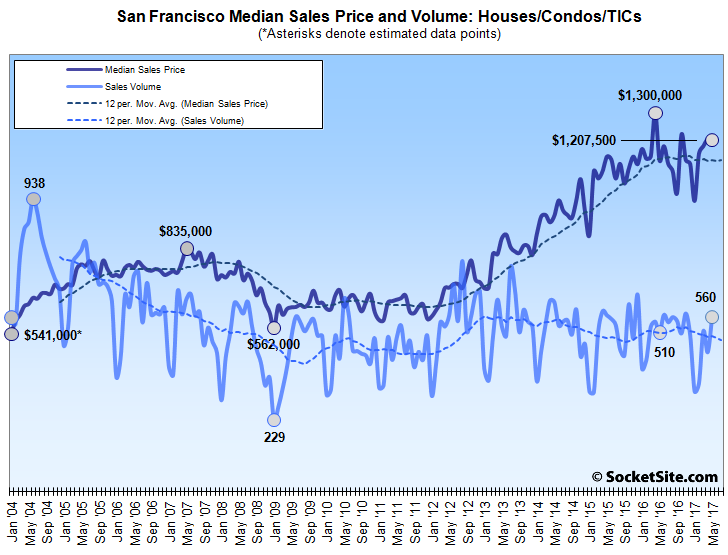

Having dropped a downwardly revised 13.0 percent in April, the number of single-family homes and condos that traded hands in San Francisco rebounded 17.2 percent to 560 in May, which is 9.8 percent higher versus the same time last year as compared to 18.0 percent lower on a year-over-year basis the month before.

And across the nine-county Bay Area, recorded home sales jumped an above-average 18.4 percent from 6,896 in April to 8,164 in May, which is 1.6 percent higher versus the same time last year versus 9.8 percent lower on a year-over-year basis in April.

The median price paid for those 560 homes in San Francisco last month ($1,207,500) was 0.2 percent lower than the downwardly revised median in April and 7.1 percent lower than the record $1.3 million median price recorded in April 2016 but 6.2 percent higher versus the same time last year while the Bay Area median ($755,000) was 7.1 percent higher on a year-over-year basis in May and an all-time high.

As we noted eight months ago, the recorded sales volume in San Francisco was being goosed by contracts for condos in new developments that were signed (“sold”) many months prior but were closing escrow in bulk as the buildings came online in the middle of 2016. signatures on new contracts, however, are down 19 percent over the past year despite an average of nearly 55 percent more inventory from which to choose.

In Alameda County, recorded homes sales in May (1,691) were 6.6 percent higher on a year-over-year basis with a recorded median sale price of $732,000, which is 3.1 percent higher versus the same time last year while sales in Contra Costa County (1,552) were 5.0 percent lower on a year-over-year basis with a median price of $575,000 (6.5 percent higher versus the same time last year).

Home sales in Santa Clara County last month (1,942) were 3.4 percent higher versus the same time last year with a median price of $940,000 (up 7.4 percent) while sales in San Mateo County (650) were 4.1 percent lower with a median price of $1,207,500 (up 17.8 percent, year-over-year).

And up north, recorded sales in Marin County (354) were 4.7 percent higher in May versus the same time last year with a median price of $1,132,750 (up 16.8 percent, year-over-year) and sales in Napa (143) were 1.4 percent higher with a median price of $622,250 (up 8.2 percent) while sales in Sonoma County (608) were 1.0 percent lower with a median price of $561,000 (up 5.8 percent).

Keep in mind that while movements in the median sale price are a great measure of what’s selling, they’re not necessarily a great measure of appreciation or changes in value and are susceptible to changes in mix, as opposed to movements in the Case-Shiller Index.

Low inventory and continuing strong (at least steady) demand is driving things. Here is an example of a year-to-year resale: 56 Danvers sold in June 2016 for $1,660,000. Just sold again at $1,820,000, up 9.6% in the last 12 months. A little higher than the +6.2% median rise, but in the ballpark.

Keep in mind that demand in San Francisco, as measured by actual sales, is running 11.3 percent lower over the past six months versus the same two quarters the year before with an average of 8 percent more listed inventory from which to choose.

And if you’re banking on medians (which you really shouldn’t), you’re down 7.1 percent from peak, right?

Demand is not measured by numbers of closed sales in a market with limited supply.

Nobody is “banking on medians,” particularly monthly medians which are based on pretty small and varying samples and jump around a lot as indicated by the chart above (annual medians are more reliable). I just pointed out a year to year “apple” with a decent gain that is pretty close to the year to year median increase. Thus, this actual sale — which is pretty solid evidence — does not appear to be an outlier based on the broader but rougher numbers.

Demand is not measured by numbers of closed sales in a market with limited supply.

Actually, that’s exactly how demand (versus “want”) is measured and prices are set (with respect to the “limited supply” part).

The monthly median for May 2016 is no more reliable than the monthly median for April 2016 in terms of divining movements in values. And when proffering apples-to-apples sale pairs, it would really behove you to understand what’s happening when a TIC (such as 56 Danvers) is involved.

So, please share with us what happened with 56 Danvers if it was something extraordinary. I know how TIC sales work. They are not complicated or unusual in San Francisco. And to the extent they are unusual, this was was the same unusual in 2016 as in 2017.

If in one month there are 1000 units on the market and 500 close, and the next month there are 600 units on the market and 400 close, that certainly does not indicate that “demand” has fallen. This is not a complicated concept.

If in one month there are 1000 units on the market and 500 close, and the next month there are 600 units on the market and 400 close, that certainly does not indicate that “demand” has fallen. This is not a complicated concept.

Actually, that’s exactly what your hypothetical indicates: that demand dropped by 20 percent.

Of course, a decrease in supply typically results in higher prices. And when prices rise, demand typically falls. But if demand had held steady in your example, 500 of those 600 units would have sold despite the change in supply (or price).

And in terms of TICs, you don’t seem to have a solid grasp of how the conversion process works, the steps involved and the incremental value that each step (including simply time) and an eventual conversion confer.

Harping on one individual address/sale is not productive. Any number of hyper-specific scenarios could have happened at 56 Danvers. A buyer could have bought/overpaid for the home next door for his parents to move in, for example.

@Socketsite,

This entire chart can be quite misleading. The reason is the combination of SFH and condo sales in one single data set. As median SFHs go for $1.3M and median condo’s go for closer to $1M, the changes in price and inventory are mainly driven by the MIX of the two in any specific month.

I see that you note that Case Shiller graphs are better indicators for price dynamics, but I would be very cautious to infer any demand/supply conclusions from the charts above (as long as SFH and condos are not split out).

socketsite, by your logic, SF housing “demand” has been steadily declining since late 2012, per your chart above. This precisely coincides with the rather remarkable rise in prices. Perhaps your method of measuring “demand” should be reconsidered. Or, I guess, we can accept your logic and simply throw out all notions that supply, demand, and price have any relationship to one another.

And, again, if you have any specific information on 56 Danvers, please share it. I’ve gone through the condo conversion process. It is not that magical, nor is there any material impact on price until the place is sold after the condo conversion is complete, and even then it is not that big a deal.

You’re conflating a change in the demand curve with the actual quantity demanded. But don’t sweat it, despite not being a complicated concept…like the observer effect, it can be tricky for some to actually understand.

A co-worker bought a home in Oakland last week and spoke of madness placing bids. The standard is now to bid over the asking price, and for his home they had to go 25% over market price and close in a few weeks. They faced competitive bidding at each home they visited.

I can attest to this – fortunately our realtor was able to track down a loft that wasn’t listed. We were able to avoid the crazy (all cash) bidding wars that are happening. Crazy.

It’s an age-old realtor trick. Instead of listing the home for what it’s worth, they list the home meaningfully below market value. Then try to create an aura of a bidding frenzy. What a joke.

This has been the case in the nice parts of Oakland/Berkeley for a while. True story: sold my condo in the city and moved to Oakland two years ago. We ended up offering on 8 homes and finally got accepted for a bit under $2M and 35% over asking. Craziest offer was this modest bungalow in Rockridge that went for 80% over with 30 offers. We were #2, but lost out by $100k to a couple with all cash. My realtor said afterwards that she was glad we didn’t get the house, and it was the most absurd frenzy that she had seen in her 20 years of doing this. I’m also pretty sure prices are up another 10-15% since then.

“The standard is now to bid over the asking price, and for his home they had to go 25% over market price”

I get the part about bidding over asking price, but what do you mean by having to go 25% over “market price”? how is market price determined here, if not the prevailing price he ended up paying.