While Bay Area home sales were relatively flat in June (up 0.2 percent year-over-year and month-over-month), and listed home sales in San Francisco were down nine percent, recorded home sales in San Francisco were up 6.4 percent versus the year before as a backlog of sales in new developments continued to close escrow.

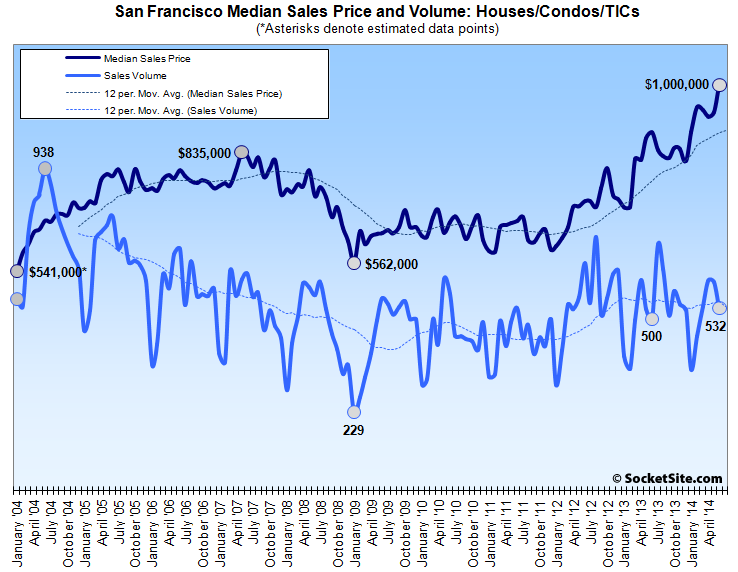

That being said, at a time when home sales volume should be increasing due to seasonality and inventory has been ticking up, the recorded sales volume in San Francisco dropped 12.4 percent from May to June, according to DataQuick. The sales volume in San Francisco has increased an average of 3.4 percent from May to June over the past ten years.

And with an increasing percentage of new construction sales in the mix, the median price paid for a property in San Francisco hit a record $1,000,000 last month. That’s 5.8 percent higher than the previous record of $945,000 set in February, 7.3 percent higher year-over-year, and 77.8 percent higher than the $562,000 mark set in January of 2009. As always, keep in mind that while movements in the median sale price are a great measure of what’s in demand and selling, they’re not a great measure of actual appreciation.

Having peaked at $665,000 in July of 2007, the median sale price for a home in the Bay Area increased 0.2 percent to $618,000 in May, up 11.4 percent year-over-year and the highest median price since November of 2007. The median price had fallen to $290,000 in March of 2009.

At the extremes around the Bay Area in June, sales volume was 3.6 percent lower on a year-over-year basis in Alameda (a loss of 60 transactions) with a median which was higher by 9.3 percent. The median price paid for a home in San Mateo increased the most, up 14.9 percent with a 4.8 percent increase in transactions (35).

Keep in mind that DataQuick reports recorded sales which not only includes activity in new developments, but contracts that were signed (“sold”) months prior but are just now closing escrow (or being recorded) and any properties that were sold “off market.”

Wow, just wow! Even after the trials and tribulations of the housing bubble and crash, Here we stand at $1 Million dollars, nearly doubling after ten years of ups and downs. It’s actually 84%, but that’s pretty darn impressive under the circumstances. An old adage that an old broker told to me a little over ten years ago, that SF property basically double every 10 years, has basically come true in this instance.

Yep, S&P 500 up 190% since March ’09, flirting with a 2K close.

What is the difference between listed home sales and recorded home sales? Do they mean listed homes for sale when they say listed home sales?

Did Marin ever hit a million? I’m sure the term Million dollar Marin was thrown around at one time, but unsure whether it was referring to its potential or an actual median price data point.

And interesting that San Mateo is over 800k median now.

As for mix, an increase of 7.3% for the year doesn’t seem like its too far away from what actual prices have done – in fact, it surely understates the increases in many key part of SF.

No one answered this, but no on Marin. I tracked these dataquick numbers incessantly during the last cycle, and never saw Marin above the $800s.

When the lines cross this will be a sign that… wait… never mind. I don’t know anything anymore apart that this is a crazy crazy market.

San Francisco is so cheap compared to London, literally 75% cheaper. With the tech jobs and companies you have there, surely SF will catch up some.

“Which” London compared with “which” SF? You need to specify before comparing London with SF.

I remember the run up of prices in Paris from 2002 to 2010. The rationale was “it is still cheaper than London”. Prices more than tripled (and quadrupled or more in cheaper areas) but Paris is so diverse in quality that many areas became way overpriced. Now prices have corrected in these areas and stayed strong in others.

are you actually knowledgeable about London? my understanding is that everywhere inside the A1 ring is extremely expensive. In fact, I just looked at some places in Dalston. It’s a hip area, but there’s no tube. And a 3-4 br house on a relatively high crime street is going to cost well over 1M pounds.

Yes I am. I studied in London actually and still visit friends there. Funny I said “Which” of London and there you’re already limiting to one part of London to make your point. You’re mentioning houses that would cost 2M USD though that wouldn’t be the cheapest today in London. That’s not 4 times more than SF like England mentioned. Yes some of London is extremely expensive, but so are some very exclusive areas of SF. Is London more expensive than SF? No question YES. Is it 4 times more expensive? It depends where you look.

i didn’t limit to one part of London. I said “everywhere inside the AI” and then cited one anecdote. slow your roll bud. you’re over in the other thread accusing futurist of looking for a fight right

By the way, since you called me out about London, do you have any authority on this market or are you just in a “I am feeling lucky and see what sticks” phase?

I’ve been active in the SF market for nearly 20 years. Or are we talking about London? Admittedly, I am no authority. I used words such as “my understanding” in order to convey that.

So your posts have fine prints and disclaimers. Good to know.

huh?

Second time I get the “yes but I did mention that…” after being called out. Maybe I am wrong and this is just a misunderstanding. Still a bit annoying to have to respond to character attacks based on the form rather than substance.

I really don’t know what you’re talking about. I asked a question and you started arguing, talking about “limiting,” trying to get an internet win or something. Guess that’s your thang. How awesome for you.

nice try, “anon”. I asked “which” London the OP was mentioning. Then you chimed in starting with “are you actually knowledgeable about London?”, to a QMC alumni, that’s actually funny, but you couldn’t know that… I gave precisions and mentioned that to compare you couldn’t speak about London or even SF as a whole, my original point. What was that about originally? Oh yes: London is more expensive tun SF. We all agree on that. But SF 75% cheaper than London? 4 times cheaper? It depends where.

“nice try” ? Bizarre

What is the A1 ring? I know about the A1 road between London and Edinburgh but haven’t heard of the A1 ring. Is it the A406?

Congratulations to the lucky folks who brought in the end of 2011, right before the price sky rocket to today’s level.

runner ups are the 2010 buyers 😉

is this site called, “boast about yourself san FronziScheme” or Socketsite?

7 years on SS and I have been open about my opinions, choices and decisions. Many “anon”s pop up here and there doing zingers, one-liners and non-sequiturs bringing mostly polemic and criticism to the discussion. Yeah, you are right, no one should ever brags about anything here.

Bragging is disgusting.

Well, we have always had eventual plans to sell our place and get somewhere larger, and this crazy market convinced me the time to do it was now. Just sold and we are going to buy some time renting until deciding what to do next.

Make no mistake about it — renting sucks after owning property for many years, but this seemed like financially the best decision. I may regret not holding on for a little bit longer, but all of the equity we had banked was just too tempting. BTW, I was told repeatedly on this board that I had bought at the peak, and that nominal prices would not be this high again in my lifetime. That obviously turned out to be incredibly inaccurate, as I returned 20-30 pct AFTER factoring in transaction costs.

My prediction is that prices go sideways for a while and possibly even correct a bit. The increases we are seeing now just don’t seem sustainable. My wife and I make very good money, and we are frankly questioning if we can afford another home in SF — at least comfortably. For most of the 90 something percent of people who earn less than us, I’m sure the unequivocal answer is no. Interesting times for SF real estate indeed.

Congratulations! There were a lot of naysayers, especially when thing went south in 2009.

If things don’t work out, do you have a Plan B? It is good to always have a second (and third) plan, I think.

Are you waiting for the next slump to get back to the market? Even if it happen it may not dip lower than today’s price.

I used to think I don’t want to carry a mortgage into my 70s too. But the number is actually very manageable for me. By the time I’m 70, I expect the property tax to catch up with the mortgage anyway. So I’m very comfortable to pay it off slowly.

Looks as though you aren’t alone in cashing in….

I think there are two questions people need to ask themselves 1) is SF affordable, obviously, but 2) is SF worth the money, even if its affordable, not sure people are really thinking about that one enough in my opinion.

Sure it’s worth it. Monaco of America!

It isn’t for me. I’m out. I put my money in Berkshire Hathaway stock.

The microeconomic view says sell sell sell. The macroeconomic view of the world and the increasing disparity between high net worth upper-class individuals families and the rest isn’t so clear.

Plan B is to move out of SF. That is also plan C and D honestly. I refuse to get myself into a mortgage that I will end up paying until I’m in my 70’s for the sake of an extra bedroom and the right to say I own property in SF. Exactly what that looks like depends heavily on prices and interest rates. We’ve given ourselves two years to decide.

I went on a colossal buying spree (5 homes, not bad for a self-employed, lifelong renter) here from 2010 to 2013 and made well over a million in equity over that time period. But I’m completely out of the market now, not even looking at properties or prices anymore. Rents are way, way up and all current holdings yield positive cashflow. This is the gravy train that will make me a multi-millionaire in under 10 years, regardless of price appreciation from this point on. Of course I won’t say no to more price gains.

I am sorry to those who missed the boat, trust me I know the feeling of despair when you calculate how much you’ll be spending on rent for the next decade! Your loss is, quite literally, my gain.

Ha, fair enough.

You own 5 homes and you’re still a renter?

I was a renter, prior to buying. I suppose that’s a dangling modifier… thanks, grammar police! No, I do not pay rent any more but I did for almost 15 years.

Dat ok.

Interesting that the median has soared but sales volumes have never recovered from the previous peak. Does that have significance in either direction?

Volume is a factor not only of the number of eligible buyers but also of willing sellers. Prop 13 creates an artificial drop in offer. Long-term owners with tons of equity who would like to move out but who do not have to move out will take the tax hit they would have to suffer into consideration. Some owners will refuse to trade up or trade down for that reason alone.

i didn’t limit to one part of London. I said “everywhere inside the AI” and then cited one anecdote. The main part of what I meant was the former. Everywhere inside the A1 would be most people’s estimation of what is actually “London,” I think fair to say. Anyway slow your roll bud. you’re over in the other thread accusing futurist of looking for a fight, right.

One anecdote doesn’t make the market. Knowing the extent of London, yes inside the A1 can be considered “real London”, just like we had the “Real SF” a few years back. If you take the “Real SF” then numbers will change.

About futurist, simply reread the thread. Context is everything.

Yeah, that’s so 2008. With recent home price explosion, pretty much all of SF is now “real SF”.

no kidding one anecdote doesn’t make the market. and i said that.