As we wrote in March 2008:

Another plugged-in reader already stole our thunder (and pretty much all our lines), but to sum it all up: 1. Eight months ago 1420 Douglass was purchased for $1,945,000 ($250,000 over asking); 2. Two months ago it returned to the market with a list price of $2,095,000 (and a few “I don’t think it will be on the market for very long” type comments); and 3. Last night the list price was reduced $100,000 (5%).

Granted, the sellers are still asking for $50,000 more than they purchased it for just seven months ago, and we don’t yet have a final sale price, but as our reader notes: “[O]riginally sold 8/09/07, GOOG: $514.73. Today – Not sold, (perhaps) languishing, GOOG: $433.35. Maybe dub dub is on to something with his “lazy indicator”!”

The property failed to sell in 2008, and as a plugged-in reader noted last month, 1420 Douglass was foreclosed upon on June 7, 2010. Back on the market today and listed for $1,595,500 (18 percent under its 2007 comp setting price).

Google closed the day at $436.55.

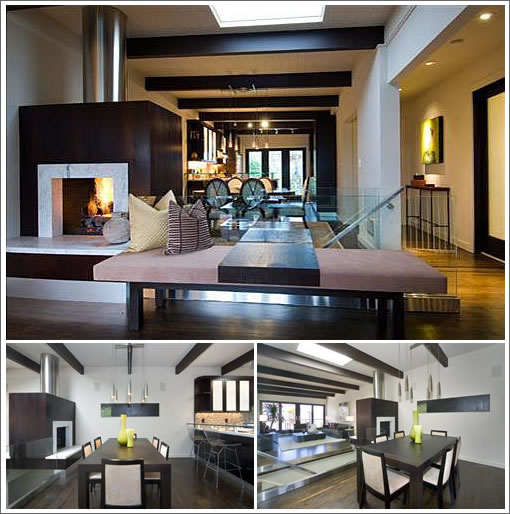

The creepy thing about contemporary style is that upscale home and upscale office look the same.

Ah, the memories….. sactel, fluj… gone, but not forgotten. We know you’re still reading.

$923/psf still isn’t cheap. Who exactly owns and is selling this place anyway?

Who exactly owns and is selling this place anyway?

PS indicates that SC Property Management (out of San Mateo) picked it up for $1,098,750 (at the auction, I assume); the original financing was courtesy of WaMu. I have no way of verifying the auction price as the Chronicle has abandoned their civic duty and no longer publishes foreclosure data (or at least it doesn’t put it online…)

Agreed, $925 is a lot of money, but I bet that’s what they just got at 2104 Castro street.

Sorry if this is a nooby-dumdum question, but why wouldn’t the 1.1M from auction represent its value? Isn’t that a comp for itself, or are auctions economic special cases?

[Editor’s Note: It’s a comp for the all cash, no warranties, and no (official) inspections market. And that’s assuming no collusion or games on – or getting to – the courthouse steps.]

Wow, the place on Castro looks nice, but I must say I’m surprised. That seems like near peak pricing.

Maybe the chopped pillows had something to do with it…

And where are lmrim, sanfronzy, robert, etc? Maybe if the economy tanks badly again they will return to ply their words of wit. Economic uncertainty is a strange agent for social bonding.

The listing for 1420 Douglass has been withdrawn from the MLS after 10 days on the market. Keep in mind that a failure to report the final sales price for a listing that closes escrow within a few months of being withdrawn from the MLS is now an MLS fineable offense.

The listing for 1420 Douglass has returned to the market with a list price that’s been lowered $46,000. Now asking $1,549,500. And once again, purchased for $1,945,000 in 2007.

Pretty shocking.

^ a 20% fall for this corner of Noe wouldn’t be shocking at all. Just around the corner, 714 Duncan fell 23% 2008 to 2009, and 728 Duncan’s current listing is getting all moldy at only 10% off its 2007 price.

The idea that someone was silly enough to pay $1200+ psf for 1420 Douglass back in 2007? Now that’s shocking, but apparently there were lots of chocking sales prices back then.

The list price for 1420 Douglass has just been reduced $54,000 to $1,495,500.

Once again, purchased for $1,945,000 in 2007 and a sale at asking would represent a 23 percent drop in value for the remodeled single-family Noe Valley home over the past three years on an apples-to-apples basis.

It’s really great to watch the pretend value of this place just melt away. The old threads on this place are fun reading – especially the shill comments from when the now foreclosed owners thought they’d find a greater fool to take it off their hands. Great stuff.

The sale of 1420 Douglass closed escrow today with a reported contract price of $1,440,000 or 26 percent under its 2007 comp setting price of $1,945,000 for the remodeled single-family Noe Valley home.

You forgot to quote the GOOG stock quote for today:

closed at 480.43

That’s only about 7% down from the previous sale date.

Not nearly as much as G has lost on his ∞ penthouse but still a nasty hit. So one can buy a very nice Noe home for a cool half million less than it cost three years ago (and you can still tell everyone it went for almost $2 million once). Bad for sellers and recent buyers. Bad for the tax assessor. Bad for realtors. But great for future buyers.

As I have oft-commented, what was once seen as a reasonable market price is now generally recognized as absurd. We’ll say the same about today’s prices a couple years hence.

New lazy indicator:

Goog stock price – goog stock price three years prior.

Today: -$50

2007: $400

“That’s only about 7% down from the previous sale date.”

To be fair to my patented lazy indicator, this is clearly a high-beta house 🙂

Speaking of 2104 Castro. Sold in 2010 for $1.825 and just resold for $2.050. +225 @ 9% in less than 3 years.

And GOOG at $810. What happened to dub dub anyway? I miss my stalker.

what happened to all these mean spirited posters? they used to get the latitude to dismiss everything that has proven to be true about where the nicer southern neighborhoods were going. is there not one who will come back here and own it? how pathetic.

Hi flujie!

How’s the flipping game treatin’ ya?

In terms of righteousness or activity or reality? Infinitely better than every single thing you have ever uttered. Game, set, match. Son.

Outstanding! It’s an ill wind that blows no one any good.