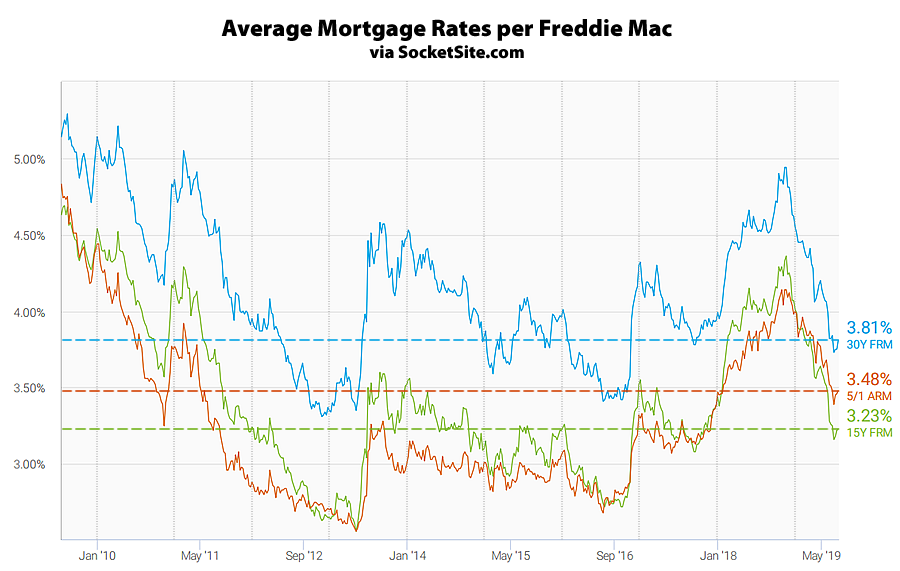

Having dropped to 3.73 percent at the end of last month and bouncing around a 32-month low, the average rate for a 30-year mortgage inched up 6 basis points over the past week to 3.81 percent but remains 113 basis points (1.13 percentage points) below its mark in the fourth quarter of last year.

At the same time, the average rate for a 15-year fixed mortgage inched 1 basis point over the past week to 3.23 percent, which is still 77 basis points below its mark at the same time last year, and the average rate for a 5-year adjustable inched up 2 basis points to further inverted 3.48 percent, which is 39 basis point below its mark at the same time last year.

And with the probability of the Fed easing rates by the end of the year holding at 100 percent, the odds of the said easing happening soon rather than later has increased over the past month according to an analysis of the futures market.