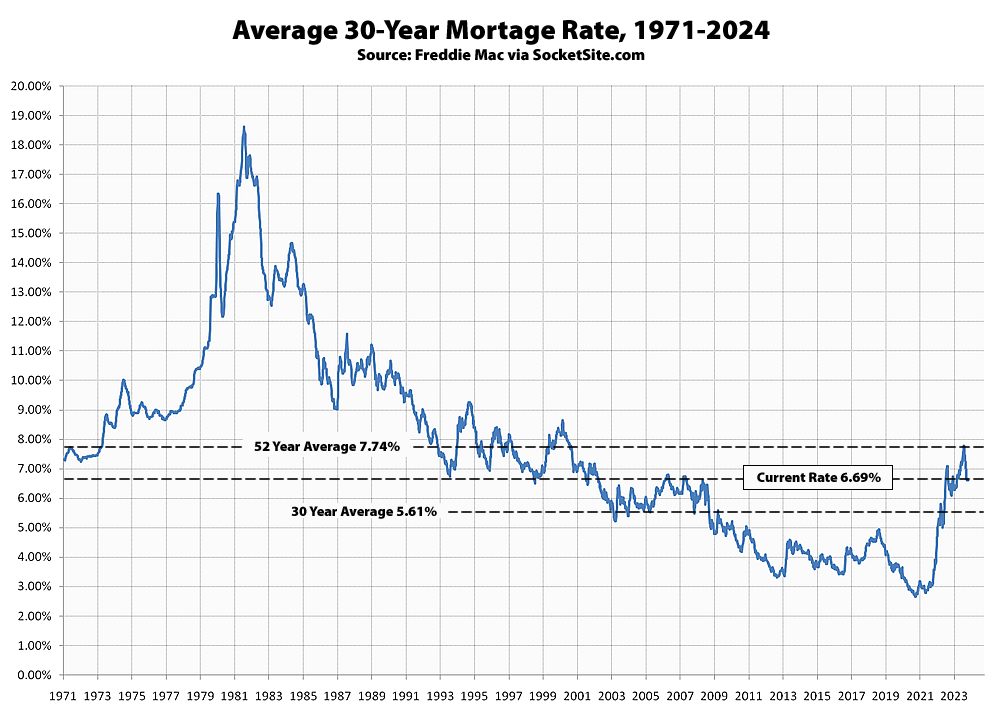

With the probability of a rate cut this quarter having dropped, the average rate for a benchmark 30-year mortgage has inched back up to 6.69 percent.

At the same time, the total expected value of the Fed’s interest rate cuts over the next 12 months has dropped 20 basis points since the end of last year and mid-six percent rates are suddenly being positioned as “stable” rather than “high,” with the current 30-year rate well below its long-term average of 7.74 percent but over 400 basis points, or 150 percent, higher than three years ago.

UPDATE: The average rate for a benchmark 30-year mortgage inched back down 6 basis points (0.06 percentage points) to 6.63 percent, which is 54 basis points higher than at the same time last year but over 100 basis points below its long-term average, with the Fed having elected not to cut rates yesterday and the probability of a rate cut this quarter having dropped to 40 percent, none of which should catch any plugged-in readers, other than the most obstinate, by surprise.