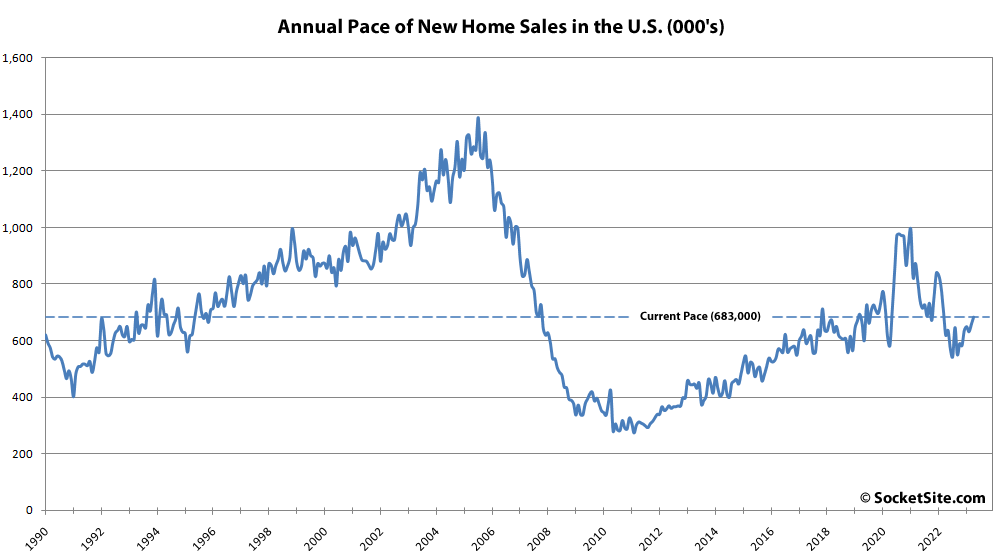

While the seasonally adjusted pace of new single-family home sales in the U.S. ticked up a little over 4 percent in April to an annualized rate of 683,000 homes, a pace which was 10 percent higher than at the same time last year, the pace was 15 percent lower than at the end of 2019, prior to the pandemic having hit, and the median sale price last month ($420,800) was around 8 percent lower on both a month-over-month and year-over-year basis, with an average sale price ($501,000) that was down nearly 11 percent, year-over-year.

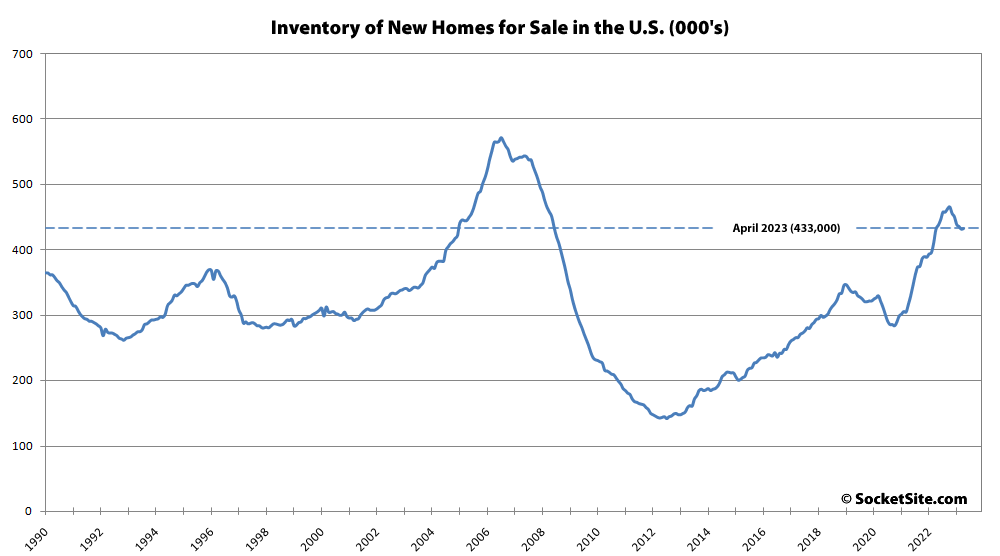

At the same time, the net number of new homes on the market inched up 0.2 percent on both a month-over-month and year-over-year basis to 433,000 homes, representing 7.6 months of inventory, which still represents a “buyer’s market” for those who actually like that stat.

In case you missed it from Gallup a little earlier this month, Views of U.S. Housing Market Reach New Depths:

Emphasis mine.

I think this is one of the few publically-available metrics where it doesn’t pay to be a contrarian. They further found that Americans still regard real estate as the best long-term investment over other assets.