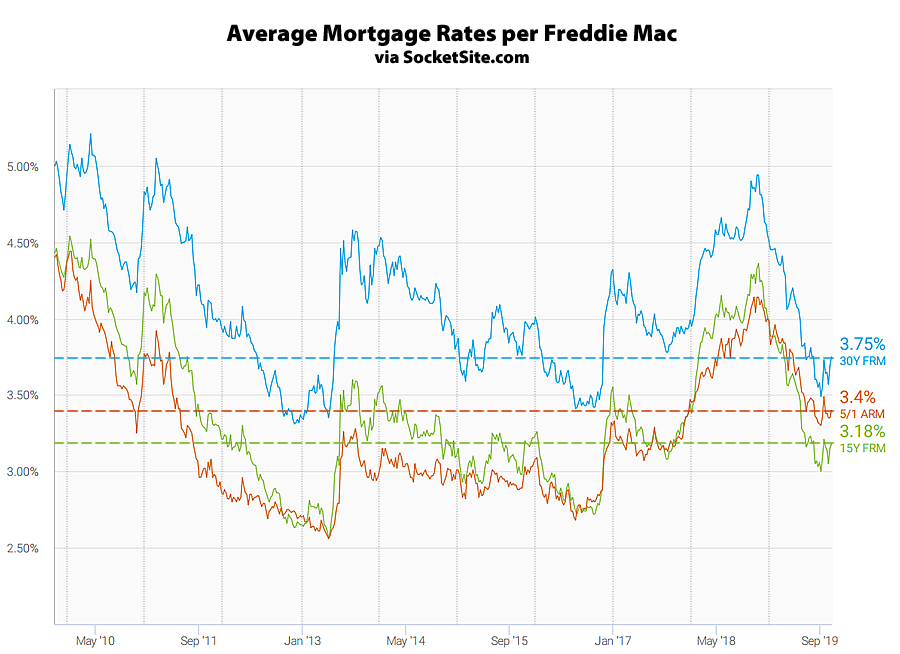

Having jumped 12 basis points last week, the average rate for a 30-year mortgage has since ticked up another 6 basis points and now measures 3.75 percent.

That being said, the average 30-year rate remains 111 basis points (1.11 percentage points) below its mark at the same time last year and within 34 basis points of a three/six-year low.

The average rate for a 15-year fixed mortgage has ticked up to 3.18 percent but remains 111 basis points (1.11 percentage points) below its mark at the same time last year as well, while the average rate for a 5-year adjustable has ticked up to 3.40 percent, which is 74 basis points below its mark at the same time last year.

And according to an analysis of the futures market, the probability of the Fed instituting a third rate cut by the end of the year has ticked up from 90 to 96 percent.

As predicted: The Fed Just Cut Rates (For the Third Time This Year)