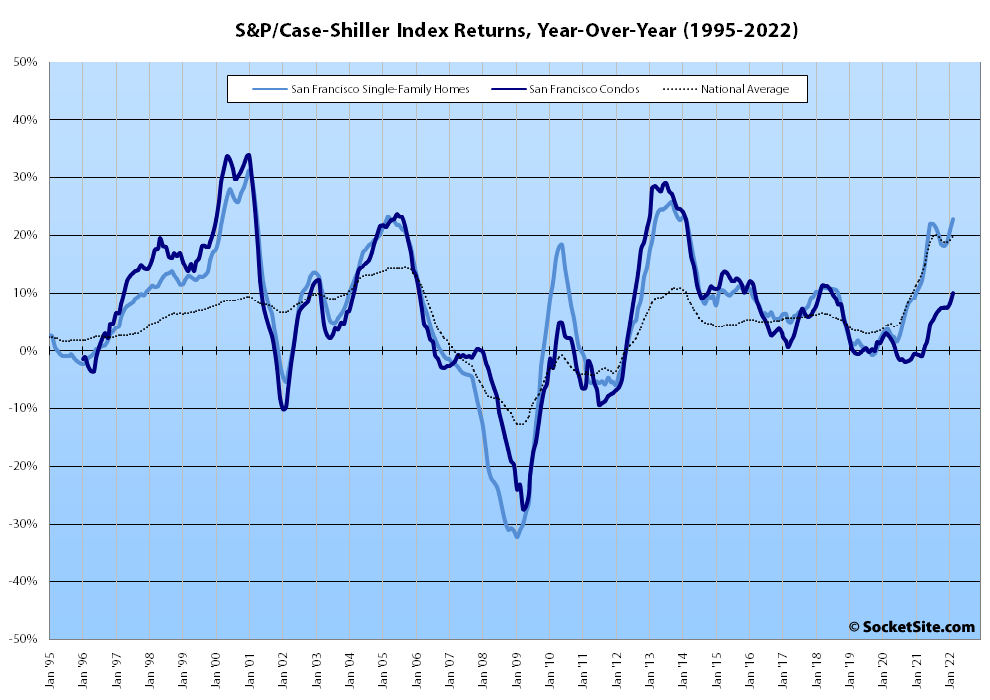

Having increased 2.4 percent in January, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – ticked up another 3.7 percent in February for a year-over-year gain of 22.9 percent, three points above the nationally average of 19.8 percent.

At a more granular level, the index for the least expensive third of the Bay Area market ticked up 2.6 percent in February for a year-over-year gain of 18.0 percent; the index for the middle tier of the market ticked up 3.7 percent for a year-over-year gain of 22.4 percent; and the index for the top third of the market ticked up 3.8 percent in February for a year-over-year gain of 23.4 percent.

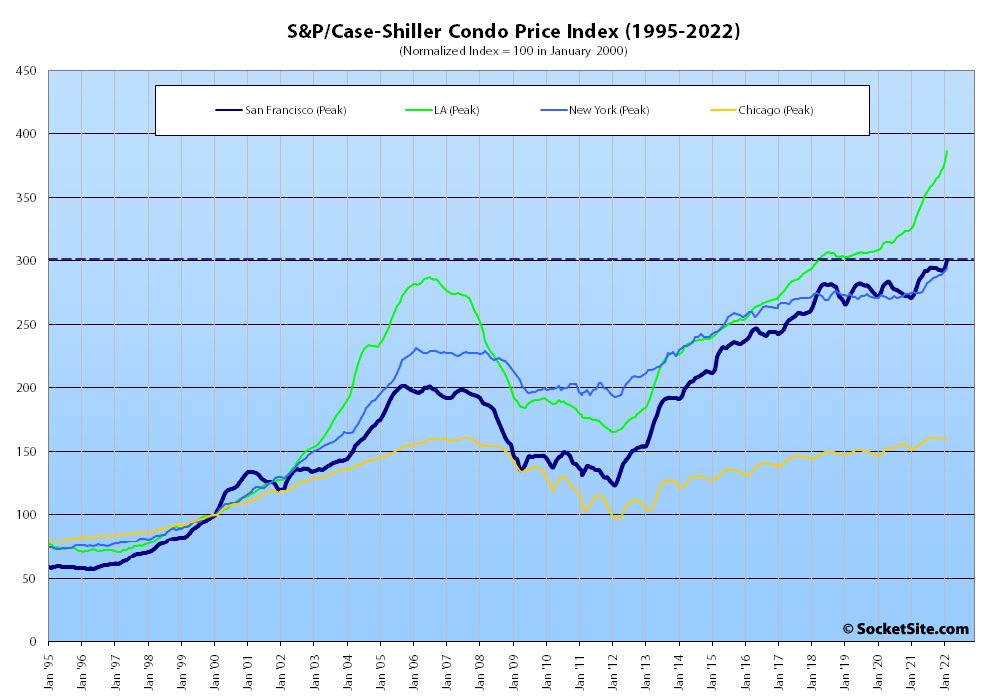

The index for Bay Area condo values, which remains a leading indicator for the market as a whole, ticked up 2.1 percent in February for a year-over-year gain of 10.0 percent (versus 17.4 percent, 5.6 percent and 7.0 percent in Los Angeles, Chicago and New York respectively).

And nationally, Phoenix continues to lead the way with respect to indexed home price gains, up 32.9 percent on a year-over-year basis in February, followed by Tampa (up 32.6 percent) and Miami (up 29.7 percent).

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

It seems like a majority of listings/sales in Marin south of San Rafael are approaching the 2015 SF standard of +\- $1k psf.