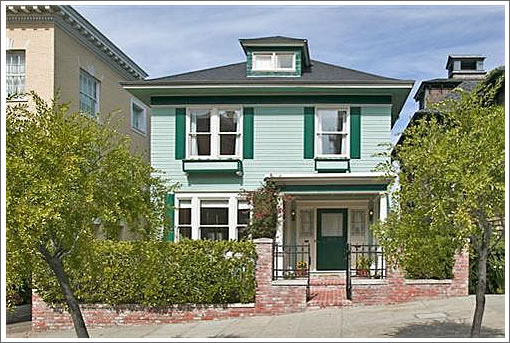

After four days on the MLS the list price for 2712 Broadway up on San Francisco’s Gold Coast has been reduced from $9,495,000 to $7,750,000. It’s a big house with big views and still asking over $1,100 per square foot (down from $1,350).

San Francisco real estate tips, trends and the local scoop: "Plug In" to SocketSite™

After four days on the MLS the list price for 2712 Broadway up on San Francisco’s Gold Coast has been reduced from $9,495,000 to $7,750,000. It’s a big house with big views and still asking over $1,100 per square foot (down from $1,350).

I think we’re seriously in free fall mode and there’s just been so little activity that there are no closed comps to justify it yet. It seems to be happening.

Also, an additional problem is that market prices have dropped so fast that a rapidly increasing number of buyers are going underwater, and are physically unable to sell without going short sale or REO. Everything’s frozen.

Or maybe the owner actually wanted to SELL and not sit on it, and came down to a more realistic asking price, even though I don’t think 7.75MM is what they’ll get…

I have to start to question the fairness of SS. I sent the editor a link to a property currently listed on MLS asking 30% more the 2003 price, and it never got featured.

[Editor’s Note: Hold that thought (i.e., great question but we’re going to give it a better place to be discussed).]

If this sells (probably below current asking), it’ll be a devastating comp for most Pac Heights luxury properties – unless of course there’s something really, really wrong with it (is it falling down the hill or something?). Sure it’s probably in terrible condition, but if outer Broadway can’t justify a $1000 psf price tag, then nothing else can…

It’s a blue collar looking house (facade-wise) on a regal row. And yep, it will be a bad comp but what I want to know is how did another Alain Pinel agent get a premier San Francisco property listing? I have rarely seen an Alain Pinel sign in any SF hood until recently- and now they are everywhere! They seem to have taken San Francisco by storm. Something must have happened… what SF firm did they take over?

I’m very surprised to see this house listing at this price! It has the best address in SF and gorgeous views. It’s not nearly as regal as its surroundings but I think it can be fixed up to be a very cute Nantucket beach house feel house. Sure it’s listing at over $1100/sqft but so are the units in Infiniti Towers! And this house has a much much better location, prestige, and at the end of the day, who wants to live in a condo when you can live in a house! That’s why in a down turn, house always holds its value better than a condo. Too bad I’m $7.75M short. I would buy it in a heart beat if I can afford it. sigh. This is a devastating comp for all the houses in Pac Heights, Cow Hallow, and Presidio Heights. I do remember long time ago. I would say about 10 years ago, the house to the right of this house was selling for 4,5M if my memory serves me correctly. So perhaps all the prices will come down close to that level again??

For those of you that don’t “get it”:

Wake up and smell the coffee..how many people do you think can afford a house at that price right now? (even the “new” price). Furthermore, who is going to lend him/her the money?

Oddly, I didn’t see this hit the market 4 days ago, but I saw it today along with the price drop. This house is an oddball and it will not sell at this price. There was a property at 2820 Vallejo that sold last year at over 1800psf. It wasn’t in much better condition either. The market has changed.

As for the listing agent — I wouldn’t be entirely surprised if top agents are turning these properties away if the seller isn’t willing to price at market. 2580 Broadway is already in contract after struggling to rent for months. 3355 Pacific is listed as ‘active’ on @ $8.9m. I don’t know about that one. Seems very high and in contention with the 3577 Pacific.

One thing is for sure — the markets are as interesting as ever to watch.

Holy crap, that is one of the BEST locations, locations, locations I’ve seen on Socketsite. There are maybe 3-4 blocks that are even arguably comparable in SF. Most of those other blocks would only have one side of the street that would be considered comparable.

I NEVER thought I’d see $1100 psf anywhere on North Broadway in my lifetime. And this has unobstructed views. Look at those views!

34 Presidio Terrace, about the same square footage with NO VIEWS sold for more than 30% more not even a year ago. And though that street is a very high end street, it can’t compare with the VIEW side of North, North Broadway.

Kind of hard to argue against a free fall at this point. Kind of hard for any property anywhere to justify anywhere near this per square foot price any longer.

Wow! Double Wow!

The rich are not immune. The giant San Francisco Ponzi Scheme is falling like a house of cards.

Some cards at the top appeared suspended in the air for a while but there’s no fighting gravity I guess.

Its listing for this price, because the sellers obviously need money NOW

The current assessed value is $260k which puts the property tax at about $3k per year; long live prop-13…

Trying to make sense of these past 2 posts:

1 – seller could need money now

2 – assessed value is $260K

If the seller has had the property for a long long time, the main reason he would want to sell at this “discount” is due to personal hardship (financial, health, family). Or maybe the seller wants to cash out on a really great investment while he still can? After all, you can have a sweet quiet life with the interests on 7.75M only.

“at the end of the day, who wants to live in a condo when you can live in a house!”

I’ll tell you who. A lot of retired baby boomers who have lived in houses, big houses, and know what a hassle they can be to maintain. There are more and more of them every year.

As for the seller, well my guess is that he/she/they are a) one of the above or b) an heir or heirs who live elsewhere.

This may or may not be a bad time to buy, but it most certainly is a bad time to sell.

this house is so outdated and needs a TON of work. whenever i see these huge, old homes in the prestigious part of town that are so run down, i always wonder why the owners never took a line of equity to fix them up…then i remember what “unearthly” said—you’re gonna mess up your tax basis if you start doing work with permit. this place feels/smells old, really old. so, whomever buys it will have to do plenty of upgrades, but whomever can afford to purchase a $7m+ home today can probably afford the upgrades and a larger tax bill.

Anyone notice the great views?

It could be that the owners are selling because they need the money, as some have speculated.

But, it could just be that the asset has been relatively costless to retain, partially as a result of prop 13. It could be vacant, or at least underutilized. Tax is only $3K per year, about what a nice bicyle costs, and certainly insignificant in relation to the price of the asset. As long as prices were going up, it was easy to look at holding the asset as being costless. Perhaps the owners now just think that prices are going to be going down for a while, so it is no longer judged as costless.

If that is the reasoning, I think it makes a tremendous amount of sense. Without the implicit subsidy of existing owners by new entrants by prop 13, I bet that supply would have been less constricted and overall price levels would be significantly lower today in SF. In essence, the restriction of supply encouraged by the effects of prop 13 provided a “false signal” regarding scarcity value that made buyers willing to pay higher prices.

If I’m right about this, as the long cycle turns (it’s only been 30 years since prop 13, and much of the effects have really only become glaringly and increasingly obvious in the last 20), “hidden” inventory will progressively dismantle these false price signals and lead to a larger bust for SF than otherwise would be the case had no tax distortion been present.

This dynamic should also progressively dismantle the apparent “insurance value” of prop 13 (locking in maximum 2% annual increases in property taxes doesn’t seem such a good deal if prices are flat or going down), further decreasing the desirability of the asset.

michael l–

the views are AMAZING from this house. this was taken with my crappy phone camera from one room, but the views came from many rooms, many angles

http://sanfranciscostuff.files.wordpress.com/2009/02/2712-broadway.jpg

I have mentioned this before: to someone who had $10 million in their portfolio investment last year…how much is it worth this year? I am hearing numbers have dropped for many 20, 30, 40% if not more. That $10 milion may look like $7 million for that person today…

An ~8M fixer eh? Some of you would benefit by knowing that each house is different, and each sales situation is different. LOL at the macro talk in this thread. About a 7.75M fixer as indicator of calamity. “Never in my lifetime” LOL. A lot of people got great outer Broadway deals in the ’90s, Tipster. I trust you were alive then.

LMRiM –

We’ve discussed the topic of how far back to push a reasonable-value from which to grow a fair price forward. FWIW, this guy says 1997 in a new book:

http://www.bloomberg.com/apps/news?pid=20601213&sid=a8mdg7z0u7Dw&refer=home

It’s still a lot of green. 😉

Goodbye, SocketSite. Your heavy editing hand has grown tiresome, and I’m unplugging. You’ve deleted my last post.

(Well, actually you’ve probably got one more ahead of you.)

[Editor’s Note: It happens and we completely understand. We simply expected more out of you than “Look out below!!!!!!!”]

“if outer Broadway can’t justify a $1000 psf price tag, then nothing else can…”

Sleepiguy – Are you kidding. Don’t you know everything above the 20th floor at Infinity Tower 2 with a glipse of water is $1200+ psf? And these units barely have a living room. Clearly you have misunderstood this SF market completely.

(Hopefully the heavy sarcasm comes through)

“It’s probably in terrible condition”

It is.

“but if outer Broadway can’t justify a $1000 psf price tag, then nothing else can… ”

Still asking 1100+

????????

Shhhhh. If you listen carefully you can hear all the residents who purchased in D7 over the past 5 years trying to figure out how to get their property tax recalculated.

Foolio,

Just catching up with this thread. Having left a number of times myself, I hope you reconsider leaving SS, or at least drop by once in a while. I for one will miss all the Foolioisms 🙂

2712 Broadway is now in escrow (although not without contingencies). Will it close? And if it does, for how much? As always, we’ll keep you plugged-in.

How do you know it has contingencies?

Also, I may eat my words about this not selling at this price. I’ve actually thought about this property a lot and can’t help but to think that for the size/money/location it might be a deal. Very curious to see the post-close details if it does sell.

Also, you guys may have noticed Malin’s Pacific St. listing went into contract as well. That’s decent news for the high-end market I suppose!

There have been a few contracts in D7 recently. I think we’re seeing the sideline buyers who’ve been waiting for any hint of weakness.

3355 Pacific closed 2/27 for the sales price with an asterisk. It went pending in 19 days only, though. So you have to think it must have been somewhat close. If the tax records are right it went for 1250 a foot.

As a plugged-in reader notes, 2712 Broadway is now being advertised as a rental on Craigslist and asking $14,000 per month (or best offer).

From the craigslist ad eddy refers to :

$14000/mo Or Offer.

Roommate Groups Are Acceptable To Owner.

Dooood ! That’s only $2000 for each of us !

7000 Square Foot Mansion On Broadway @ Baker

With 2 Car / SUV Side-By-Side Garage, 6 Vehicle Parking Pad & Big Private Yard.

Kuhl ! A spot for each of us and Owen can park his Vespas on the back yard.

Contemporary Kitchen & Baths, With A Massive Amount Of Living Space.

Did he say “massive” as in “Massive party” ?

3 Living Levels With Sunny South Orientation & Panoramic Golden Gate Bridge & Water Views North.

We’re all going to get soooooo laid ! Even James is gonna get some of that sunset action !

$14000/mo Or Offer.

Lets get Johnny’s mom to bargain this one down. Maybe just $1800 each.

Details:

• Super Spacious Single Family Home With Rooms Of Grand Scale

• Hardwood Floors, High Ceilings & Period Details

• Large Stainless Steel Kitchen With DACOR Gas Stove,

DACOR Double Oven, Dishwasher, Disposal & Granite Surfaces

• Oversized Woodburning Fireplace ( 3 )

• Large Private Yard

• In-Residence Side-By-Side Washer / Dryer Laundry Room

• 2 Car / SUV Garage + 6 Vehicle Tandem Outdoor Pad Parking

• All Kitties & Doggies Considered

We’re soooo gonna get laid. twice a day !

$14000/mo Or Offer.

that’s the third time they said “or offer”. Get Johnny’s mom to bargain down to $1500 each

Ready For Occupancy.

Ready to Par-tay !

This grand home has had just three owners and offers a rare opportunity to live on this gorgeous tree-lined Upper Broadway block.

Soon to experience 7 owners. all at once

Owner Seeks Conscientious Residents

With Appropriate Income / Assets & Credit.

No prob. Uncle Satchel will cosign. He’s a pro at convincing owners to rent so long as cash is not an issue.

If you can find 6 friends you can sort of stand, this sounds like a fun deal, especially after bargaining the rent down.

Remember to spring for maid service though 🙂

No prob. Uncle Satchel will cosign. He’s a pro at convincing owners to rent so long as cash is not an issue.

LOL, Milkshake.

The key when dealing with these sort of owners is to act “above it all”. When they ask for an application, just laugh it off with a jovial, “What are you worried about? I haven’t held a job in 10 years, so at least with me you never have to worry about a job loss stopping me from paying the rent on time”. Show them a printout of a free online credit report, and a copy of your latest trading account brokerage statement.

Hey, it might work (it did for us, twice). If these guys were crazy enough to pay upwards of $7M for a rental investment anything goes! Seriously, this cl ad is astounding. What could be the cap rate on this – taxes alone are going to be half the attained rent at least!

I’m guessing these guys aren’t ready to renovate it to live in it, but they liked the house a lot and so jumped on it. They probably just want to generate a little $$ for a few years until they turn it into their dream home. That’s the type of seller (potentially) who might agree to a big rent discount to a small family (less wear and tear/potential issues) b/c clearly the financial motive for picking up the place was not as a rental.

3355 Pacific closed 2/27 for the sales price with an asterisk. It went pending in 19 days only, though. So you have to think it must have been somewhat close.

Then again, maybe the asterisk is hiding a $2M sales price, and the wishing rent is right in line with a reasonable cap rate in this environment 😉

dub dub,

I still owe you some thoughts on Prop 13, but looking through this thread I may have been saved by my own verbosity! Take a look at my post at February 5, 2009 8:22 AM above and see if you agree.

It’s odd, but another Gold Coast home a few doors down was sold a few years ago (asking a little below 10) and that too was turned into a rental. My guess is that the buyers have another home elsewhere that they probably can’t sell, but the Broadway house was priced too well to pass on; so they figure they’ll try to wait out the market. Or, maybe their renovation plans are so drastic they figure it’ll take at least three years in approvals… lol

“Or, maybe their renovation plans are so drastic they figure it’ll take at least three years in approvals…”

Maybe they are trying to pull a Nunemacher:

https://socketsite.com/archives/2009/03/1268_lombard_the_resourceful_demolition_of_a_historic_r.html

Put some renters in, let them trash the place, apply for an emergency permit to demolish…

I’m surprised that these higher end homes are not renting actually. I’d have thought that renting for less than taxes would be a good hedge against buying. There are quite a few high end rentals out there; but none of them are really moving. The Metallica home was offered, not sure if it ever rented? Somehow Coombs seems to get these higher end listings?

Propertyshark has this listed as closing at $7.8M