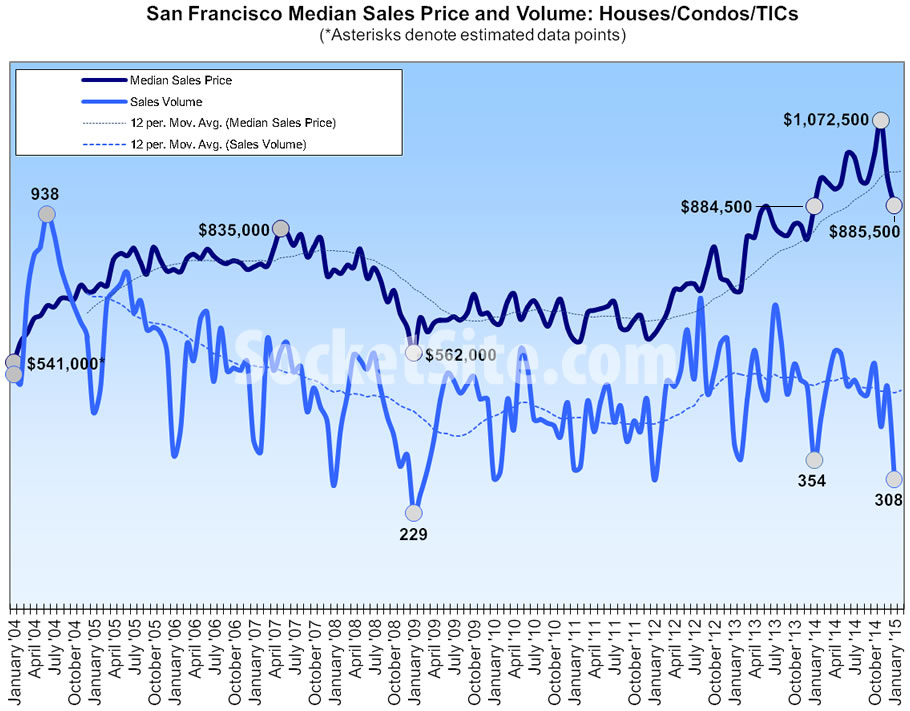

Having hit a record high of $1,072,500 this past November, the median price paid for a home in San Francisco dropped to $949,000 in December and then to $885,500 in January, down 17 percent in two months and a nominal 0.1 percent higher versus the same time last year.

It has been three years since the median price paid for a home in San Francisco was unchanged, or lower, on a year-over-year basis.

And in terms of activity, the number of recorded home sales in San Francisco fell 42 percent from December to January (versus a typical seasonal drop of closer to 35 percent) and sales were down 13 percent versus the same time last year, the slowest month in three years.

That being said, the median price paid for a home in San Francisco last month was 58 percent higher than the last low-water mark of $562,000 recorded in January 2009, a metric which was relatively unchanged from the month before.

Across the greater Bay Area, homes sales dropped 41 percent from December to January and are down 6 percent year-over-year, the slowest January since 2008.

The median price paid for a Bay Area home in January dropped 5 percent from December to $572,000 but remains 9 percent higher versus the same time last year and 80 percent higher than the low-water mark of $290,000 recorded in March of 2009. The Bay Area median home price peaked at $665,000 in July of 2007.

At the extremes around the Bay Area last month, Contra Costa was the only county to record a meaningful year-over-year increase in sales volume, up 5 percent with a median price of $410,000 (up 7 percent year-over-year), while Sonoma recorded an 11 percent increase in the median price paid for a property, but the sales volume dropped 14 percent, year-over-year.

Keep in mind that DataQuick reports recorded sales which not only includes activity in new developments, but contracts that were signed (“sold”) months prior but are just now closing escrow (or being recorded) and any properties that were sold “off market.”

And as always, while movements in the median sale price are a great measure of what’s in demand and selling, they’re not necessarily a great measure of appreciation or changes in value.

Low volume, big drop. Not very significant but this could be a sign the buying season might see some major resistance as too many buyers are priced out.

I agree. The tech folks are an important group of buyers but alone cannot sustain the market. And prices in many cases are above what even they can afford.

Bidding war is going on. I think this was caused by the severe rain storms in December.

“very low inventory –> low sales volume –> fewer high ticket sales for upward mix” = the story

Not sure what we’re trying to say here. Every decent home that comes online sells fast and for over asking.

Can’t argue with eddy, most of what I have seen (and i’ve seen a lot these past 10 months) that is at all appealing is selling easily, quickly and over asking. There are some blatantly overpriced exceptions, but not too many. However, you never can tell when a market will finally hit that point where there just aren’t enough qualified/willing buyers. While anything is possible, I still expect that the worst case is a flattening of prices for the these next 1-2 years. Unless we have another black swan event, of course. Honestly, everyone is so conditioned to expect another major crash that it would be just like the markets to simply travel sideways for a couple of years, then continue their march higher. As go the equity markets, so goes SF real estate.

With a grain of salt… The source data for Dataquick is provided by Corelogic. Their info for newly constructed product has always been sketchy. It often takes months (and months) before new houses and condos actually make it into the database, regardless of whether a sale has occurred or not. I’m working a project now in SJ where a condo project completed in 2012 isn’t in the database although many units have sold. That said, my own analysis using MLS data shows prices up YOY, but flat to slightly down on quarterly and monthly comparisons. That goes for both SF and SJ. Haven’t had occasion to do any other markets in past month or so.