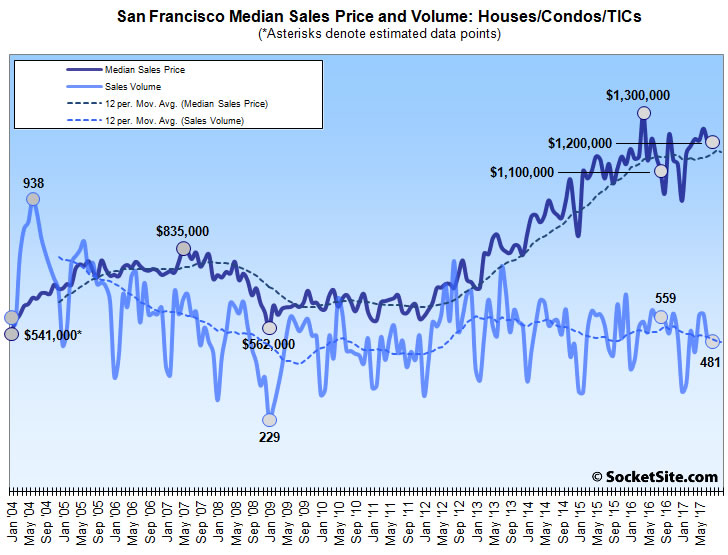

While the number of single-family homes and condos that traded hands in San Francisco proper only dropped 0.8 percent from 485 in July to 481 in August, the sales volume was down 14.0 percent versus the same time last year and the month-over-month decline was muted by a downward revision of the previously reported July sales by 6.9 percent.

At the same time, home sales across the greater Bay Area jumped 11.7 percent, from 7,512 in July to 8,388 in August, and were 1.7 percent higher versus the same time last year, according to recorded sales data from CoreLogic.

In Alameda County, recorded homes sales jumped 13.6 percent, from 1,586 in July to 1,801 in August, and were 3.3 percent higher versus the same time last year; sales in Contra Costa County jumped 16.0 percent to 1,749 in August but slipped 0.9 percent on a year-over-year basis; and sales in Solano County jumped 24.0 percent to 733 in August which is 0.5 percent lower, year-over-year.

Home sales in Santa Clara County ticked up 6.7 percent from 1,744 in July to 1,860 in August and were 9.6 percent higher versus the same time last year while recorded sales in San Mateo County jumped 14.0 percent to 661 in July which is 0.3 percent higher versus the same time last year.

Up in Marin County, sales dropped 14.5 percent to 288 in August but were still 3.6 percent higher versus the same time last year; sales in Napa ticked up 10.2 percent to 140 in August which is 9.7 percent lower versus the same time last year; and home sale in Sonoma County jumped 21.8 percent to 675 in August which is 3.5 higher, year-over-year.

The median price paid for those aforementioned 481 homes in San Francisco last month was $1,200,000 in August which was unchanged from the month before and still 7.7 percent below the record $1.3 million median price recorded in April of 2016 but 9.1 percent higher versus the same time last year.

The median sale price in Alameda County was $752,000 in August which is 11.7 percent higher versus the same time last year; the median sale price in Contra Costa County was $572,000 and 12.4 percent higher versus the same time last year; and the median sale price in Solano County was $398,000 and 3.4 percent higher, year-over-year.

The median sale price in Santa Clara County was $935,000 in August which is 13.3 percent higher versus the same time last year while the median sale price in San Mateo County was $1,134,750 and 11.3 percent higher, year-over-year.

The median sale price in Marin was $960,000 in August and 6.9 percent higher versus the same time last year while the median in Napa was $562,500 and 3.2 percent higher, year-over-year; and the median in Sonoma was $577,600 in August and 10.0 percent higher on a year-over-year basis.

And across the greater Bay Area, while the median home sale price slipped 3.0 percent from $765,000 in July to $742,000 in August it remains 11.6 percent higher versus the same time last year.

Keep in mind that while movements in the median sale price are a great measure of what’s selling, they’re not necessarily a great measure of appreciation or changes in value and are susceptible to changes in mix, as opposed to movements in the Case-Shiller Index.

Ask yourself why people would pay these high prices for a house right now? It’s usually because they think the prices will go even higher, or their financial situation will keep improving. I think most people are coming around to the idea that upside might be limited for the time being.

Around here, improving financials often means IPO funny money. But why haven’t some of the biggest tech unicorns gone public, or even announced plans, while the stock market keeps rocketing to new all time highs? Because they know their private valuation is way overshot, and the majority of high profile tech IPOs since 2015 have gone south. Meanwhile the latest iPhone release was a flop, buy hey they have a cool new spaceship.

I’ll wager people buy in this market because they need a place to live.

Buyers can afford these prices because they have a high salary.

By the way, an IPO is the opposite of funny money. An IPO is real money.

Like I’ve said before, most people who actually work for their money are at least somewhat sensitive to price. I consider IPO money to be funny money for lots of employees, because it was largely gotten by being in the right place at the right time, somewhat akin to winning the lotto. I even know some of these lotto winners personally. Also, in the case of the majority of IPOs that head south, someone will be left holding the bag. In the end, value was not created, it was just a transfer of wealth to the winners from the losers.

Sour grapes, I think.

I don’ think IPOs have really been putting a lot of money into the housing market, because it is the huge established companies that are paying everybody. Look at how many people work at Apple, Google, Facebook, Adobe, NVidia, Intel, whatever. NVDA share price has tripled in the last year alone. If you had a pretty normal $100k/year share grant from NVDA you are now walking around with a $300k/year vesting. That’ll buy some houses.

Sure, these IPOs created literally thousands of overnight millionaires, but none of them were interested in going out and buying a house. I read a story about the Facebook meeting when Zuckerberg announced the IPO, a former employee said some people already had their laptops open and were shopping for real estate. You all want so desperately to believe that these prices are supported by fundamentals, they are not.

Sabbie, why do you find it so hard to believe that Apple, Google, Facebook, Adobe, Nvidia, Intel, Salesforce, Oracle, etc. pay high salaries to their employees?

Sure. But those aren’t the largest employers around (with exception of Oracle) and high salaries alone will not buy you the high end homes in SF or SV. So it doesn’t explain the trend sorry.

Why do you find it so hard to believe that many of the crazy bids which really drive up prices here are coming from cash? Foreign, IPO, and Old Money cash. Markets depend on liquidity and the real rate of return. People who have cash can either have it in the bank where it is not just sitting idle but actually being devalued in real terms, or put it into assets. SF real estate is one of those desirable assets right now. It is not just a place for people to live as you say. If you don’t believe it, then look at Canada and Australia where they actually keep track of these things (because they care about their citizens not just the bottom line).

Partly I believe that because I don’t know anybody who bought their homes with old money or foreign money. A few people have benefitted from an IPO. But virtually all of my friends have bought homes based on money saved from their salaries. It’s damn near universal.

Despite having worked at mostly startups in my 18 years here, I’ve never had a big win. No IPOS. However, my partner (also no IPOs on record) and I were able to save up to buy a place. It just took longer than if we had stayed in the midwest. It’s definitely doable on two tech salaries with one salary a bunch lower due to working at a start up.

I’ve worked at Intel for 11 years and Dolby for 6. All of the post IPO companies have a similar pay structure for their rank and file engineers, product managers, etc. A base salary which is usually in the low six-figures or higher. And then there is an annual bonus which is a percentage of the base salary. This can be from 10% to 100% or even higher depending on how high up you are. And then finally all post-IPO companies I know of award what are called RSU which stands for Restricted Stock Units. This is just jargon for the company granting you a certain amount of stock share each year which you can keep or sell.

My point here is that the post-IPO employers in SF offer large compensation on top of already high base salaries (high relative to the rest of the USA that is) so with some disciplined living someone can save up for a down payment on a house even if it’s $1M+.

Another point – I would argue there are more employees in SF employed by established companies like Intel, Apple, Google, Facebook, Genentech, etc just based on the number of shuttle buses they deploy to SF everyday to ferry their employees down south. The only pre-IPO companies with large numbers of employees living in SF would be big Unicorns with HQ in SF like AirBnB, Uber, etc.

You have to save the down payment not just with discipline, but with the headwinds of paying the highest rents in nation plus the $15 cocktails etc. I know lots of people who saved up and bought SF real estate with only their earnings. All of them were pre-2012.

I know plenty of people who’ve saved up and bought since then. It’s very easy to not purchase $15 cocktails–just don’t buy them. Save your money for a down payment instead.

anyone spending $15 on a cocktail and complaining about not being able to buy something really needs to get their priorities straight

Nah, it is the population in general that needs its priorities straightened. In 1950s America, households spent more on alcohol and tobacco than housing. Those were the days.

oops FAKE FACT ALERT! Not even close (or close to close)

UBS just did a study. How many years does it take to save up enough to buy a 650 sqft apartment in the city center for the “average annual income in the highly skilled service sector”. San Francisco came in at 5-8 years.

What are the assumptions in that study about salary, cost of the place, saving rate, etc?

I love the perspectives here, but am struggling with a couple data points. First, I was reading a month or so ago that only 10% (or around that) of those that live in SF can actually afford to buy here at current prices. That kinda makes sense. SF is largely a rental town – especially at these prices. Second, I am scratching my head wondering how even tech people with good “high” paying jobs can save enough here to pay for the down payments needed to buy a $1.4MM house (I believe the median price is ~$1.3/1.4MM as of last month). That requires saving $280k + $50K in CASH. I agree with Sabbie – saving in this city when rent is $3500+ for a one bedroom, and income tax is damn near 45/50%. Sure you could invest your cash you saved to help get toward the down payment goal, but in CA, capital gains taxes are the same as ordinary income! Long story short – saving here is really really hard. I think that explains the 10% number.

Even the stock/RSU grants are “watered down”. JWB – that $100k a year stock grant you mentioned –

that gets taxed 45% (I’m assuming the highest tax bracket) when received or as it vests, and any gains on that are also taxed at 45%. Soooo, yes, after 3 years you got $300k in stock value, but you paid over $150k in CASH when you received it/it vested.

Prices have gone so high the down payment numbers are dare i say “unobtainable” given the taxes people have to pay, and the cost of living people have to endure while they are saving up (again, rents are still high). Even with high salaries, the increase in compensation has not matched the rise in real estate, and taxes are killing people’s take-home pay. Taking into account all these data points – the numbers make sense. While SF’s real estate market may not go down 30% or 40%, but I really don’t think it’ll continue to rise substantially. People can’t afford it (they would if they could), so places adjacent to SF will see more interest if people really want to stay and be home owners, or people will move out of the area completely.

Why haven’t the biggest tech unicorns gone public? Because they don’t need to. They can raise additional $500M rounds whenever they please so they can continue to improve their product and business without any distraction of an IPO process or short-term investor demands. Meanwhile, they can provide liquidity to early employees through tender offers, where employees are able to sell say 20% of their stock in a company-sponsored/organized deal. There are also specific cases for certain businesses: Uber is in shambles and also has regulatory hurdles to overcome. AirBnB has regulatory hurdles as well. Dropbox needs to get their Dropbox for Business numbers up first. There’s no strong reason for alarm: those companies *will* go public.

Panhandlepro – how many of those companies actually have equity recycling programs? That takes an enormous amount of cash on the balance sheet, which banks aren’t gonna do, and VC firms really aren’t going to consider a good use of capital. And to be honest, if I’m a VC investor in such a company, i don’t want to make a public market for people to be able to sell out “early” – I want them all pushing for an IPO. Why would I want to give anyone any liquidity so they can become complacent? I could be completely mistaken here, but it just doesn’t seem like something that makes a whole lot of sense (excluding an internal market where buyers and sellers are both Uber employees).

No, many people do the math on monthly payments and have children and need to get them into schools and need extra space. I cannot believe you do not understand this. Do you have children?

Chart pretty nicely shows in the moving average the plateauing, or slight upward drift, in prices over the last year. That looks about right. Certainly not the big reductions people have claimed were already here.

“Apple” in point: 139 Henry St., 2 br 1 ba condo sold for $1,100,000 in July 2017, just sold again for $1,360,000, up 23.6%. Again, anyone looking for bargains relative to 2015 (or 2016, or 2014) prices is going to be sorely disappointed. Of course, the future can bring anything. The usual suspects here predicting imminent declines have been wrong for about 5 years running. I suppose at some point they can (and will) proclaim, “called it!”

Sorry, 139 Henry St. sold for $1,100,000 in July 2015, not 2017.

“Again, anyone looking for bargains relative to 2015 (or 2016, or 2014) prices is going to be sorely disappointed. ”

This one still hasn’t sold over a month at price below its 2015 price.

139 Henry St. was also listed below its 2015 price. Sold for 23.6% more than its 2015 price.

But I’ll qualify things. Yep, some very small number of places have indeed sold below 2015 (and 2016 and even 2014 prices). But if you are looking for such a deal, you’re going to be sorely disappointed because they are very much the exception and not the rule, as evidenced by the broader data.

Also in San Francisco, I sent my kids to great schools, the sun shined on my lawn in my backyard, and I had a short commute, because I live in the city. Dungeness crab season will open in a couple of months. I buy gas for under $3 a gallon, and a lot of things are right in the world. Get in while you can.

Something tells me you’re white, too, and that is also pretty right in this world. America! Groovy!