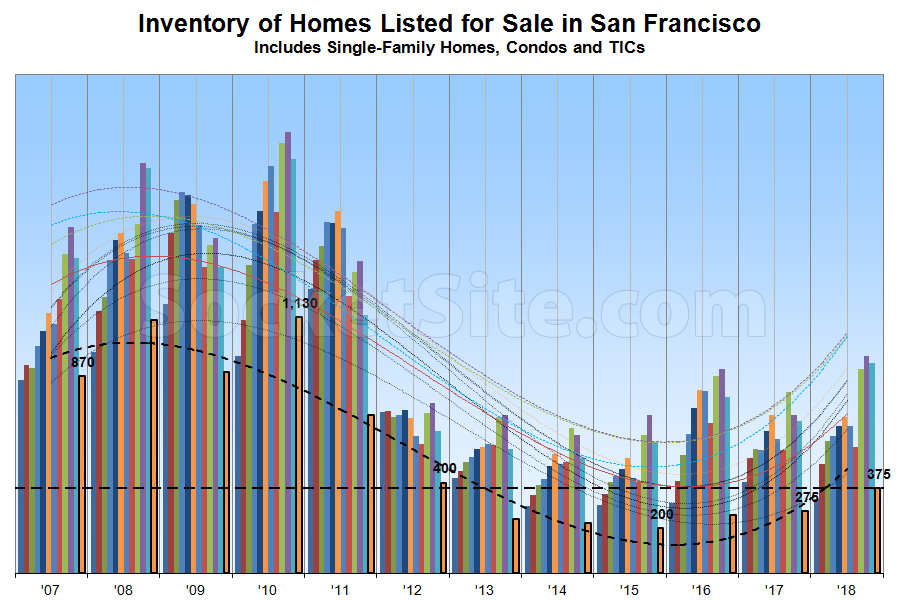

With only a handful of homes having been newly listed for sale over the past week, and the seasonal culling of unsold listings – which will likely return to the market as “new” in the new year – having peaked, the number of homes actively listed for sale in San Francisco has dropped to 375 but remains 36 percent above its mark at the same time last year and a 6-year seasonal high.

Of those homes currently listed for sale in the city, 38 percent are now listed for under a million dollars (versus 36 percent at the same time last year) and 27 percent have undergone at least one price reduction (which is up from 24 percent at the same time last year).

And with the total number of homes that have sold in San Francisco since the beginning of the year running around 3 percent lower than in the first eleven months of 2017, pending sales are currently down 8 percent versus the same time last year and the average list price per square foot of those homes in contract ($893) is 3 percent lower, year-over-year.

We are still entering 2019 with a less than a month’s worth of inventory. Conditions are still looking tight on supply side. Especially when you compare inventory levels to 2009, 2010, and 2011.

2009, 2010, and 2011 followed the worst housing crash in US history.

Inventory levels were 3-4x higher in 2009-2011, yet home prices and home values remained flat. I believe we are still in a supply constrained marketplace.

Possibly demand constrained as well.

home prices did not remain flat during the recession. They declined 15-20% in most parts of SF, and by much more than that in places like Bayview/HP

Palo Alto has less than a month’s supply, too. Didn’t stop a prime located home from losing ~ 2 mil.