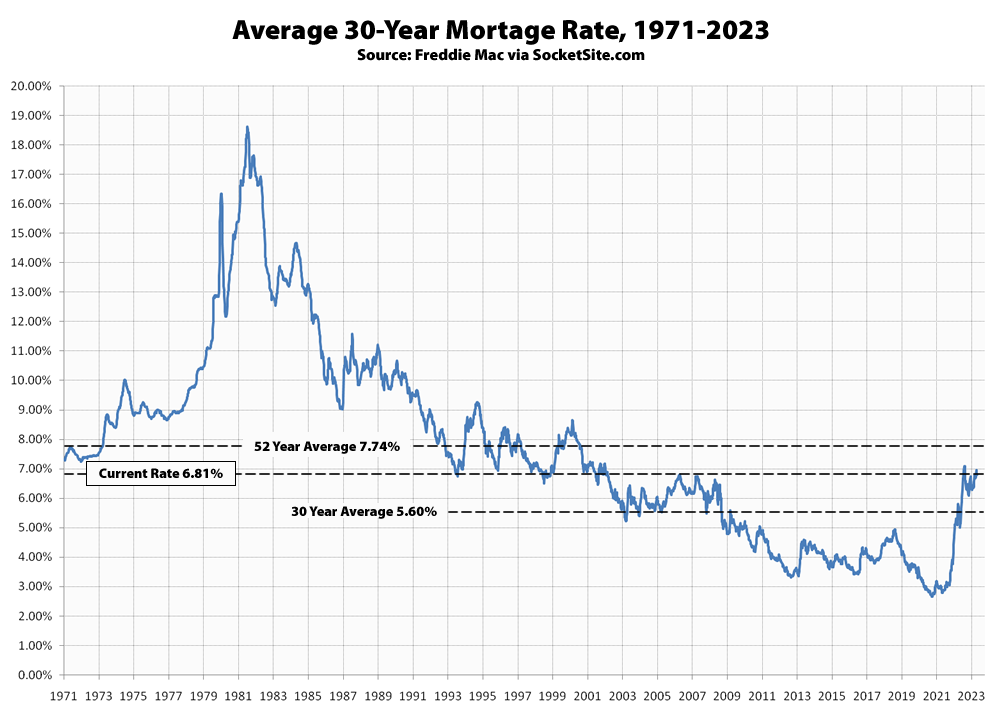

The average rate for a benchmark 30-year mortgage inched up 3 basis points (0.03 percentage points) over the past week to 6.81 percent, which was 151 basis points higher than at the same time last year and 416 basis points higher than its all-time low of 2.65 percent in early 2021 but still below its long-term average of 7.74 percent.

While measured prior to the Fed’s quarter-point rate hike on Wednesday, said hike was effectively priced-in and the yield on the 10-year treasury, which is the foundation for the 30-year mortgage rate, has only moved up around 5 basis points since.

At the same time, while the probability of an easing by the end of the year has ticked up to around 9 percent, the probability of another rate hike is three times higher and the futures market is currently projecting that the Fed funds rate will remain unchanged through the end of the year, none of which should catch any plugged-in readers, other than the most obstinate, by surprise.