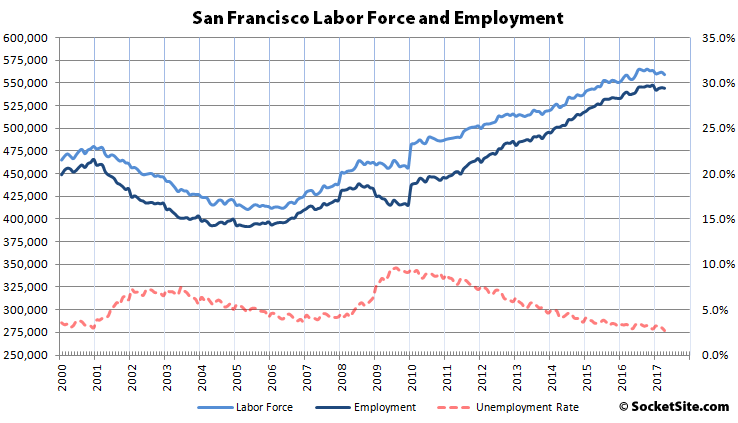

Following the weakest first quarter for employment growth since 2009, the number of people living in San Francisco with a job slipped by 700 to 543,900 in April.

But with the labor force having dropped by 2,600 as well, the unemployment rate in the city has dropped to a near record 2.7 percent. Having hit 8.8 percent in 2010, the record low unemployment rate in San Francisco was 2.4 percent at the end 1999.

And while employment in the city remains 3,300 below an all-time high of 547,200 at the end of last year, there are still 78,400 more people living in San Francisco with paychecks than there were at the end of 2000, an increase of 107,200 since January of 2010 and 7,000 more than at the same time last year.

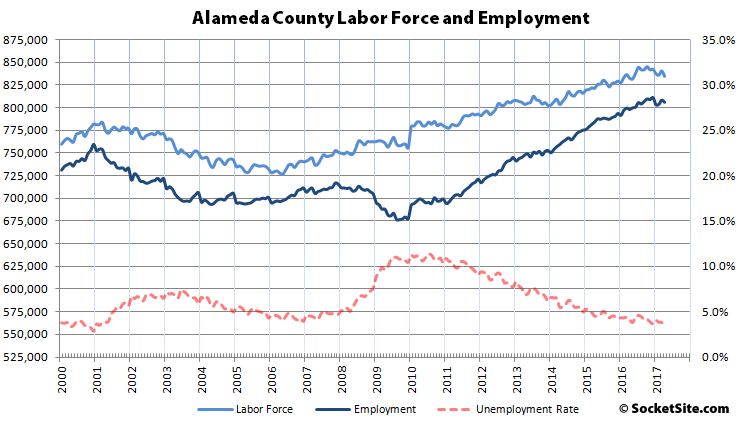

In Alameda County, which includes Oakland, employment slipped by 2,300 in April to 805,600 but remains 7,900 higher versus the same time last year, with an unemployment rate of 3.5 percent and 113,600 more employed residents since the beginning of 2010.

Employment across the greater East Bay slipped by 3,800 in April to 1,339,300 but the unemployment rate dropped to 3.5 percent as the labor force shed 10,100.

Up north, the unemployment rate in Marin County dropped 2.7 percent while employment slipped by 600 to 135,900.

And down in the valley, the unemployment rate in San Mateo County dropped to 2.5 percent while employment slipped by 700 to 436,800 and the unemployment rate in Santa Clara County dropped to 3.1 percent despite a 4,300 drop in employment to 985,400.

I’m trying to understand the drivers here. The labor force is dropping faster than the number of people employed. This all happens in an environment of full employment and sky high living costs. I know that the US population is aging and that more prime age males are outside of the labor force than 30 years ago, but this should not apply to the Bay Area due to the factors mentioned above. Here are my questions:

– Are more and more baby boomers retiring? Has house price appreciation accelerated their retirement planning of homeowners?

– Are more parents choosing to drop out of the labor force in order to take care of kids (rather than pay for expensive nannies and pre-schools etc.)?

Well, how can a person survive for long in San Francisco without a job? Lose job, take flight, is my guess.

If that’s the case, then the number of employed people in SF should fall IN LINE with the decrease in labor force. However, labor force is decreasing faster than the number of people employed.

If 1,900 of the 2,600 people lost or quit their job more than three months ago, or perhaps never had a job like a spouse for example, but only moved away in the past three months, then they wouldn’t be counted in the “700 less people with a job” for this quarter? (just assuming no turnover here for argument sake) Basically more are giving up on SF, for the unemployment rate to go up you need people to lose jobs but also stay put.

It’s tough to hang around when you’re paying $1,500 for a room and $9 for avocado toast and maybe still student loans too. Back in the day we called it “funemployment” but it’s probably not fun anymore unless parent’s basement is here in SF.

I was around for the ‘great recession’ and had a few friends on unemployment during that time.

The max unemployment benefit is/was $450 a week which comes out to about ~$1800 per month. While not a lot by today’s standards, most of us were paying less than $1000 for a room, so it was enough to get by. It seems like it almost created a ‘floor’ to rent prices though, because I don’t re-call rent getting much cheaper.

The flip side to that coin, is now that median 1-bedrooms are running around ~$3500, my guess is a recession of similar size would sent those prices crashing down.

Lose job, take flight, then someone else with a (probably higher paying) job moves here

Agree, there is certainly lots of that turnover hidden within those numbers. Middle class being replaced by upper, most likely.

No doubt. It’s been happening for decades here and some other cities, but the trend is clear.

Let me think… replace roommates in rent controlled unit with roommates who pay effectively market rate or slightly less than market rate. Profit. As long as subtenants don’t know the original rent price, don’t know that this is illegal, or are simply glad to have found housing then the original tenant wins.

Yes, it is illegal. Can only sublet at the proportional rate of the lease rate. Like many laws, I’m sure this one is routinely broken.

I had a friend who got busted (by the roommates) doing this. I’m fairly sure lawyers got involved.

It’s hard to say anything specific with just one or a few months’ jobs figures. The graphs show a leveling out of BA employment in the past 6 months or so. Recently SS had a piece that mentioned there was an actual drop in population for SC and SM counties – the net outflow some here have posted about.

All one can do is speculate and IMO these numbers may foreshadow a leveling of BA job growth relative to other booming metros like Atlanta (which is turning into a tech hub) and Seattle. It’d be nice to have the recent equivalent numbers for those cities.

Forbes listed the 20 best metros for job and population growth and the Bay Area was not on that list. Another anecdotal piece of information to factor into what may be going on..

Anecdote from on the ground. A unit I rented last year had 20 responses a day to my Craigslist ad. Priced the same this month, I’m getting 2 responses a day. Renters seem to have disappeared for the moment.

Meanwhile my friend who owns in a second tier inland CA city said that his rental unit just got unprecedented response compared to the last two times he recently rented it out. We’ve hit “peak SF” for the time being folks, it’s just not worth the cost of admission for most people.

The former manager of my Sacto rentals (1031’d out of the state in 2014) recently told me sales are up in Sacto and most of the people buying are from the Bay Area.

That aside, its not just SF. SC County built uber amounts of office space but not enough housing. The housing was relegated to the Tri Valley area and south of SJ. It’s gotten to the point where even many engineers can’t afford the inner BA prices and the thought of hour plus commutes is not appealing – especially if one has a young family.

Google is belatedly helping build some housing for employees in the MV area. UCSF is doing the same. That is not a good sign.. Companies are having a harder time attracting talent to the BA – especially when that talent can get an equal paying job in Seattle or Atlanta or the dreaded LA.

Again, if more and more people are fleeing SF, we should see a SIMILAR drop in people employed and living in the city AND the labor force in the city. But this is not what the numbers suggest. The numbers suggest a drop in the labor force that is HIGHER than the drop in employed people living in SF. Now, this could be a temporary thing, but can anyone provide a theory for this specific trend?

Perhaps it’s due to the fact that not everyone who is employed in SF lives in the city. If the labor force drops by 1000 but just 40% of the workers live in SF the numbers will show a drop of 1000 in the labor force but only a drop of 400 in the number of people living in SF who have a job.

In any case, the ongoing drop in the overall labor force is the more telling number to watch – especially for developers wanting to build yet more office space in SF.

That’s incorrect. The numbers above are specifically for the universe of people who live, but don’t necessarily work, within the city limits of San Francisco (i.e., those who demand a place to live).

Data indicate that SF has 6300 more in the labor force than a year ago, and 8400 more with a job than a year ago. And unemployment is close to a record low. Basically, one can’t draw any negative conclusions at all from this. One can justifiably say there are indications that SF may have topped off and may have some slight easing in numbers, which would be good for the really tight housing situation. But no conclusions can be drawn yet. Good numbers to keep an eye on. Astonishing that SF had 8.8% unemployment in 2010, and even then the sky hardly fell here, although housing prices had a healthy correction then. Even when the unemployment rate was still at 7% home prices were starting to rise quickly. I’d like to see these numbers flatten or go down a little, if for no other reason than to ease traffic.

Yes, unemployment of 2.7% is incredible. It can’t last forever, but the Bay Area economy is so strong right now.

I wonder at what percentage you guys would call it a crash or bubble burst vs correction? 94124 dropped about 40% after 2008.

Meanwhile U Mich consumer survey shows six-year low among those who think it’s a good time to buy a house and a 12-year high among those who say it’s a good time to sell.

40%? That’s a “crash.” So is 20%, which is also a healthy correction after a massive bubble. Toe-may-toe, toe-mah-toe.

I agree it is a good time to sell in SF and probably not a good time to buy, if one is considering this as a purely economic investment.

But if anyone is looking at this SF jobs chart and thinking “sure looks like a crash is imminent,” then that is simply delusional.

I dunno, I’m looking at the first chart, and that little rollover we’re seeing now doesn’t look much different than 2001 or 2008.

Seriously? During 2001, the unemployment rate shot up from 2.5% to about 6%. During 2008, it shot up from 4% to 7.5%. In 2017 to date, it has continued to drop, now at 2.7%. If we see that rate spike in the next 6-8 months, to 5% or 7%, then I’ll agree we’re looking more like 2001 or 2008. Presently, any such comparison is just frivolous. If there is any resemblance to the recent past, it would be 2013 (and, no, I’m not predicting we will see 2013-style housing price increases any time soon).

Noise around the labor force numbers isn’t going to tell you anything. The labor force fell pretty steadily from 2003-2003 and housing prices skyrocketed. This chart has a weak correlation with housing market health, but if there is any insight to be gleaned, it is from the unemployment rate component.

As the old saying goes, they don’t ring a bell at the top. We’re not going to get much more warning than this. If we did, then it wouldn’t be a crash would it (or healthy correction if you will). When the unemployment rate shot up to 6 or 7% we were already standing deep in it.

We’ll get more warning. If the unemployment rate rises and hits 4% then 5% and continues to rise, that will indicate something of note and you can ring the bell. Continuing near record low unemployment rates don’t warrant any bell ringing.

I’ve been hearing “top of the bubble” bell ringing from the zerohedge crowd for six years now.

Have to wonder what % of the Bay Area economy comes from the Feds because obviously that is going to go down over the next 4 years. I’m guessing it’s small but will be noticable in the numbers.

The difficulty with these figures is they are mixed. There is the labor force contraction in SF and the drop in the number of workers living in SF with a job – in SF or outside. The latter number comprising people participating in the Alameda, SM and SC labor force subsets as well as the SF labor force.

So, if the labor force contraction were equivalent on a percentage basis in each of the labor force markets SF residents participate in then the falloff in the SF labor force would match the falloff in the number of SF residents with jobs. It does not match per these numbers which means the relative fall-off in the labor force outside of SF (including SF residents in that labor force) was smaller than the fall-off in the SF labor force.

I asked my driver the other day what his other clients talked about…he said that the recurring theme was that the Bay Area has gotten too expensive, too crowded, and that they were planning on moving, typically to the Pacific NW.

Not long ago a friend moved to Seattle from here. he was renting a nice apartment in Oakland and is now renting a nice apartment in Seattle. it has many more amenities than his Oakland apartment did and, factoring in not having to pay state income taxes, the rents come out about the same.

Yet you talk to the long time PNW residents and they resent the flood of new residents, and their chatter is not all that different vis a vis “traffic, overcrowding, etc.” Seattle traffic can be terrible. Not AS BAD, but geez.