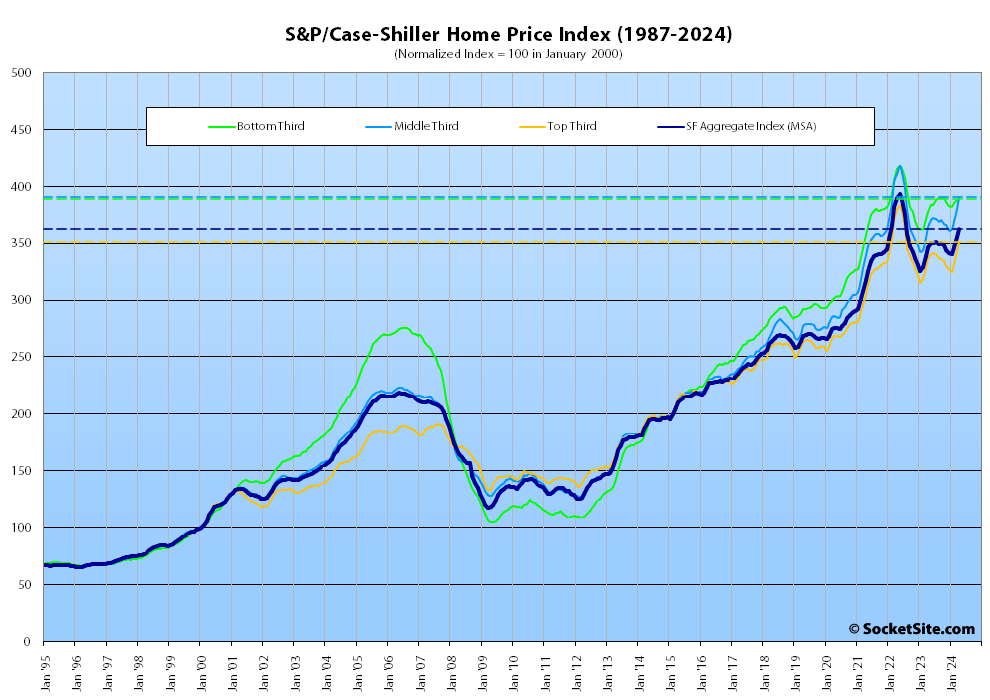

Having ticked up 2.6 percent in March, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area (i.e., “San Francisco,” which includes the East Bay, North Bay and Peninsula) ticked up another 2.0 percent in April, albeit with some seasonality still in play.

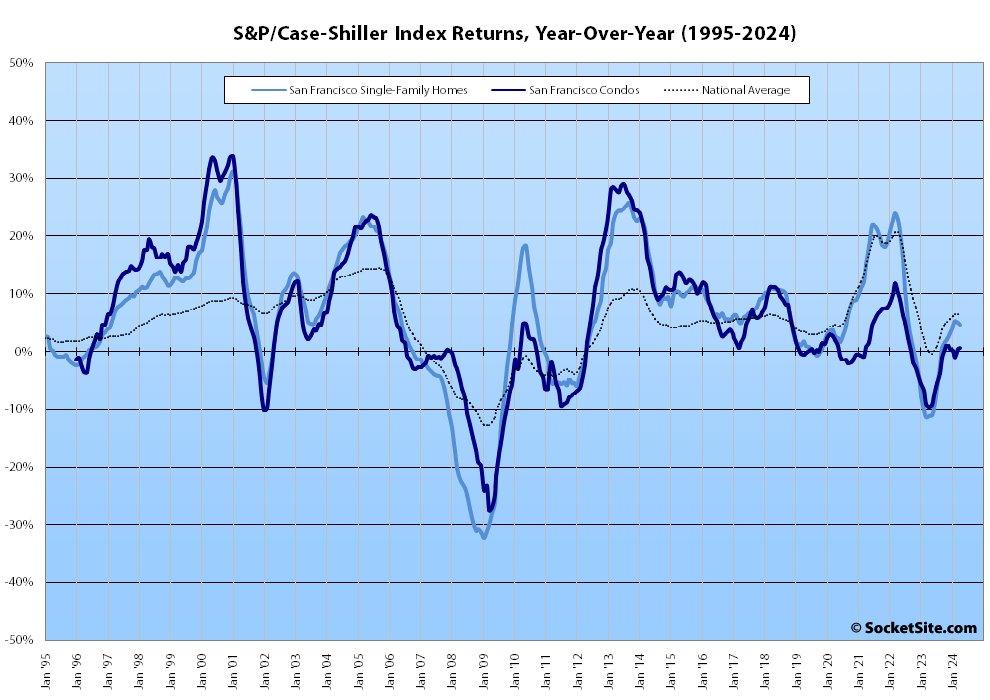

As such, the index is now 4.7 percent higher than at the same time last year, slipping from 5.0 percent year-over-year gain posted the month prior.

That being said, the “San Francisco” index is still 7.9 percent below its peak in the second quarter of 2022, with the index for the least expensive third of the Bay Area market having inched up 0.3 percent from March to April, the index for the middle tier of the market having ticked up 2.7 percent, and the index for the top third of the market having ticked up 2.4 percent but still 8.4 percent below its pandemic-driven peak.

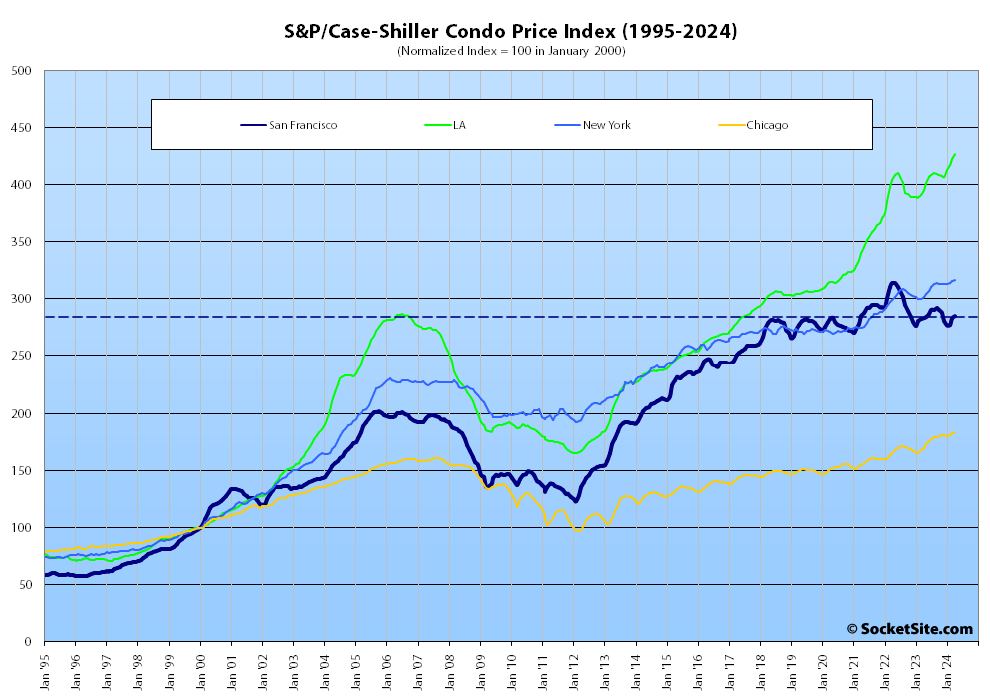

At the same time, the index for Bay Area condo values, which remains a leading indicator for the market as a whole, was up 0.7 percent on a year-over-year basis, having inched up 0.8 percent in April, but still 9.0 percent below its peak in the first quarter of 2022.

And having ticked up another 1.2 percent in April to a new all-time high, the national home price index was 6.3 percent higher than at the same time last year, with San Diego up 10.3 percent and still leading the pack, followed by New York (up 9.4 percent) and Chicago (up 8.7 percent), with Portland at the bottom of the table, up 1.7 percent year-over-year.