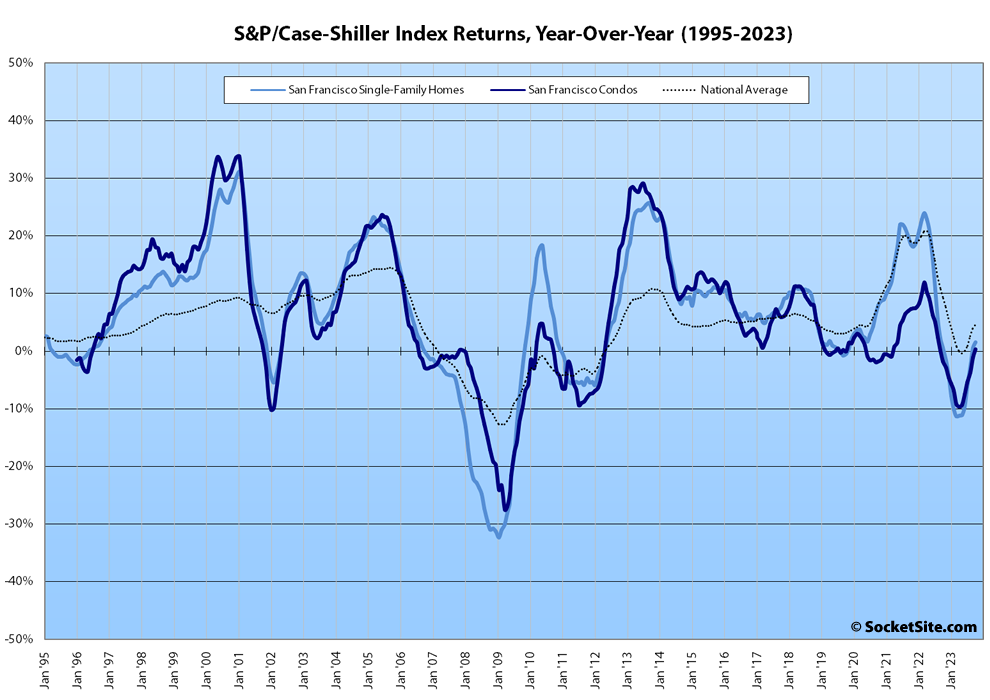

Having inched up 0.1 percent in September, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area (i.e., “San Francisco,” which includes the East Bay, North Bay and Peninsula) slipped 0.5 percent in October.

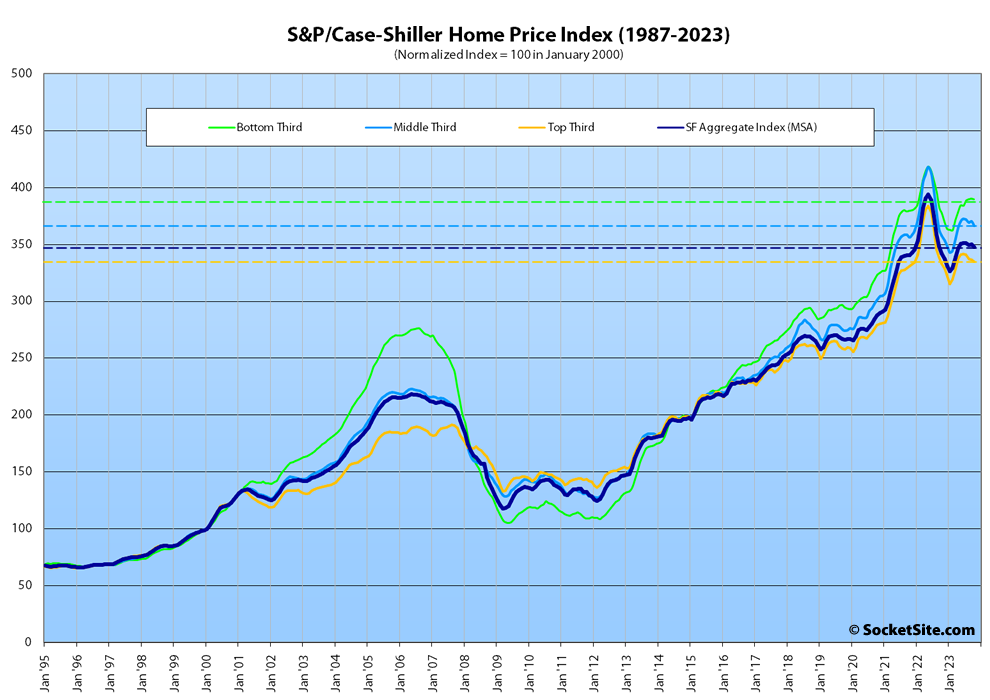

As such, while the index was up 1.6 percent on a year-over-year basis, it was nearly 12 percent lower than last year’s peak, with the index for the least expensive third of the Bay Area market having slipped 0.1 percent in October but still 3.1 percent higher than at the same time last year, the index for the middle tier of the market having ticked down 1.1 percent but still 2.4 percent higher than at the same time last year, and the index for the top third of the market having slipped 0.5 percent in October, up less than a percent on a year-over-year basis, and nearly 13 percent below last year’s peak.

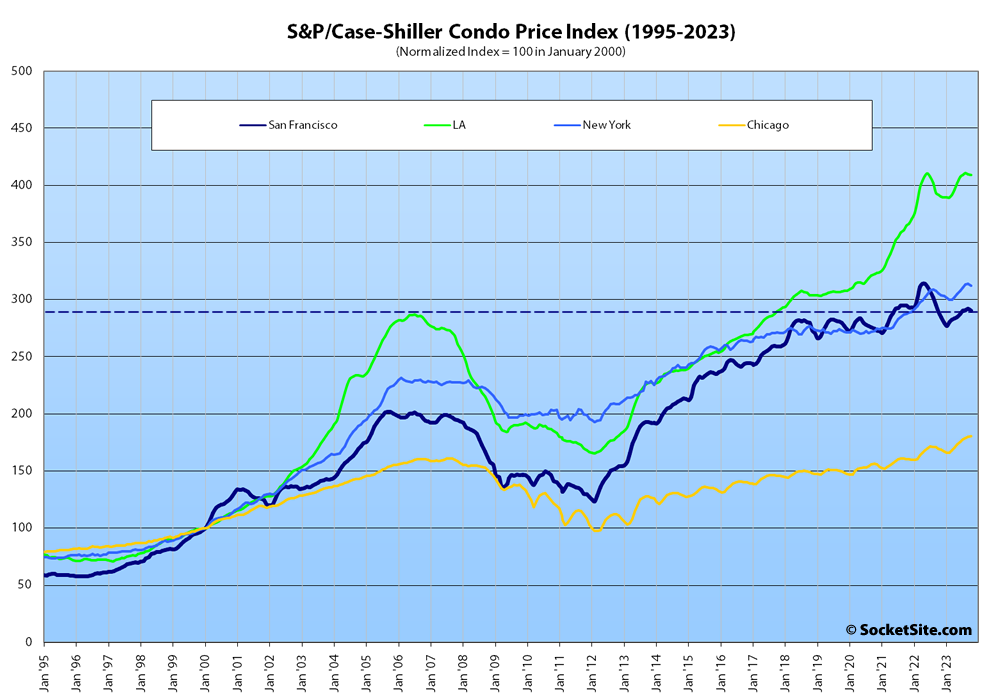

At the same time, the index for Bay Area condo values, which remains a leading indicator for the market as a whole, slipped 0.6 percent in October and was effectively even, year-over-year, with the indexes for Los Angeles, Chicago and New York recording year-over-year gains of 4.3 percent, 6.5 percent and 2.3 percent respectively.

And while the index for San Francisco is down nearly 12 percent from peak, the national home price index inched up another 0.2 percent in October to an all-time high that’s now 4.8 percent higher than at the same time last year, with Detroit up 8.1 percent on a year-over-year basis, followed by San Diego (up 7.2 percent) and New York (up 7.1 percent), and Portland the only major metropolitan area to record a year-over-year decline (of 0.6 percent).

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).