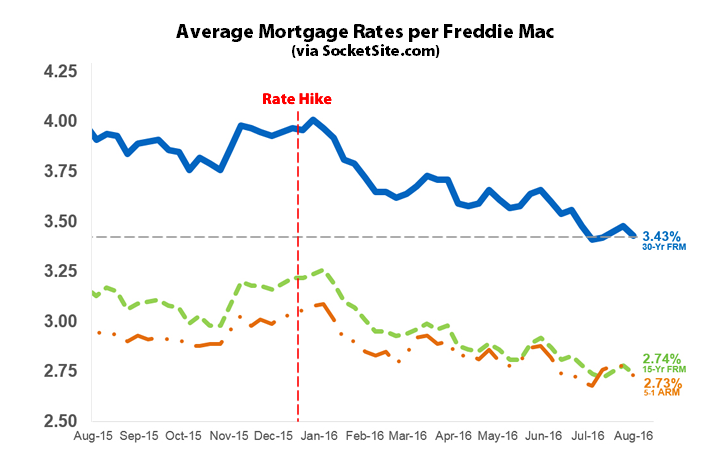

Having ticked up over the past three weeks, the average rate for a benchmark 30-year mortgage has dropped to 3.43 percent, which is down 5 basis points over the past week and within 12 basis points of the all-time low rate of 3.31 percent recorded in November 2012.

And with the current average rate 48 basis points below the 3.91 percent average rate recorded at the same time last year, and 54 basis points below the 3.97 percent rate in place prior to the Fed’s first rate hike in December, refinancing activity is up over 50 percent versus the same time last year while purchase activity is up 6 percent.

The drop in rates over the past week followed the Fed’s announcement that it would leave the target Federal Funds Rate unchanged. And the probability of the Fed enacting a second rate hike by the end of the year has dropped below 35 percent according to the futures market, down from 40 percent yesterday.

Can anyone explain why the 6 month LIBOR has been heading in the opposite direction since the rate hike?

The Ted Spread

Because the Fed really doesn’t have much control over interest rates beyond very short term rates. This is why talk of “artificial rates” created by the Fed is rather silly.

LIBOR has moved up cause of money market reform regulations which go into effect in mid October. It’s reduced the amount of funding available in the market so LIBOR has moved up accordingly, various articles about it in financial press (WSJ, etc…).

Yes, and the new regs create a significant demand for short term govt debt. It should be interesting to see the spreads on commercial paper and govt securities when everything is sorted out.