Last October we first reported struggling sales at The Royal in San Francisco. Today, we report what appear to be a number of significant price reductions. For example, while two story townhouses were originally “priced from $1,575,000,” townhouse #804 was just listed at $1,400,000 (a reduction of at least $175,000 or 11.1%). And while two-bedrooms were originally “priced from $940,000,” two-bedroom #602 was just listed at $915,000 (a reduction of at least $25,000 or 2.7%).

And then there’s a one-bedroom (#503). It was just listed at $650,000 or $870 per square foot. As you might recall, a flipper appeared to be having difficulty selling another one bedroom (#604) late last year. And while it was slightly larger (771 versus 747 square feet), a floor higher, and an end unit (although it has one less window than #604), it had also been reduced to $1,023 per square foot after failing to sell at $1,049 per square foot. It was originally priced by the developer at $940 per square foot ($725,000).

∙ 201 Sansome #503 (1/1) – $650,000

∙ 201 Sansome #602 (2/2) – $915,000

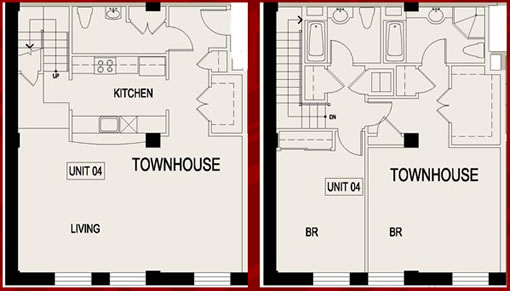

∙ 201 Sansome #804 (2/3) – $1,400,000

∙ The Royal San Francisco: An Update (And A Flip) [SocketSite]

∙ The Royal San Francisco [SocketSite]

Reminds me of 188 King. I just can’t imagine being one of the people who purchased when the building was first released only to see prices now being reduced. Would this be an example of “instant equity loss” in San Francisco?

Atlantic Pacific just retained the Mark Company to do marketing + sales

I saw a unit there over a year ago and the price just seemed high for what you got, so maybe they are finally realizing that.