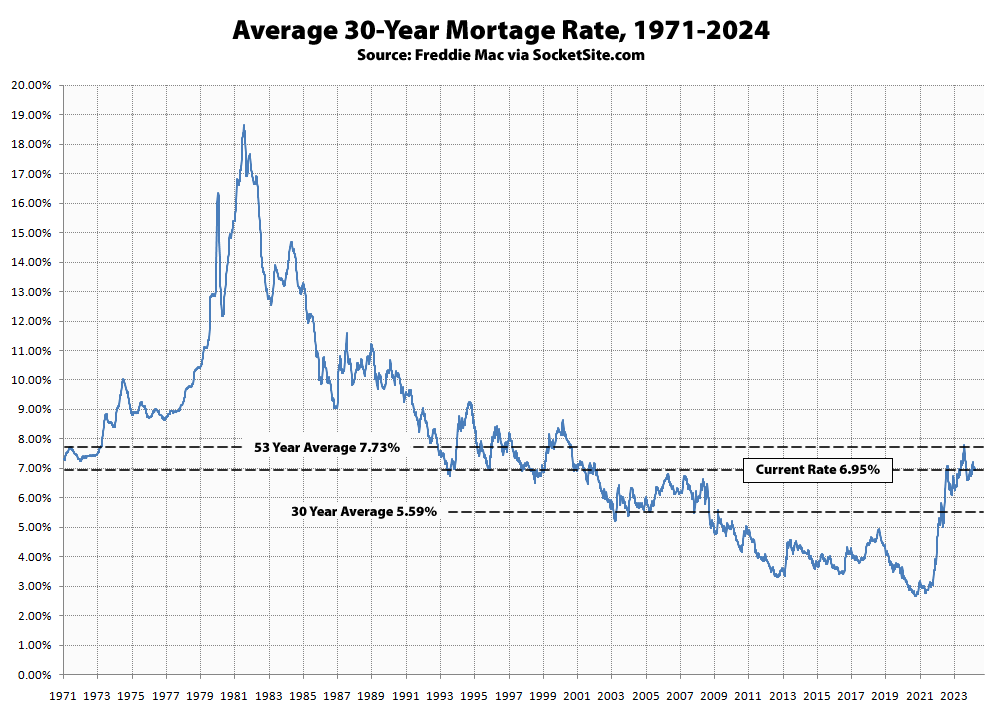

Measured prior to yesterday’s affirmation by the Fed, the average rate for a benchmark 30-year mortgage inched down 4 basis points (0.04 percentage points) over the past week to 6.95 percent, according to Freddie Mac’s latest mortgage rate survey data.

As such, the average 30-year rate is still 26 basis points above its market at the same time last year but 78 basis points below its long-term average of 7.73 percent, having hit 7.79 percent in October of last year.

All that being said, the yield on the 10-year Treasury, which drives the 30-year mortgage rate, has dropped 15 basis points since Freddie Mac’s latest survey and is trending down. We’ll keep you posted and plugged-in.

Is the petrodollar dead? Turbulence ahead?

Double digit interest rates in 2025 is my current bet. Leaving this here for the record.

Well, I certainly agree that there’s going to be “turbulence ahead” in terms of mortgage interest rates, but I don’t think it has much to do with the expiration of the supposed 50-year-old agreement requiring that Saudi Arabia price its crude-oil exports in U.S. dollars. And indeed, it appears as of this writing that nasdaq.com has removed the above cave_dweller-linked article entitled U.S. Saudi Petrodollar Pact Ends After 50 Years from their website (the link above produces a redirect to their home page).

Why? Well, most likely because Reports of the petrodollar system’s demise are ‘fake news’:

Go ahead and read the whole thing. The Saudi riyal was and is currently pegged to the US dollar at the rate of 1 US dollar to 3.75 riyals, but the US Dollar to Chinese Yuan Exchange Rate is up 1.37 percent from one year ago, a few months after cave_dweller began going on about “Trade is moving away from U$D to whichever local currency or commodity is best suited…de-Dollarization gaining momentum”.