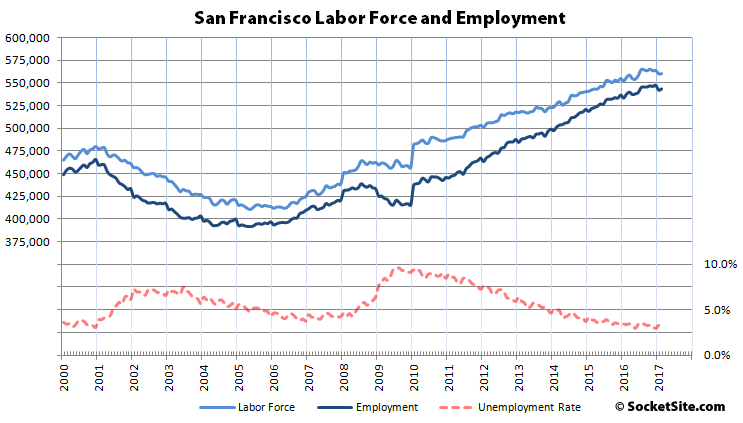

Having dropped the most in nearly a decade at the beginning of the year, the number of people living in San Francisco with a job ticked up by 1,400 last month to 543,200 but remains 4,000 below its peak at the end of 2016.

At the same time, there are still 77,700 more people living in San Francisco with paychecks than there were at the end of 2000, an increase of 106,500 since January of 2010 and 5,600 more than at the same time last year, but the year-over-year gains have been trending down since the fourth quarter of 2014, with last month’s the smallest in eight years.

And with the labor force in San Francisco having inched up by 200 last month, the unemployment rate in the city has dropped to 3.0 percent.

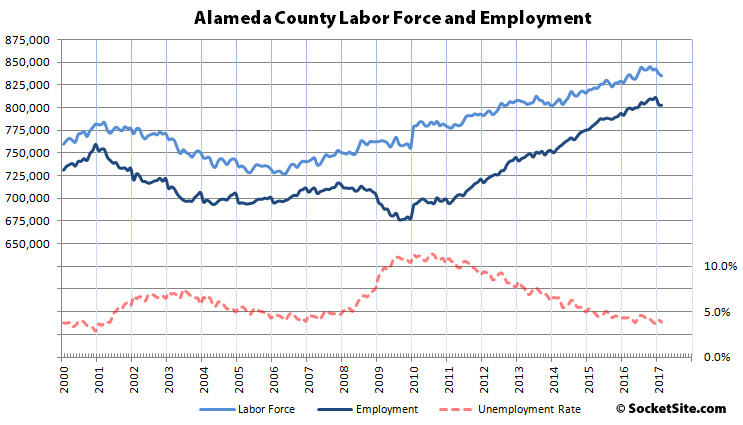

In Alameda County, which includes Oakland, employment slipped by 800 in February but remains 5,500 higher than at the same time last year, which is the smallest year-over-year gain in six years, with an unemployment rate of 3.9 percent and 110,300 more employed residents since January of 2010.

Employment across the greater East Bay slipped by a nominal 900 last month while the unemployment rate dipped to 4.0 percent as the labor force declined by 3,900.

Up north, employment in Marin County inched up by 600 to 136,500 and the unemployment rate dropped to 3.0 percent.

And down in the valley, employment in San Mateo County ticked up 1,200 to 436,300, dropping the unemployment rate to 2.8 percent while employment in Santa Clara County dropped by 2,400 to 985,600 but its unemployment rate (3.5 percent) dropped as well as the labor force shed 4,000.

For some reason SJMN painted a bleaker picture…with the same data?

I’m not sure it is the same data: at first I thought it was simply place of employment vs. place of residence, but if you add up county numbers – which would more-or-less even things out – the net county figures here are only -100, but -7200 in the BANG.

So something seems different…and perhaps explalns the different tone.

3% unemployment is fantastic

3% is too low. It means anyone looking to hire is either dealing with underqualified applicants and/or forced to pay a premium to steal people away from other jobs or regions. That leads to reduced customer service, worse across-the-board job performance, more employee turnover and hence decreased productivity, longer wait times for services, higher costs of living, and the inability for small businesses to get the people they need to compete with the big guys. A healthier balance would be around 5%.

Full employment usually means a recession is just around the corner.

And “Full Employment” has crept downward – i.e. the Full Employment UI has crept UPward – over time. In the 20’s it was 2-3%, then in the 70’s it was 3-4%, now practically anything in single digits is said to be exerting “inflationary pressure”.

Your causality is backwards. That chart demonstrates that unemployment increases after the stock market drops. In other words, recessions cause unemployment, not the other way around.

There is no causality implied, just correlation.

But your correlation is backwards. First you have a stock market drop (i.e. recession). Then you have increased unemployment.

I am looking at employment, not unemployment. It shows that once that certain zone is reached, looks like roughly 4.5%, it has not tended to last for very long. In other words, based on history this is about as good as we are going to get. In other words, we’re a lot closer to the top than to the bottom.

You still have it backwards. Unemployment goes up after the stock market drops. One is a cause and one is an effect. It’s as plain as, well, the chart you linked to. If the stock market drops precipitously, then we should expect to see employment fall. A significant increase in our unemployment rate would significantly affect the housing market.

Also, you do know that employment and unemployment are the same thing, right?

You still are trying to look for a cause and effect after I already said there is none. It simply illustrates what most economists know as “the business cycle”.

Ah, well we can acknowledge that the business cycle exists generally, but its general existence doesn’t really affect real estate prices. What matters is where we are in the cycle

Well, the stock market has only been this overvalued twice before in history.

“The two times the CAPE ratio reached these levels, doom followed in the stock market. In 1929, it only stayed above 30 for about two months until Black Tuesday sparked a crash that sent stocks tumbling more than 80 percent from their peak. It happened again in mid-1997, but stocks and valuations continued to rise. The ratio eventually rose above 44 in late-1999 and stocks ran up almost 85 percent before eventually losing half their value by 2002 after the technology bubble burst.”

But maybe this time it’s different…

CAPE over 30 has predicted 2 of the last 28 recessions/depressions. Maybe it is more complicated every time.

That’s a bit like saying that having a blood alcohol level of 0.3 only predicts 2 out of 28 car accidents. And then concluding that it’s safe to drive because 2/28 is a small fraction. For a drunk guy, the fact that sober people sometimes have accidents is irrelevant because that isn’t the situation he’s in.

nope, not at all. I made no claims about anything being “safe” nor did I have need to make up a weak strawman argument to avoid responding to what you wrote. Perhaps you could reply with equal courtesy and advance the conversation with germane information instead of alt-facts.

It’s an analogy. No one is saying that you’re racing around the city with a half empty bottle of Thunderbird in your lap. In fact were you to be sipping on a Mimosa this fine Sunday morning it might do you good by relaxing you a bit before you hit the keyboard.

The point is that showing that ‘B’ occurs without ‘A’ doesn’t weaken the case for ‘A’ leading to ‘B’.

The stock market has only been this overvalued twice before so of course there have been plenty of booms and recessions when the market hasn’t been this overvalued.

It’s a bad analogy. Sadly, our understanding of the relation between blood alcohol and traffic accidents is based on more than two events in 100+ years. Accounting methods change over time more than blood alcohol measurements. And the causes & predictors of a single traffic accident are a wee bit less complex to analyze than those of an economic recession.

Regardless, Shiller’s Cyclically Adjusted Price to Earnings Ratio (CAPE) is currently at 29.3. In the dotcom it reached that level in February 1997, when the S&P Comp was just under 800. Then the S&P Comp increased by 86% over the next 3.5 years before crashing and eventually bottoming out above 800. Are you predicting the stock market will gain 50-100% over the next 3-4 years? Are you predicting that after the next economic recession the stock market will be at about the same or higher value as today? What really does your trivia foretell?

Price to earnings ratio is a common valuation metric both for individual stocks, market segments and the market as a whole. And the idea of smoothing earning over a number of years seems like a good idea and has been done for decades. Also, Shiller won a Nobel Prize. Hardly a barroom trivia winner!

The fact is that we are already seeing signs of housing market weakness even with the stock market at it’s current lofty levels. And these current levels are at historical extreme levels of valuation.

PE ratio, instantaneous or time averaged, is just a number. The very article that you linked to above says “CAPE ratio requires some context and caveats apply when discussing its use in making investment decisions….You can’t use valuations to precisely predict future returns or the timing of market crashes”

So what is the point of your magic ~30 CAPE? And why can’t you answer any of the questions I asked you above? Fact is we are far from the “extreme levels of [stock] valuation” of 1999, measured by CAPE. Fact is we are closer to the CAPE of 2004 and 1996 than 1999. Fact is that you have not provided any reason to correlate a particular CAPE value with economic recessions or SF employment or future RE prices.

We need to hire 100 people in tech in the next year, and it’s a painful struggle to find them. They simply don’t exist. It’s not that we won’t be laying off people as a result and a recession will happen. (what a dumb point made above) The bigger problem is that we just won’t make as much money.

Not sure what you mean — are the qualified techies not applying because living and working in SF is relatively expensive? I had a discussion with my leasing broker who confirmed the rental market has cooled and she needed to adjust/lower landlord’s expectations accordingly. As for me, I am happy with good tech tenants paying reasonably moderate rents, and still be able to enjoy SF city life and culture.

Generally, migration has turned negative in the valley: “In fact, in some parts of the Bay Area — including Santa Clara, San Mateo and Marin counties — already more people are leaving than arriving, according to the estimates released Thursday, which cover the period from July 1, 2015, to June 30, 2016. The same would be true in San Francisco if it weren’t for the high number moving in from abroad.”

Amewsed – I meant that I can’t simply find the people. As you also said, there is definitely the problem that SF is cost prohibitive right now, despite paying people at the “market rate”, it’s still not attractive enough to live in SF. People do “think twice” before moving to SF.

The market has definitely cooled, I have several properties so I feel it myself. But, the market cooling is going to benefit SF. Uber bought into MB partly, I believe, because the market chilled out 10-14%.

It’s funny because today I tried to buy 100 shares of MSFT for $30 and I couldn’t find any. I’m telling there just aren’t any shares of MSFT available to be purchased. They literally do not exist.

Of course employees are available if you raise wages. Double the wage and you’ll get your candidates. If that doesn’t work, triple it. Keep raising wages until you get the people you need or until you can’t afford the employees anymore.

The supply curve will intercept the demand curve and the market will clear, as long as you are willing to let the market set the price.

If you are not willing to let the market set the price, then at least stop talking about people “not existing” — what you mean is that there is no bid for your ask. Raise your ask and you will get a bid.

It’s strange to have to explain this stuff to business people, but some of them suddenly turn communist when it’s time to open their wallet, even though they are happy to charge whatever the market will bear when it’s time to sell.

The kicker about that is that except for the very financially unsophisticated, it’s the net that matters not the gross.

And what are you netting when you stretch to get into a house that’s rocketing up in value vs what are you netting when you stretch to get in at the top?

So how many people are scrambling to get to the bay area during a housing upswing vs people migrating away when the party is on the downslope??

I think buying a house with the expectation of appreciation is very foolish. Long term, it will appreciate with overall incomes in the region, but short term you really can’t predict when the next downswing will be, and that short term should be measured in decades.

Sure, lots of people made money doing that, but lots also lost money. Many lost their homes and life savings. Making a big levered bet with your life savings is crazy.

Buy a house that you enjoy living in and can afford, and you’ll be fine. If more people had that attitude, we would have avoided much misery. Many have been forced into foreclosure for treating their house like a casino and some life event forces them to sell in a downmarket.

No one knows when they will get sick, or lose their job, or get divorced. No one knows when the next downturn will come, or even when the next earthquake will come. Buy a house because you are OK paying that much to live in that house, not because it’s your ticket to a lifestyle that your income alone wont give you.

I agree that it is foolish and I’m not advocating it. But it’s those who buy that set market prices, not those who don’t. And during boom times the foolish will outbid the more conservative. And at some point, foolish behavior becomes normalized.

And lenders slowly relax standards which further enables leveraging, because it’s those who make loans that get their bonuses, not those who don’t….

Actually, we pay market rate – still doesn’t work when people literally “don’t exist” to fill the jobs, because they’re gainfully employed.

I think the point is that by definition the market rate is the rate/price where transactions occur. If you are making an offer at a certain price and receive no takers then q.e.d. you are not offering market rate.

If these people are employed elsewhere then they obviously do exist.

That is true. Double your pay, Dude, and you’ll get people.

(I’m sympathetic. We’re looking for talent too. People exist. The challenge is convincing them to work for you.)

They don’t exist, huh? Seriously? Something tells me that 100 tech workers do exist in the bay area, and if you offer them enough money, they will leave their current employers and go work for you.

Last I checked, the bay area had more than 100 programmers working here, so the people are available. You need to pay them more than they are currently making in order for them to go work for you.

And you of course are not offering market rate for the market in which you are getting your 100 people. You are offering the market rate in the market in which you don’t get your 100 additional people. But as demand increases, the market rate also increases.

How much of a salary bump would *you* require to leave your current job and go work for someone else? Something tells me it’s not zero.

It’s not just jobs. Was talking to a guy the other night who has an old house from a divorce and an in-law unit in his current house, both of which he rents on Airbnb. And he partly relies on that income. How many people are floating properties they cannot afford by virtue of our sky high rents?

Although home prices did not come down that much after the dot com bust, rents came down A LOT. Tons of people were able to negotiate rent decreases or just moved to greener pastures. The latest Zumper data says rents have come down 9% in SF already during a supposedly booming economy. What happens when that rental income is cut by another 20% or more, you might see some motivated sellers enter the market.

As we first reported last month: S.F. and Oakland Rents Have Dropped 8 Percent / San Francisco Apartment Rents Back to 2014 Pricing and foreshadowed last year: San Francisco Rents Drop, East Bay Rents Stall.