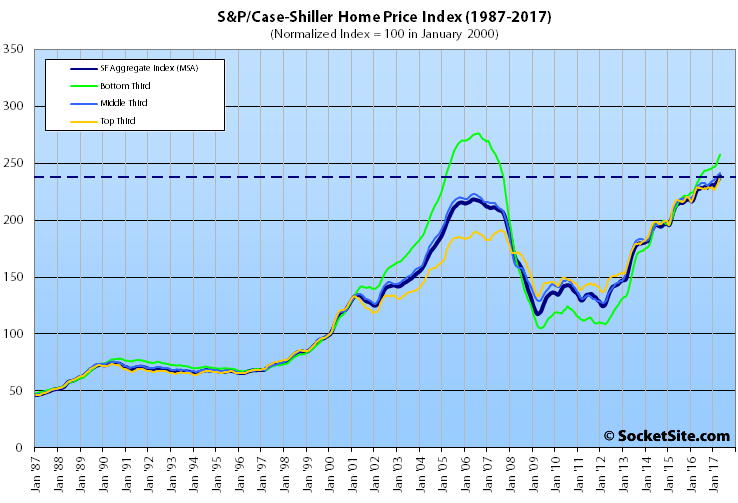

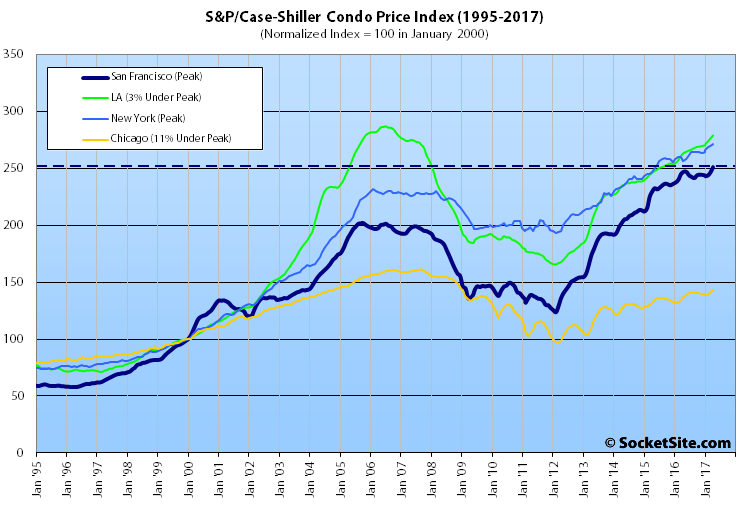

Having ticked up an upwardly revised 1.1 percent in March, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – gained another 1.5 percent in April and the index for area condos gained 1.8 percent as well, lifting each index to new all-time highs.

That being said, the year-over-year gain in the overall index for single-family home values dropped to 5.0 percent, which is the smallest year-over-year gain since July of 2012 and versus 7.8 percent higher on a year-over-year basis at the same time last year, led by gains in the bottom third of the market.

Having gained 1.5 percent in April, the index for the bottom third of the Bay Area market is now running 10.4 higher versus the same time last year. The index for the middle third of the market is running 5.2 percent higher versus the same time last year having ticked up 1.0 percent in April. And having jumped 2.2 percent in April, the index for the top third of the market is only up 3.6 percent versus the same time last year.

While the index for the top third of the market is running 24.2 percent above its previous peak ten years ago, the index for the bottom third of the market remains 6.7 percent below its 2006-era peak.

And facing its first year-over-year loss in five years, the index for Bay Area condos jumped 1.8 percent in April for a 1.6 percent year-over-year gain and is running 24.3 percent above its previous cycle peak in October 2005.

And across the 20 major cities tracked by the home price index, Seattle, Portland and Dallas reported the highest year-over-year gains for the third month in a row, up 12.9 percent, 9.3 percent and 8.4 percent respectively versus a national average of 5.5 percent.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

No surprise. Low supply + high demand = higher prices. Tight supply, in particular, has been the situation in SF for the last six months. Those claiming the crash is upon us have simply ignored the facts.

I haven’t seen anyone here claim the crash is upon us. Just that it’s coming at some point, and probably sooner than later. It’s quite possible that the only thing that saved it from happening already was Trump’s election and the false hopium it created for more business friendly laws. The market conditions today (both housing and stocks) are very similar to 2007 in numerous ways.

Neither Trump nor Obama (or the BOS) can change the LAWS of economics. It’s supply and demand. Yes, prices will go down at some point and go up at another point. If you own so what if you don’t have to sell; and if you rent when prices go down-buy! Draw your best straight line through the graph, 1995-2017, what does that tell you. Economics 101.

Sabbie, are there any charts you can link to showing how market conditions are similar to 2007? CAPE, P/E ratios by vertical etc. Legitimate question, not being snarky.

The Schiller CAPE is at the level it was on Black Tuesday in 1929. A level it’s hit only then and on the up and down swings of the 2000 bubble.

How correlated is that with SF real estate though?

I agree US stocks are way overvalued but SF real estate has not gone up as quickly as US stocks as far as I can tell.

A year old, but you can see that the housing price/income ratio is shooting up again as it did in 2007.

For real estate, the monthly chart of SF median home values and its moving averages, standard deviations, and momentum indicators all look extremely similar to 2007, plus my recollection of being a market participant at that time. For the stock market, Fed tightening into slowing growth, yield curve, Shiller CAPE, complacency level of the S&P500 VIX futures, Citibank US Macro Surprise Index. All sorts of weakening credit impulse like C&I loans rolling over, tax receipts down, defaults across all types of loans starting to turn up. Plus this time there are new problems such as the rise of indexing/passive and algorithmic investing.

One difference from 2007 is that buyers who seek a purchase money loan now must fully quality for the loan, rather than relying on stated income loans from the past.

This bubble is not driven by easy mortgage loans, it’s driven by easy credit to companies and investors, who instead of using the downturn to invest in productivity, decided upon being gifted artificially low interest rates by the Fed that they would instead buy back their own stocks, throw money at lame lottery ticket startups, and/or front run asset bubbles, all of which filters down into the housing market.

The 2007 bubble was driven by easy access to credit from home buyers. That is no longer the case.

Uh, when interest rates are near zero and mortgage rates are 3.5% for 30 year fixed, thats exactly what that is. Different kind of easy access to credit, but easy access to credit nonetheless.

Except credit is now only available to well-vetted borrowers who can repay the loans. In the 2003-07 time frame, large nothing-down home loans were freely available to those with no hope of ever paying it back.

It is true that rates are low (but so is inflation, so rates are not particularly low in real terms) but credit is not “easy” by any stretch. It is quite difficult to obtain credit.

Lending standards are very different today. Interest rates aren’t relevant if you can’t get a loan.

I’m also unaware that derivatives of crappy mortgages are being repackaged and given top ratings as they were in 2007.

The 2007 housing bubble and bust was the first time the entire national housing market had a bubble. The breadth of the bubble was the unique factor in 2007. A fast food worker in Nowheresville, Indiana could lever up and get a huge loan. The amount of exuberance and capital needed to bubble up the entire county (and many parts of the rest of the world) was mind boggling.

But San Francisco is a small city of less than 900k people with much of the housing stock being rentals and much of the rest tied up due to Prop 13. You only need a tiny fraction of the exuberance of 2007 to bubble up a city like SF.

A 20k/year worker may no longer be able to lever up 10x into a 200k home, but a 100k tech worker is a prime customer for banks and low rates, borrowing from family and under-saving (borrowing from your future self) allow them to display quite a bit of exuberance.

But with home prices up 5% in the last year, and condo prices up 1.6%, I’m not seeing a lot of exuberance. Just steady, moderate growth.

Look at the data the editor posted. Going from 23.9% YoY to 1.6% is not “steady, moderate growth.” It’s a transition from going up sharpy to flattening out.

Precisely. A far cry from “exuberance.” Four years ago, perhaps one could raise red flags. In recent years, prices continue to increase, but more slowly. Just steady, moderate growth.

The data looks like SF housing prices are on a plateau for about the last year.

If they were still increasing 20%/year, it would be worrisome

If your read of the data is plateau, and the data includes the lower-cost East Bay markets which have been outperforming San Francisco in terms of gains, any thoughts on what that might suggest for the component of the index which represents SF proper?

Yes, this is right there in the post. The lower tier is up 10.4% in the last year, and the top tier is up 3.6%.

The first commentator from this post in 2016 seemed to think the crash was around the corner.

The differences in market conditions between now and 2007 are enormous.

I just read that thread, and I don’t see the word crash used even once, nor do I see any prediction with regards to timing.

So you’re saying that there will come a time in the future that markets will decline, but are unwilling to say when that might be?

I agree. There will come a time that the market declines.

Oh, here’s a post from exactly two years ago where someone is discussing the impending bubble burst.

Not even the smartest minds in finance, Ray Dalio or Jeff Gundlach or Lacy Hunt or whoever, would be able to tell you when the market will tank. All you can do is try to buy closer to the bottom than the top and vice versa, and be prepared when it comes. Hint: we’re closer to the top here in SF.

And in this day of Central Bank omnipotence you can’t even predict the severity of the crash, the government will hold nothing back when it comes to spending your (and your children’s, and grandchildren’s) tax dollars to prop up their failed banker cronies. Rugged free market capitalism is only for Main Street, for Wall Street we have a real nice safety net. Do not be surprised if they allow the Fed to directly purchase equities this time around.

No one is saying the market will decline out of context.

Generally recesions happen every 8 years or so. Is it time for one by historical standards? Yes.

Generally the value of the cape is median/mean approx 16. It’s now at 30 the second highest its ever been. Are stocks over valued? In that context? Yes.

Generally bubbles occur when monetary policy is too loose. Have interest rates been so low by historical standards? Yes.

Just a little thought experiment for you: Let’s say you are in charge of a large pension fund and have millions of dollars in pension obligations and you assumed 15 years ago you could get at least 3-4% on tbills for your obligations.

Now, fast forward to 2017 where interest rates are now near zero yet you still have those pension obligations but can get maybe .75%. so what do you do now? You still have that responsibility to those pensioners. So you go yield chasing. And some of that yield chasing is going into the stock market. Some of it is going in sf/sv in the form of venture capital. Which employ a bunch of non-profitable companies in sf/sv.

And here is the last non-out of context kicker. When that next recesion occurs, in all likelihood interest rates will still be low, and the political climate will still be anti-fiscal spending, which will likely result in a longer than normal recession. And those unprofitable companies will die, and thousands of people will leave sf/sv and the expectation that you will be able to get the same money you got for sf real estate in 2016 will be gone.

When will this happen? Who the hell knows. But there are already leading indicators of an impending recession.

Some time in the next 24 hours the sun will set and the sun will rise. Predicting a decline some day eventually is worthless.

If the market rises 20% in the next two years, then suffers a 15% drop in 2019, was your prediction correct?

Lucky for me I’m not in the business of predicting, I’m in the business of real estate investing (on the side) and I wouldn’t even consider buying real estate at anywhere near these silly over inflated prices, nor would I put my money in nosebleed stocks right now as a ‘buy and hold’ investor.

And as a long time SF resident, I’m sad at the negative changes this lame tech bubble has brought to the City. And as an American, angry at the financial and social destruction wrought by the Fed and their politician cronies in pursuing Bubble Economics for the benefit of the creditors, and the reckless behavior of those who will surely come begging for my taxpayer money in the next bailout.

April 2014 to April 2015 saw a 10% rise. The next year 8%. The past year 5%. No way one could see that and reasonably think “bubble, imminent crash.” We are seeing moderate (and moderating) increases coming off of very high increases that followed an epic crash. That is not cause for alarm but evidence of a solid and reasonable market.

The 2007 bubble saw prices rise sharply, flatten for a year or two and then crash. This time we saw prices rise sharply, now they look to be flattening. A crash isn’t guaranteed, nothing about the future is certain, but there’s not much difference now from the early stages of the market turn last time.

Here’s the more detailed year-over-year data for single-family homes, on a monthly basis, since the beginning of 2014:

23.1%

22.7%

21.3%

18.4%

15.6%

13.2%

10.5%

9.0%

8.2%

9.3%

9.1%

9.4%

7.8%

10.1%

10.5%

10.3%

9.7%

9.5%

10.2%

10.5%

11.1%

10.9%

11.0%

10.3%

10.6%

9.3%

8.5%

7.8%

6.5%

6.5%

6.0%

6.6%

5.6%

5.6%

5.4%

6.1%

6.4%

6.4%

5.1%

5.0%

And the same data for condos:

23.9%

22.6%

20.2%

16.3%

14.5%

11.3%

10.1%

9.0%

9.4%

9.9%

11.1%

10.9%

10.7%

11.0%

13.2%

13.7%

13.4%

12.5%

12.0%

12.5%

12.2%

11.4%

10.1%

11.0%

12.0%

11.5%

9.0%

7.6%

6.2%

5.3%

4.0%

2.7%

3.1%

3.6%

3.9%

3.1%

2.3%

1.6%

0.6%

1.6%

Last time, the market turned form going up to being flat. Kicked around at or near all time highs for a few years and then started it’s downward trend.

Your constant implication that a crash has to be immediately upon us or will never occur has no basis in fact.

What’s important to look for now is the turn from up to relatively flat.

No crash is coming. I visited 923 Folsom, and a 2/2 is $5850 + $300 parking. Studios start at $3300. They said they leased out 25% so far, and it’s been a month.

While prices may dip, these overall prices are here to stay for the long term.

I am def seeing more for rent signs around town when I am taking my weekend drive.

Every time I travel to a different city and come back here it really makes me appreciate how great the quality of life is here in SF..I would argue SF has the highest quality of life of any city in the world. And I have been to many, many cities all around the world. The only place that came the closest to the quality of life here was Sydney.

Sydney has much better transit, fwiw. And beaches. But I can live here without A/C so it’s a push?

You must be kidding. NYC, Boston, San Diego, Seattle, Portland and especially Oakland, have better quality of life than San Francisco.

No. The only thing better about Oakland is the weather.

Oakland ha NO CLAIM on being even a second-tier city until all the violent trash is cleared out. Probably another 5-10 years yet.

Source: I’ve lived in Oakland since 2014.

Since 2014. Wow, so u the Oakland expert now huh?

And the parkland, and the convenience airport within city limits, and the zoo, and the theaters, and the restaurants, and the slower pace, and the 30,000 fewer crimes, and the 700 fewer violent crimes.

Where you live in Oskland is like judging SF by 16th & Mission, or the Tenderloin. Go to Rockridge, Montclair, Piedmont Avenue, Lske Merritt, Uptown, JLS, Redwood Heights, Ridgemont, and tell me the quality of life is better in SF.

I’ve lived in three of the cities you list. I left those cities for this one because quality of life is much higher here. Go ask some former New Yorkers whether they are eager to go back–few are.

Exactly how is the quality of life in SF better than the quality of life in Oakland?

Different strokes for different folks.

There’s no accounting for taste, but if you are trying to make a case that Quality of Life issues accounts for the price changes we’ve seen, you need to have some explanation for the ups and downs.

Did SF QoL rise sharply upto mid 2005, plateau a few years, then crash down, kick along the bottom for a few years, shoot up mid 2012 only to turn the corner and plateau again?

Oakland is not one of the three I’m referring to. So I’m not really in a position to fully answer your question. I would not want to live in Oakland but don’t profess to have complete info there, and many of my friends love it.

SF Parks are superior to Oakland. For me, this is a critical quality of life component. Ocean Beach, Presido, GG Gate are only the big ones; SF has superior neighborhood parks as well. I actually love Oakland, but boosterish claims that it has a better quality of life are at best very debateable. The hills parks are not very accessible, and need a lot of work. The shoreline is a mess, except for pockets near JLS and maybe future Brooklyn Basin. Lake Merrit is nice, but has minimal open space, it’s mostly paths.

I also lived in NYC, and quality of life there is quite poor, especially considering parks and outdoor recreation.

Frank, the parkland in Oakland is much bigger. Redwood Regional is a gorgeous 1600 acre redwood forest less than 5 miles from Downtown Oakland. Right next to Redwood you have Sibley Regional Park, Huckleberry Preserve, Anthony Chabot Park, Robert’s Park and the 500 acre Joaquim Miller Park. Joaquin Miller also boast the gorgeous 2,000 seat Woodminister Amphitheater where you can enjoy Broadway plays under the redwoods and stars.

Oakland also offers the scenic MLK shoreline Park. Oakland was rated 6th best in parkland in the nation in a recent publication ahead of San Francisco.

Oakland was ranked 7th best city for outdoor enthusiasts while SF was ranked 10th.

I have to disagree with you regarding the parks in NYC vs SF. Central Park is vastly superior to Golden Gate Park and much better maintained. Battery Park and the promenade next to the Hudson River offer extensive recreational opportunities. The gorgeous Bryant Park on 42nd Street is perhaps the most beautiful and well maintained urban park I have ever seen. Bryant Park is a smallish impeccably maintained park with kiosks ping pong tables a gorgeous lawn, beautiful fountains surrounded by beautiful upscale apartment buildings and sleek skyscrapers. This park puts any public urban parks in SF or Oakland to shame. It is however a public/private partnership that maintains the grounds.

My favourite colour is red. My wife’s is yellow. She is completely wrong and I am right

Gonsalves on parks is just silly. Oakland’s parks are far out of reach for most Oaklanders. You have to drive to them. Most badly need maintenance. I have been to them, too. Oakland’s parks ARE nice…but that is not the point. They are inferior. SF’s parks are interspersed, are on the coast, have stunning views. And Gonsalves is arguing acreage. It’s comical. The GG vs Central park debate is actually debatable. The rest is not. Oh, but GG park has ocean access and 20% more space.

If you consider being stuck in trafficto be a great quality of life than yeah, SF rocks. Moved to Reno last month and I much prefer it. My condo in SF goes on the market next month.

Does this data contradict the oft-cited softening of the condo market here by Socketsite? The Mark Company index also?

Not sure if we should be relying on a global data company with a price index constructed by a Nobel Laureate or by the non-public Mark Company data and so-called apples-to-apples comparisons.

What’s a reasonable person to do?

No, it does not.

While the index above is for “San Francisco,” it includes the East Bay, North Bay and Peninsula, as pointed out in the first paragraph above and noted every month.

A reasonable, or at least informed, person should understand the differences between the various indexes and comparisons, as well as the relative performance of each component and their implications as a whole.

I am curious if the old adage ‘real estate is local’ impacts the index because it includes a relatively broad swath of the Bay Area. It would be really interesting to see if the fraction of homes in the top third category had a much higher proportion of SF and Peninsula homes in 2014 when RE appreciation was more dramatic versus 2017 where the East Bay in particular has been seeing larger YOY %increases in values compared to SF.

Keep in mind that the tiers aren’t based on the current values of the homes that just sold, but rather the price at which said homes were purchased in the past.

Different indices measure different things. A reasonable person should accept that no measure is perfect.

The takeaway is, as some of us have been positing, an ongoing slowing in Bay Area home appreciation to a point where it mirrors, give or take, the national average. No crash, short some kind of external event which would crash other markets too, but a flattening with just average appreciation over the next decade or so.

For local residents this is a net positive as affordability will increase – though it will remain out of touch for median income households.

For investors – a general exodus should occur as we are seeing already with the large drop-off in new SF projects this year compared to last – and last year was down from the one prior. The investor class will look more to greener pastures (and climes) as ROI is still much better in most markets including robust metros like Seattle, Dallas, Atlanta and these booming markets now offer much better appreciation potential.

Anecdotal, I know of a developer who only does entitlements in the Bay Area. He has had winner after winner in the past 15 years. His most recent project, which just closed, is the first to not meet the projected profit (mapped out in 2015) though it still made a nice return for the LLC. This particular project was in Pleasant Hill which underscores the fact that the whole Bay Area will likely lag many markets in the coming decade.

The biggest local driver has been tech jobs but jobs in the technology, media and information sector that were growing by about 15% two years ago are now at roughly 1% according to BLS, and this figure is lagging national job growth in general.

Bay Area home sales volume sank to its lowest level since 2008 while this slowdown was going on. When those bloated tech salaries meet layoffs, buyers will disappear, and already out of reach prices will have to come way down to attract anyone, especially when other cities are offering way more bang for the buck. No, you won’t see the distressed selling of 2009, but these prices are also much further from the mean than the last bubble. And layoffs are coming, because lots of these smaller companies are running on fumes, you hear about it all the time.

And as an aside, SF Fed’s Williams said today “The stock market still seems to be running very much on fumes”.

[Editor’s Note: Bay Area Employment Slips, Trending Down in S.F. and Alameda.]

I can’t comment on the stock market. I have stocks through my 401K, but my passion is real estate investing. One key element of a real estate investment is a city with a diverse job base.

The job situation in SF is not diverse and in some respects is not strong. Tech aside, the large non-tech employers continue to leave from Schwab to Blue Shield to Union Bank and more. Thousands of jobs gone with no large non-tech companies coming into to replace them. Aside from that there is tourism, government jobs (the city and state are hiring apace) and health care. That is where the job growth is – a narrow job sector is not a healthy thing long-term. Just as one needs to diversify with stocks, a metro area should have a diverse and growing job base. SF does not.

As to tech, it accounts for less than 10% of SF jobs and is, to a certain extent, spillover from the SV. There are exceptions – Salesforce, Uber and Twitter but, in the case of the latter two, if they were to go under a big chunk of SF’s tech workforce would disappear overnight. The fact that tech companies account for 50% of the sublease space being put on the market now is an indication that SF expansion plans by these companies is being put on hold. IMO LinkedIn will relocate much of its SF workforce to the NW. There are rumors to that effect in the company though those may be due to wishful thinking as a good chunk of the workers want to relocate out of the area.

Finally, the overall office space numbers are not good. About 5 million feet being looked for with more than 8 million feet being available before the end of this year.

What is the ‘tech sector’ after all?

Treating every company that does business on the internet as the very same sector is like treating every electric product as the one and the same sector (‘electricity).

IMO, SF based tech companies have penetrated deep into other sectors and the drivers of their profits/losses are becoming more and more distinct: E.g.:

Google/Facebook: Media, Advertising

Uber/Lift: Transportation

Salesforce: Business appliances

Airbnb: Hospitality

etc. etc. etc.,

Here his how this ties back to real estate: My thesis is that SF real estate is MORE resilient when it comes to economic downturns because the different ‘tech’ companies make their money in very different parts of the economy.

While the tech sector may be somewhat diversified, your statement about “make their money in very different parts of the economy” is not exactly ingenious because lots of these companies don’t actually make money but are operated at losses. Like Blue Apron for example: “Less than 24 hours after collecting $300 million in its initial public offering, Blue Apron Holdings Inc. faces the reality of needing more cash — and soon.” The ones that are making money, is it just me or has their innovation dropped off lately, perhaps they are spending too much on buybacks, fancy spaceship campus, and traveling to the midwest to practice running for president. Either way, investors lately don’t seem too excited about their near term prospects with the easy money spigot turned off.

Apple’s revenue in 2016 was 215 billion dollars.

Google’s revenue was merely 90 billion dollars.

Sorry but Apple and Google aren’t going to hire all the folks from these failed startups, like for example SoFi who are now offering millennials who buy a house at the top of the market with 10% down a month of free avocado toast (for real).

Is SoFi laying people off?

Note: SoFi appears to have less than 1000 employees. Google has about 55,000. So it would appear that if SoFi did disappear, all of them could be hired by Google. But they wouldn’t all go to Google, of course. Unless you’re proposing that every fintech in San Francisco will go bust and none of them will survive.

His data is moot when the average price of a house in SF is still around a million dollars and still out of reach for the vast majority. When you have cities like Seattle, Portland and Dallas showing gang buster increases, it is because they were at the bottom and still affordable compared to the Bay Area as a whole. Even when prices during the GFC dropped to a median of 700K in SF, it was considered still unaffordable to many.

Unfortunately, even with a sustained appreciation just tracking the national average, homes will still be unaffordable to many here. But it’s at least a move in the right direction. I travel to other cities quite a bit and a common theme is how they can avoid the mistakes the Bay Area made in terms of development and affordability.

Despite the boom, Seattle’s median home price is 670K with a median income of 66K. SF has a median price of 1.3 million with a median income of 77K. The median incomes between Seattle and SF are even closer when you factor in no state income tax in Washington – adding a net of several thousand to the 66K median there.

In Portland the median income is 56K, but with a much lower median home price than Seattle. In Vancouver, across the Columbia from Portland, the median home price is 305K. The quality of the homes is generally better in these other cities too.

It’s unfortunate the Bay Area did not aggressively pursue affordability and job distribution issues 2 decades ago. It’s too late to totally rectify the problems created from the hyper development other than moving towards a somewhat more affordable situation.

I believe this is (slowly) happening.

Oakland has numerous large-scale commercial and residential towers going up. Several companies are moving departments to the East Bay. With good access to BART and freeways, downtown Oakland can be reached from the Richmond’s, Livermore’s and Antioch’s more cheaply and easily then downtown SF or Palo Alto.

On the other hand, jobs paying 56k or 66k are leaving the Bay Area while six figure salaried jobs remain. I’m not approving of this trends, but I believe that this will be the reality until zoning and tax rules (prop. 13) are reformed significantly.

If you travel to the Seattle metro area there are cranes everywhere – in town, out of town. A massive boom spread throughout that region. It never was so here. The cranes are concentrated in just a few Bay Area locales. One writer from the NW noted that when visiting this region last year.

The regional jealousy/competition can’t be overcome by the politicians. SF will not ban additional major office construction at the political level, but talks of such a ban are circulating in community groups WofTP – which areas have been so negatively impacted by the growth. If an indefinite ban on new office construction was put in place in SF and parts of the SV, that alone would relatively quickly change things in terms of affordability, average commute times and quality of life. Something dramatic like that is needed to “save” the Bay Area because business as usual can’t go on.

If real estate prices are a function of high-paying jobs in the area, it is worth looking at some commercial real estate figures. The SF business journal does a good job summarizing recent deals.

Several very large leases were signed during the 1st half of 2017:

– Prime Tower is nearly leased to 100%

– Amazon is looking at 200’000 SQF of office space downtown

– Facebook is talking about a large new office close to Transbay Terminal

– Autonomous car companies (Otto, Cruise) have either already signed, or they are looking at large scale office spaces downtown.

To me, this sounds like a lot of new, high paying jobs are coming to SF.

And for those interested in the bigger picture and longer-term trends: Office Rents in San Francisco Slip, Vacancy Rate Inches Up

This is a good link. When it comes to commercial real estate, my focus is not predominantly on the price per square foot, but at the fact that rapidly increasing supply is being met by demand. Even if net absorption has turned negative in Q1 2017, it follows 23 positive quarters, 5+ years of price appreciation and a windfall of new office space hitting the market. What matters for residential real estate is the fact that quality employers are still looking for SF commercial space. As long as this is the case, the sky-high real estate prices in SF will stustain.

“Sustaining” prices would be an absolute disaster for those buyers who are expecting appreciation.

the cape ratio doesn’t make sense to use as an indicator now, because the S&P500 have negative earnings during the great recession mostly because of huge losses in the financial sector. since the cape ratio is just Price / [average earnings over last 10 years], of course the average earnings over the last 10 years will be very significantly lower than normal because you are factoring in negative earnings for 2008, 2009, etc. from the worst years of the great recission. if you eliminated those outlier years, i bet the overall ratio is much much more in line with normal

By that logic, you”d have to eliminate every year there would be a recession and therefore the total average would be lower and we’d be right back in the same place.

But the whole point of the CAPE is to average over the business cycle.

You can’t excludes the losses from people and businesses being unable to pay back loans they took during the boom times, but include the “growth” and earnings produced by those very loans. Because the business cycle often manifests itself as a period of financial expansion and overly loose lending followed by a bust or contraction, you need to look at both the boom and bust times together to get a true picture.

You can have a great lifestyle for a few years by piling debt on your home and credit cards, but ignoring the years when all that debt needs to be paid back would paint an unrealistic picture of that financial “strategy”.

And if anything the earnings over the last cycle were probably overstated. Because as large as those financial losses were, they’d be even larger were it not for a set of massive government bailouts.