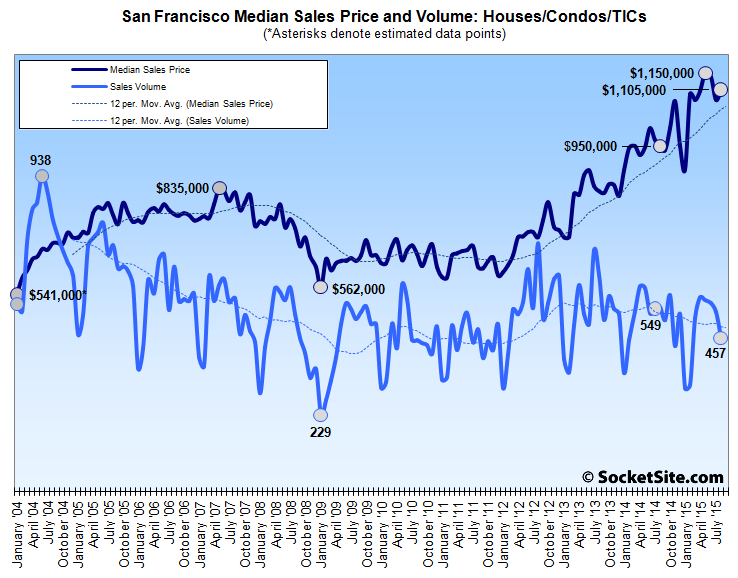

While home sales activity in San Francisco typically ticks up in August, recorded sales for single-family homes and condos in the city dropped 14.4 percent last month and is running 16.8 percent lower on a year-over-year basis, according to data collected by CoreLogic. At the same time, the inventory of homes for sale is climbing.

The median sale price of the homes that sold in San Francisco did increase to $1.125 million in August, up 4.7 percent from $1.075 million in July and 18.4 percent higher year-over-year, but remains 3.9 percent below the $1.15 million mark set in May.

As always, keep in mind that while movements in the median sale price are a great measure of what’s in demand and selling, they’re not necessarily a great measure of appreciation or changes in value and are susceptible to changes in mix.

Home sales across the Bay Area dropped 11.7 percent from July to August but were 4.5 percent higher versus the same time last year with a median sale price of $650,000, up 6.2 percent year-over-year.

Home sales in Alameda County were 1.1 percent lower in August versus the same time last year, with a median price of $649,000, up 6.6 percent year-over-year.

Weren’t inventory levels at around 12% lower YOY at the end of Labor Day week though?

Given that, a drop in sales of 14% seems fairly usual, and expected.

I wonder how the rate of IPO’s and Startup Acquisitions is right now compared to last year. Are we seeing a smaller pool of newly-wealthy?

It looks like the Chinese stock market crash has not had any immediate impact on prices.

The large drop in number of sales is concerning…

I e never seen any actual data that suggests Chinese investors were buying SF RE, despite many assertions that a significant number of cash buyers are Chinese parking money. I really wish someone would put relevant data forward if they have it

It is only a hype that people will forget soon.

Actual data? How would let’s say a dozen Chinese buyers being active in a portion of the market over the course of two-three quarters even look, data wise? They’re enough to move a local market with scant inventory. Are they perceptible to people who read blogs? Sometimes you really should just take well reasoned anecdotes and factor them in.

forget it. I don’t care.

ill take data on a dozen. i haven’t seen even that much data. well reasoned anecdotes are BS in my world.

how would you propose a dozen Asian buyer in a specific small market be represented? why are well reasoned anecdotes bs in your world? what is your world? what is your interest in the market? what would you do with knowledge of Chinese money, or not, in the SF marketplace? how would you use that knowledge, and to what purpose?

my world is science, and if there is a truth, there must be data to support it. I dont beleive there are a ton of asian buyers parking their money in SF RE and gobbling up tons of the new high rise condos, and I wont beleive it until i see some support that its true. Its a red herring

So I asked you specifically how it might be presented, and you said “I am a doubting Thomas” ? That’s not helpful.

Think about it. Some of these people probably never even got into the things they attempted to buy. The market was so competitive. How would that be represented?

Do you doubt that a dozen would be cash, or private finance, buyers can greatly influence a market with such limited inventory?

Nobody is saying a ton of Asian buyers. But a few handful can effect this market, given the limited inventory.

And of course anecdotal info is relevant. That’s why scientists and data nuts usually suck as RE investors. Fooled by data and with little ability to conduct qualitative analysis. Jake, you reading this? Take a bow bro.

Editor- Can you link the original source for this data? Or maybe add their Bay Area data as a comment? They have nice county by county stats that are interesting to compare to SF.

http://www.corelogic.com/downloadable-docs/dq-news/july-2015-ca-home-sale-activity-by-city.pdf

At some point the insanity has to meet a physical ceiling. Are we at this place yet?

Generally a price drop is preceded by a slowdown in sales volume. Frankly, I have yet to see any solid evidence that prices are dipping. But the editor is right to note this as a leading indicator. Given the recent turmoil in the markets and some caution being introduced into the newest tech frenzy, it certainly wouldn’t surprise me if things slowed and even reversed. I certainly wouldn’t buy here now unless I had a large financial cushion.

I think we are at the usual political and economic 7 year cycle peak, the international financial markets and current political crisis (somehow, I see India and Japan being ok but Russia and China will be harsh) should take us into a significant recession next year. The markets should truly crash this fall. The faster we get it over with the faster we can recover.

Applogies for the barrage of questions. But truly, how might a phalanx of would be Asian buyers possibly be represented via data?

SF is 33% Asian and 48% white. Asian buyers are a important market segment though white buyers are most likely a bigger segment.

Right but that’s not what we were talking about. We were talking about Asian buyers from overseas.

Every buyer and every seller will have a proportional, tiny impact on the whole market. Assuming that the Asian buyers from overseas are not idiots, they will make an offer that is close to market price. Assuming that the sellers are not idiots, they will not accept an extremely low offer from some of the Asian buyers from overseas.

If the total number of Asian buyers from overseas are very small, their impact on SF market can be negligible. If they represent a 10% of buyers in super high end Lumina, they may have a 10% impact on Lumina sales. If they represent 0.1% of SF buyers, they will have 0.1% impact on SF sales.

Can you find out the exact numbers of the Asian buyers from overseas in each SF neighborhood or at least for the whole city?

“Can you find out the exact numbers of the Asian buyers from overseas in each SF neighborhood or at least for the whole city?”

No, I don’t know how that would be possible. That’s the issue.

Yes each buyers impact (assuming they buy only one property) is “proportional,” but keep in mind that inventory levels are quite low in the city, so having another set of buyers, like foreign Asians, can make an impact on the market.

The difficult part is assessing if the Asian buyers are Bay Area residents, or foreign based. But even that is murky. There are foreign buyers who buy because of extended family or friends here. Or they pool money with local Asian families. The stereotypical rich Asian buying luxury condos on their own also exists, but I think there are other variants that may even be more numerous.

In 2008, “very few foreigners buying in SF“.

In 2014, “Less than 3% of Paragon’s buyers have been from outside the U.S“.

San Francisco has a minority-majority population, as non-Hispanic whites comprise less than half of the population, 41.9%, down from 92.5% in 1940