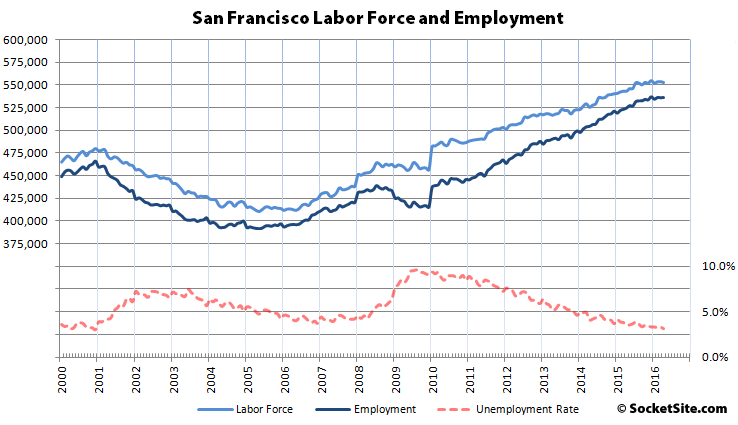

While the unemployment rate in San Francisco has dropped to 3.1 percent, the lowest unemployment rate since the end of the dot-com boom, the drop from 3.3 percent in March was driven by 900 people leaving the labor force versus the 100 jobs that were added.

In fact, the number of employed people living in San Francisco (535,500) hasn’t changed over the past quarter.

Over the same three months last year, employment in San Francisco increased by 2,600. The year before that it increased by 2,800. And the last time it was flat to down was in 2009.

That being said, there are still 70,000 more people living in San Francisco with paychecks than there were at the end of 2000 and 11,500 more over the past year, an increase of 98,800 since January of 2010 but 900 fewer versus at the end of last year.

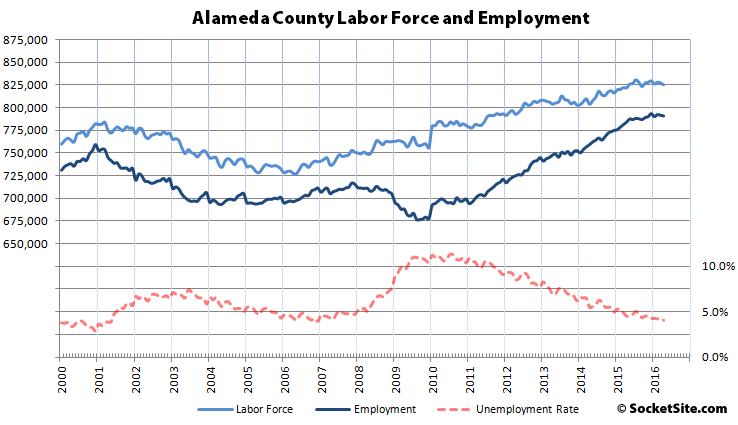

At the same time, employment in Alameda County, which includes Oakland, dropped by 700 in April to 790,800 yet the unemployment rate dropped to 4.1 percent as the labor force shed 2,000 folks.

Employment in Alameda County remains 6,900 higher over the past year, down from 10,300 higher on a year-over-year basis in March.

One thing that’s interesting to do is to watch for signs of companies in trouble, and note their locations. Recently SF-based Lending Club (not a household name outside of tech) has started to look like it’s in the early stage of failure. That’s about 1000 jobs.

Of course there will be other non-top tier names like Lending Club in the near future. But given the amount of runway that some of them have, it will take a while, as opposed to being a quick reaction to public markets. For this reason I think you’ll see decreased rental demand long before you’ll see reduced sale pricing.

I was about to say, Theranos, Lending Club, Zenefits…. unicorns, or donkeys with horns taped to their heads?

People forget that tech is net deflationary. These disruptive companies will be disrupted. What Dropbox did to file clerks, Degoo will do to Dropbox, and so on. What happens to the programming jobs after they create programs that can program?

I have been hearing about self-programming but so far what I have seen is exponential need for code and better developing methods filing to absorb the extra work.

Compare it with how knitting machines changed the apparel industry. Instead of having one jersey you would keep for years, you have several ones, much cheaper. Your choice increases, fashion evolves faster, life gets a tiny bit more interesting.

As the unicorns, and the public tech companies (LC, Yahoo, GoPro) start to lay off, how many net jobs In SF do you estimate will be lost by end of 2016? Can’t decide if I think it’s a lot 25K+ or just around 5K. Kinda hard to say.

Why do these always leave out Contra Costa County? Coco is about 40% of the “East Bay” population wise, and has substantial commuter inflow to both Oakland and San Francisco.

(and of course doing so would make the EB look bigger and stronger! 🙂 )

Employment in the greater East Bay, including Contra Costa County, dropped by 1,200 in April and the unemployment rate dropped to 4.2 percent as the labor force declined by 3,600. Bigger, but not stronger, indeed.

Alameda County, and Oakland specifically, have become a big part of the Socketsite “story” about what is happening in San Francisco. In this cycle there’s been a lot of office and residential moves to Oakland that are tied directly to SF’s economic boom. It therefore makes sense to include it. My sense that Contra Costa is more tangentially related to the narrative.

Of course there are folks (and always have been) who commute into SF on the Concord and Richmond lines. But the development scene in Walnut Creek has damn little to do with what’s happening in SF, and there is certainly not a city that in CoCoCo that can compare to Oakland as an SF alternative. (In the 80’s and 90’s there WAS actually more connection as many SF headquarters moved all or some of their functions to places like Bishop Ranch, but that’s not happening with tech, or even much with other sectors currently in SF).

An excellent response! And if SS’ goal is to perpetuate the Imperial San Francisco narrative, where every story is judged by its impact on the city itself, and Oakland and San Jose are seen as tribute territor…er, suburbs, that makes sense (and indeed since OAK and SJ are actually “categories” within the site, that can be inferred).

But I was hoping it might want to take a more regional view (and since recently it featured two CoCo properties – one all the way out in Alamo – that might also be inferred).

As much as I wish that all 1,000 of LC employees were in sf, I don’t think they are all here. However, it will definitely add to the decrease in jobs in SF. Prosper had already laid off a good chunk and I am sure there are more to come. I would say dropbox, palantir, pinterest are next. and then all the catering companies who supply their food.

That’s what happens when you turn the economy over to companies that don’t earn profits.

We are at full employment in SF. Not really any higher to go (absent increasing the number of residents). One could call this “stalling.” But really, a more accurate headline would be “San Francisco Employment Remains at Record High Levels While the Unemployment Rate Remains Near Record Low Dotcom 1.0 Levels.” Gives it quite a different feel.

But a headline of “San Francisco’s unemployment rate plateaus at historically low levels” wouldn’t be nearly as exciting

Both of you are on the money.

Unlike interest rates, unemployment rates cannot go negative.

What if some people have two jobs?

Full employment is actually bearish. When unemployment stalls out we are typically less than a year from recession.

The second derivative of the unemployment rate has predicted 18 of the past 11 recessions. Coin flip terroir.

Though it’s worth pointing out the difference between flipping a coin and predicting a 50% chance of something.

There have been approx 800 months since the 1948 start point on the graph you linked to. If your recession model just consists of flipping a coin, you would on average predict a recession 400 times. That’s very different from a model which predicts a recession 18 times, 11 times of which were correct.

I don’t have a recession model, but if I did have one based on the second derivative of the monthly unemployment rate, then it would not have “on average predict a recession 400 times.” It would have predicted it about 18 times since 1948.

And if you were to take those ~18 predictions of recession and then flip a coin to decide whether to believe the prediction or not, then it would not be unusual for you to get about 11 coin flips telling you to believe. All of which is just a way of saying that no you cannot use this second derivative (when … stalls) to predict a recession, typically.

The TLDR is that flipping a coin to predict the weather is not at all the same thing as being able to predict a 50% chance of rain.

A “coin flip” model is a useless model that only produces random noise. Being able to forecast a 50% chance of rain is useful and meaningful even if it is not definite. (Presuming of course that the average chance of rain isn’t 50%)

“if I did have one based on the second derivative of the monthly unemployment rate, then it would not have “on average predict a recession 400 times.” It would have predicted it about 18 times since 1948.”

And this is exactly why it isn’t a coin flip model. Because flipping a coin every month would produce about 400 recession calls.

Sure, but if the only predictions you ever make are correct about as often as a coin flip, then I may as well have a conversation with a bag of loose change.

BTW, I used to be a member of a climate and weather team at a NASA lab. Our minimal threshold for the daily forecast was it needed to be more accurate than either ‘tomorrow same as today’ or ‘tomorrow the same as last year on the same date’. Both of which are more accurate than 50%, typically.

The coin flip is over whether to believe these predictions, not whether to generate the prediction. Presumably we have many other info sources available, some more reliable predictors than a coin flip, typically.

If you’re sitting in sunny southern California thinking that it never rains and your weatherman correctly predicts a 50% chance of rain which you choose to completely dismiss, you are correct that he’ll be wrong half the time. But it’s also true that you’ll get soaked half the time.

The best course of action might be to take the prediction for what it is and, as you pointed out, go look elsewhere for data to corroborate or disprove the prediction.

If you think it never rains in southern California then you have bigger problems than the weather forecast.

If for whatever reason or non reason you believe a forecast of rain, how you respond should depend on the severity of the storm you expect and your exposure. A weatherman that can’t predict a hurricane any better than a sprinkle …..

i work in tech; and start ups are for children to learn how to work; the VCs throw money at everything; then when it dries up, promote what’s left standing. most start up are nothing but places for young-fresh-out-of college kids learning how to work… do you think any professional company has ping-pong tables and do nothing perks… its for children. and because of that, most of the companies really don’t have a business (reason) to exist, will never make a profit.

The only companies I see (and I’ve been programing since 1991, pre-internet) making money are companies like Urber and AirBNB; I know the ceo of urber, and told him when it was just an idea, that it was “money”… other than that, what is really new from say 2002?

A few more new things since 2002 (local only):

Facebook

The iPhone

LinkedIn

Google (as a public company)

Palantir Technologies

Tesla

Docker

Fitbit

Just off the top of my head.

linkedin = monster.com

facebook = myspace

iphone = blackberry

fitbit=livestrong

docker=pants

palantir=bullsh*t

tesla=EV-1

Facebook = myspace? iphone = blackberry? Unless you’re talking about a 20 year time horizon (from now) and are somehow have a reason for discounting actual billions in revenue, you completely disqualified yourself as a credible observer of business and tech.

myspace was run by marketeers, facebook is run by the nsa. iphone = blackberry. In tech, if you’re not growing, you’re dying, and tech products come and go within 5 years time easy.

I can be that ridiculous:

uber=chariot

airbnb=manger in Bethlehem

google=Library of Alexandria

facebook=Australopithecine grunts

docker=mud bricks

So, you see, not only is there nothing new since 2002. There is nothing new since 2002 BC! Young whippersnappers who think anything has changed since then are just ignorant of history.

nothing new under the sun; just propaganda.

Half of these companies have no real product. They just connect people with other people and services. Digital pimps, easily disrupted by regulation and/or innovation. And many just give away their “product” for free to attract eyeballs for ads. Flashy digital billboards. The ones that do actually make something, they make it in China. Not a solid foundation on which to build a great economy.

Our economy has been service based for almost 70 years. Heck, banks and insurance companies have no “real product” in the same sense that tech companies do not. Not really a fad, or unstable flash in the pan, to have an economy based on service industries. If you don’t “make things” you are not “real”? How very very trumpian. Let China make the cheap crap. We’ll buy it, and we come out way ahead with that arrangement.

Time will tell if these services are a flash in the pan. As for who benefits from globalization, maybe this chart will help you understand.

Wait, do you really not see the difference to SF real estate from myspace (based in LA, acquired for $500M) and Facebook (based in the Bay Area, market cap $335B)? Really?

yeah, the government wasn’t completely printing money and destroying the economy through inflation. as for real estate, when the government gives money away for free, and prints it to prop up the nation, you buy physical assets like there is no tomorrow because there isn’t. Plus, you have chinese escaping their oppressive regime buying everything not nailed down, because we have property rights here, compared to the 70-year lease in china.

I think the common denominator of tech is that they generally can be obsolete faster than big historical brick and mortars, but in varying degrees. very fast (groupon, myspace, candy crush, LC, Zenefits (TDB but probably)), medium fast (yahoo), slow but fast relative to big non-tech (HP, Nokia, Blackberry). And in the bay/sf we have a combination of all of these. While Facebook and google make tons of money now, I feel they could loose a lot of that very fast as it is all based on advertising revenue, and so if the eyeballs go away, so does their business model (However they still have cash on hand).

Uber and Airbnp could be super fast depending on how the regulation plays out and how many other competitors come to market.

Apple slower, yet still very dependent on Iphones and ipads for revenue. We have a combination of all different tech types and some will exit super fast. To me the interesting question is how long the new tech companies (unicorns) and some public ones (Twitter, LC, GoPro) will last and how big of an impact their potential demise will have on the local employment and real estate.

How can you attach any degree of “fast” to Yahoo’s arc?

youtube

Netflix IPOed May 2002, and started streaming in 2007

intertube bandwidth ate the TV channel

big data yuge enough for the NSA to store all your bits, naughty and nice

several generations of moore’s law, such that a 2002-era desktop cpu+memory now fits on a chip with built-in wifi or bluetooth for a couple bucks. Amazon uses a lower-end version in their gizmo that allows you to order Tide at the push of a button. And a pack of dollar sensor gizmos with hw sensor fusion allows their drone copter to fly it in for delivery, FAA approval pending.

i’ll give you youtube.

If it were yours to give, you’d be worth about $40 billion. I’d take your offer, by the way.

I know – it’s no different from looking out a window. Or a hole in the wall before that.

I’m also in tech – and I think you’re totally out of whack. Plenty of them have pool tables and “kids”, have been in business for decades and have produced multi-billion dollar companies.

What’s changed from 2002? Disruption, don’t you know?? I have doubts about the long-term viability of both Airbnb and Uber. Both are doing “well” now but it will be interesting to see how long they will last when the regulation finally settles, and other entrants come to market. The irony of having an at will sharing economy for your supply means the drivers and owners can just as easily and willingly move to another platform.

disruption or illegal, all the new companies basically breaking the law to make a profit… airbnb usurping hotel laws, urber breaking taxi regulations.

All of them? That’s horse hockey. BTW, I’m the first person to say there’s a lot of nonsense in the current tech economy, and I wouldn’t mind seeing a lot of these consumer plays die off, but your arrogance, pessimism paranoia (NSA “runs” Facebook?) and ignorance are off-the-charts. You don’t know squat, but you think you’re an oracle.

Wow, unemployment is the lowest in 15 years and the number of employed people is at it’s highest ever, yet all you can hear here is doom and gloom? To the ones dreading the upcoming depression, I would suggest the following:

– Move to Cleveland Ohio, where unemployment rates are at a ‘healthy’ 7.1%, so the drop during the next recession won’t be that bad. An additional benefit is that there are not Tech companies that have created tens of thousands of ‘flimsy, unsustainable’ jobs that can vanish any second. And last but not least, have you checked out the affordability levels of housing prices in Cleveland?….It’s a no-brainer

Or one could argue Cleveland is an example to how an area can deteriorate even when it has large advantages, both natural (access to raw material, proximity to markets) and created (a trained and educated [for the time period] work force, excellent infrastructure), if the market models change.

Of course that was then, so it has nothing to do with us .

Which is why I think technology is a healthy addition to our economic mix. Cleveland wishes it had our tech sector

Our “tech sector” is centered about 30 miles south of SF in the Silicon Valley, not in the SF CBD. The Cleveland area is not doing so badly economically, at least wrt to unemployment rate. The Cleveland MSA has an unemployment rate of 4.8% (April), whereas the SF MSA has an unemployment rate of 3.8% (April) and was at 4.8% as recently as Jan 2015.

Also, in the recent recession the Cleveland MSA unemployment topped out at 9.7%, while the SF MSA reached 10.3% and the San Jose-Santa Clara MSA reached 11.3% and was over 11% for nearly a year.

Seems our vaunted tech sectorizated local economy might be a wee bit more volatile than poor old Clevelandia. Easy boom, easy ….

Yeah. Cleveland was an odd choice. There are other rust belt cities they might have chosen. Pittsburgh and Cleveland are success stories. Oh well, start with ignorance and what do you get? more ignorance.

I don’t believe the BLS numbers do a great job of capturing people working in 1099/contract/Uber-ish job either. The namelinked article showing Uber drivers from June 2012 to present (making ‘at least one trip in the specified month’) has increased from a few hundred to over 15K.

Noise in the numbers for sure, but is another manifestation of how tight the labor market is here. Most drivers I encounter live at least 45 minutes outside the city and come in to drive.

The point about full employment presaging recession also makes sense, but has to be reconciled with local vs. semi-local employment markets. We are 3.3% but Solano County is still at 5.7% (down from 6.6% in March of 2015). Solano’s still striking distance for work in the city (yes, a point I have made repeatedly…)

The BLS does two sets of numbers. A payroll survey, which surveys employers and by design does not count contractors. And a household survey which surveys people directly and does count contract workers.

If you google around you can find some articles talking about how some of the gains in employment are due to these “gig economy” jobs which don’t necessarily pay very well.

If you further google and see some estimates of the net take home of your average Uber driver and then look at rents/prices in SF you will be much less surprised that few Uber drivers live in SF.

Today’s WSJ says: “One of the labor market’s early-warning signs may be flashing trouble. Hiring by staffing agencies has ground to a halt so far in 2016, a worrisome sign because the category fell off before a broader job-market slowdown ahead of the past two recessions. Many economists look at the sector as a leading indicator because cautious firms tend to first hire temps when an expansion begins and dismiss those nonpermanent workers when they sense the economy is faltering.”