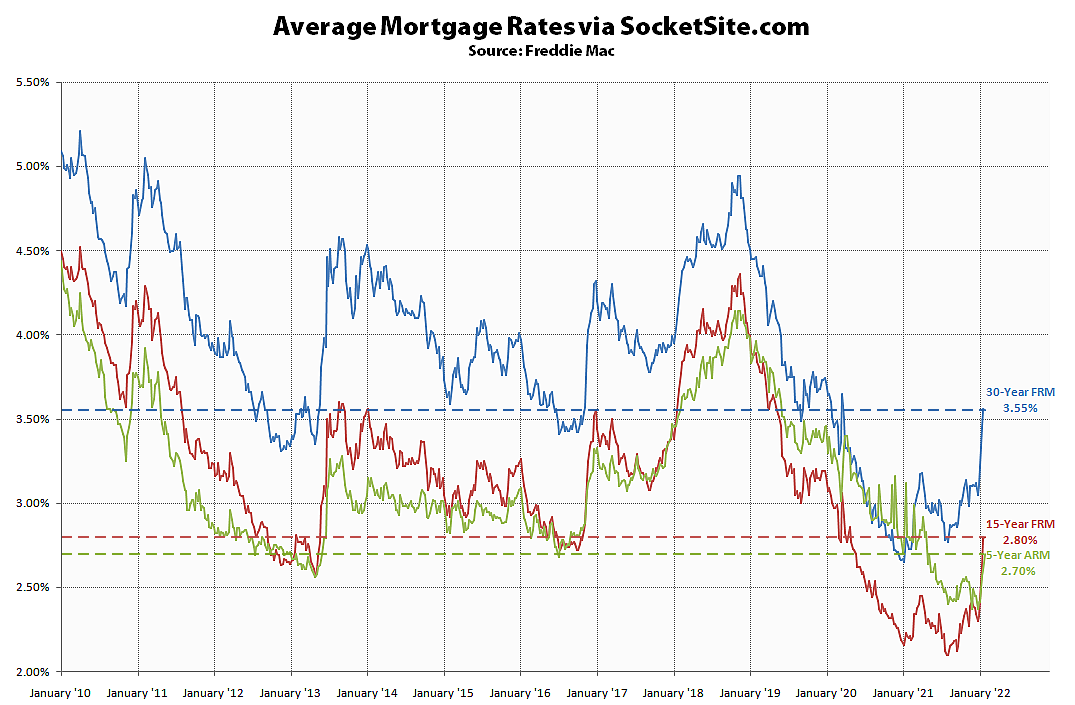

The average rate for a benchmark 30-year mortgage inched down one (1) basis points (0.01 percentage points) over the past week to 3.55 percent, which is 78 basis points percent higher than at the same time last year and within 10 basis points of a 2-year high.

At the same time, the Fed has now affirmed its intention to start raising rates, and “soon,” with traders expecting the first quarter point increase in March and an additional three, if not four, quarter point increases by the end of the year, which should translate into higher mortgage rates, less purchasing power for buyers, and downward pressure on home values.

Collapse of “superbubble” predicted, leading to possible next Great Depression: “We face the largest potential markdown of perceived wealth in U.S. history.”

Key word “potential”. What bets are you making based on your risk assessment?

Did you read the [name linked] article?

“Next Great Depression”

Maybe. On the other hand, Apple just generated $34B in *profits* in the last quarter, their best quarter in history. So maybe not.

But Apple is such the exception. They make real products which work very well, are very popular, are expensive but deliver more value then their cost (in the opinion of many consumers). Their products are very complicated and hard to design, so they have a great “moat” against competitors.

Nobody thinks a change in interest rates is going to affect Apple’s ability to design and build products. People love their phones and devices, during the last housing crash people kept buying phones even when household finances were strained. Apple has strong pricing power. If inflation hits they are in a great position to raise prices without losing share. They are also probably in a great position to control costs.

The issue is all the countless companies out there that aren’t Apple. And how many are zombies that are kicking along only due to investors chasing yield?

And again, it will not be lost on investors and managers that Apple had their best quarter in history while most of their employees have been working remotely for years. I know that Apple specifically really wants to bring people back in to some degree. But how many managers/investors are asking themselves why they need the costs associated with pricey locations if Apple can get these results working remote?

Companies are going to be under increasing pressure to cut costs and the pandemic has created an involuntary experiment as to the necessity of operations in high cost locations. People will not forget the results of this experiment even once the pandemic is over.

My point is not about working remotely. I agree with you that it’s been shown to work, at least in some cases. I also feel that the repercussions of how this will impact life in major cities around the world are still reverberating through society. I do not know how it will pan out.

My point is that if we were about to enter another Great Depression, one might expect to see some sort of indication in this from Apple. Apple’s customers seem to be feeling ok.

Not this time. You could avail yourself of the so-called “Fed Put” in earlier episodes of uncertainty, but that was when inflation was less than 2%. That isn’t the case now, so I would not bet on the FOMC relenting.

If you want to see dramatic, wait until the hard landing comes.

Don’t know about this “next Great Depression” or even right now vs in a few years. But as I said here, looking at the long term graph of interest rates, this has to end sometime.

Maybe we keep going from 3% down to 0%, but what then? No one seems to think we can keep the downtrend going into negative rates. (I know some markets/countries have hit slightly negative rates, but does anyone think we could generally have mortgages at -3% then -6% then…)

The “Fed Put” has eased the pain for lenders/creditors of low rates. You may not make much (if anything) off lending operations, but when rates get pushed down you get a capital gain on your securitized debt. But how do you flatten out at near zero rates? You get nearly nothing for your ongoing lending operations, have little capital gains upside since rates can’t go much lower and have a huge downside risk if rates go up.

I just don’t see what the endgame is here.

And really we should be looking at real (inflation adjusted) interest rates. So we are already a bit closer to zero then you’d think.

The big question of the day is whether the inflation we are seeing now is just a transitory increase or the start of a longer trend. The 5 year forward inflation rate inferred by Treasury bond prices is still just around 2%. So at least that market is voting that the current inflation spike is just a blip.

But if inflation takes hold at its current rate we could quickly find that zero (or negative) real rates are a real problem much sooner then you might expect.