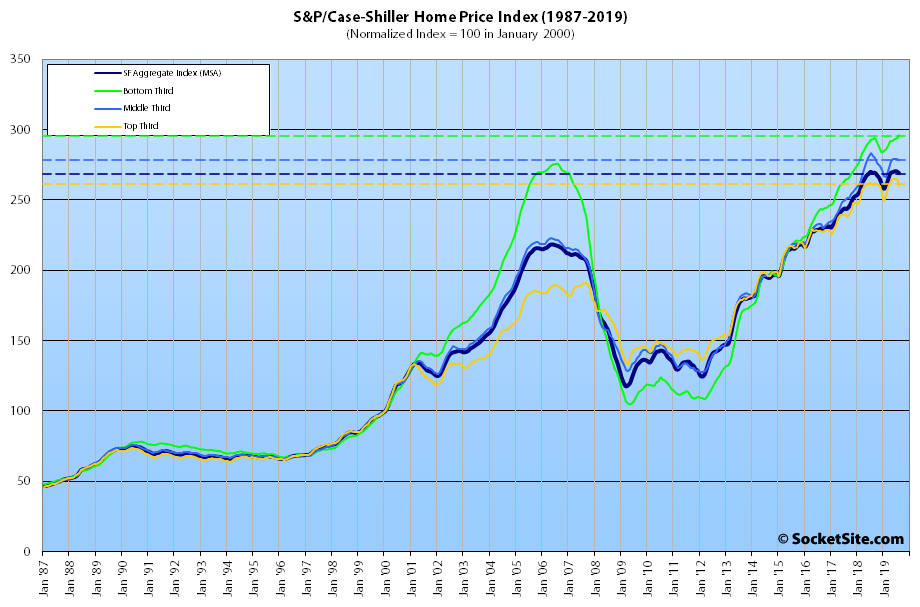

At a more granular level, the index for the bottom third of the market managed to inch up 0.8 percent in August for a total year-over-year gain of 1.0 percent (versus a year-over-year gain of 10.7 percent at the same time last year); the index for the middle third of the market, which peaked last year, slipped another 0.3 percent and is currently down 1.2 percent on a year-over-year basis; and the index for the top third of the market dropped 1.5 percent for a year-over-year gain of 0.0 percent (versus a year-over-year gain of 9.7 percent gain at the same time last year).

And having slipped 0.5 percent in August, the index for Bay Area condo values is now down 0.3 percent on a year-over-year basis having turned negative for the first time since 2012 in the first quarter of this year.

Nationally, Phoenix is still leading the way in terms of home price gains, up 6.3 percent on a year-over-year basis, followed by Charlotte (up 4.5 percent) and Tampa (up 4.3 percent) with Las Vegas (up 3.3 percent) having just dropped out of the top three.

And of the top 20 metropolitan areas in nation, San Francisco was the only metro area to record a year-over-year loss in August, with Seattle, which ranked second to last in terms of performance, managing to eke out a 0.7 percent gain.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

At this point the index is running on fumes from Contra Costa county (median up 2.4% month-to-month). Sales volume wise, a little more than a third of the transactions are from Alameda County, a little more than a third from Contra Costa County, and a little less than a third from San Mateo, San Francisco and Marin Counties combined. Ess Eff median was flat month-to-month and the remainder were down. Median sales price is over $1 million in all counties except Alameda ($825k) and Contra Costa ($630k). This data is per CoreLogic, YMMV, median… mix… blah, blah, blah…

Time of death: Summer 2019.

Cause: well, let’s wait to make sure the patient isn’t only mostly dead.

Santa Clara has driven the train for the small year over year slip that CS’s MSA shows.

Santa Clara has been a massacre (in three part harmony) over the past year. Just to be clear, it is NOT included in the Case-Shiller Ess Eff index. Everyone else (besides Ess Eff proper is down month-to-month). The CS Ess Eff Index only shows a slight drop as it is a three month rolling average. June was an okay (up) month but it wasn’t enough momentum to sustain the gains into the August CS numbers.

We see two -10% troughs on this graph, lasting different durations. Has anyone done the math on what rate of appreciation one needs in Y2Qx to wipe out a 10% hit taken in Y1Qx?

11.1%

So much for the tech IPO bloom.

After the two rounds so far of Uber layoffs and Stripe moving on out, to add salt to the wounds Juul is laying off 10-15% of its workforce. It’s going to be a brutal market the next few years. Just brutal.

Just wait till we win this trade war. Trade wars always have winners, right?

The S&P 500 just hit an all-time high. Apple’s earnings were up. Facebook’s earnings were up. And nationally, the Case-Shiller index was up 3.2 percent. But the reason for the drop in the San Francisco index is the trade war?

Sure, let’s look at some numbers! If the trade war started in about March, 2018.

S&P 500 then was about 2700. Today it’s about 3000. So an increase of 300 in about 19 months.

In the 19 months before March, 2018 (August 2016-March 2018), the S&P 500 went from 2100 to 2700. That’s an increase of 600. So growing about half as fast after the trade war kicked off.

Stock prices for Facebook and Google essentially haven’t grown at all since then, and those companies have a disproportionate effect on SF’s market. (Right? Or are we disputing this too?)

So yes, I’m comfortable with the numbers on the trade war. Is it Socketsite’s position that the trade war does not affect the economy?

“Stock prices for Facebook and Google essentially haven’t grown at all since [March, 2018]”

Facebook stock is up 22 percent since the end of March, 2018. Apple stock, which is at an all-time high, is up 51 percent.

And again, the S&P 500 just hit an all-time high as well.

At the same time, the Case-Shiller index for San Francisco has somehow lagged the national average, and quite significantly, since the end of 2018 and is currently the worst performing major market in the US.

The reason you rate an infinitesimal, point zero one, colored by one super frothy area in Santa Clara, a significant drop versus an epochal year is what, precisely? The reason you put that into people’s minds is what, precisely? Because you bought into the whole late 20th century “must see constant growth” shareholders perspective? Baloney perspective IMO.

Ok SS, what is your theory about the August drop? Most of the easy answers would apply to LA as well – the trade war, the SALT changes, etc. I think that what you’re insinuating is that there is some SF-specific force that can take prices down without affecting other MSAs. What force is that?

If I had to guess, I’d say that anticipation of an IPO spike pulled demand forward a bit, and between stumbling unicorns and the lockups not actually expiring yet, the summer and fall got hollowed out here and not elsewhere.

I just looked, and Uber’s lockup expires on Wednesday. How time flies!

I think the folks posting sarcastic comments about the trade war over and over again are just expressing their sorrow over not being invested in the S&P 500. If such a poster had invested in a China A-Shares fund…well, let’s just observe that the iShares China Large-Cap ETF (it’s the largest in terms of total assets) closed 3/1/2018 at $47.26. On Friday, it closed at $42.00 for a decline of over 11%. If I were that person I’d be posting decrying the trade war, too.

I think the trade war is stupid and I have no idea what Brahma is talking about.

Trade wars damage the economy, which hurts everyone, which is why they’re stupid.

Boy, that trade war, “which hurts everyone,” sure is fickle!

Is it Socketsite’s position that the trade war is not a negative thing?

I will definitely agree that it hits the Bay Area harder than most regions. Especially in combination with the increasing difficulties faced by immigrants. Lucky us!

What, exactly, does Socketsite believe?

What happened to…”my argument is that SF’s economy is stronger than most places, so SF real estate will do better than most places?” You know, with “Apple and Google…still supporting real estate prices?”

Because…of the top 20 metropolitan areas in nation, San Francisco was the only metro area to record a year-over-year loss in August. And in the third quarter, home prices rose in 93 percent of Metro Areas across the nation, but not in the Bay Area. Has “everyone [suddenly stopped] using smartphones?”

By saying “I will definitely agree that it hits the Bay Area harder than most regions”, what you’re admitting is that trade wars hurt some people and/or markets more than others. Which is exactly the point I was making earlier: Someone fully invested in the U.S. stock market, via the S&P 500, is being “hurt” by the trade war less than someone fully invested in the Chinese stock market via a Chinese A Shares fund.

Of course, each stock market is not a comprehensive barometer of each respective country’s economy. But to the extent that they are indicators, one market is being “hurt” more than the other.

Is it SFRealist’s position that the trade war “hurts everyone” equally? If not, what, exactly, does SFRealist believe?

I do not say that the trade war affects everyone equally. It damages (almost) everyone, but to different degrees. The Bay Area, with its economy based on companies with global reach, is hit harder. In addition to this, the Bay Area has a heavy immigrant population and has been damaged by the anti-immigration policies of the administration. In addition to that, the tax plan has made property ownership in states like California less affordable. In addition to that, the government has drastically increased the deficit when there was no need to do so.

I do fully admit to not imagining that any President of the United States of America would be so stupid and so interested in damaging the economy. Guilty as charged!

But once again, as of eight months ago, which was well after the trade war had commenced and said policies had been enacted, you were actually arguing the exact opposite (“my argument is that SF’s economy is stronger than most places, so SF real estate will do better than most places“), bolstered by a long running notion that “Apple and Google [are] still supporting real estate prices.” And not only are both stocks up since then, along with Facebook, but Apple is up significantly and recently hit an all-time high.

I don’t view 8 months as a “long run” in real estate. But if Socketsite does, that’s your perspective.

I think affordability is finally catching up with the bay area market.