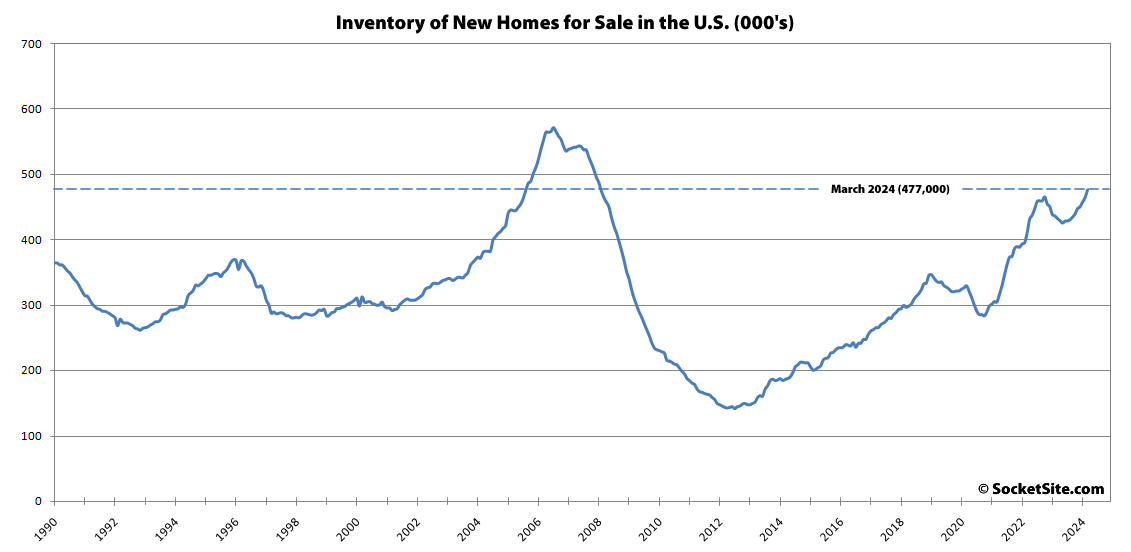

With inventory levels now 45 percent higher than prior to the pandemic, having hit a 16-year high in March, mortgage application volume for new home purchases in the U.S. ticked up a below average 2 percent in the absolute from March to April but was 22.1 percent higher than at the same time last year, based on loan application data from the Mortgage Bankers Association

At the same time, the average loan size for new home purchases, which is correlated with pricing, effectively held, despite a typical seasonal bump, inching up from $405,400 in March to $405,490 in April, which was up 0.9 percent from $401,756 in April of last year but 7.1 percent below a pandemic-driven high of $436,576 in April of 2022.