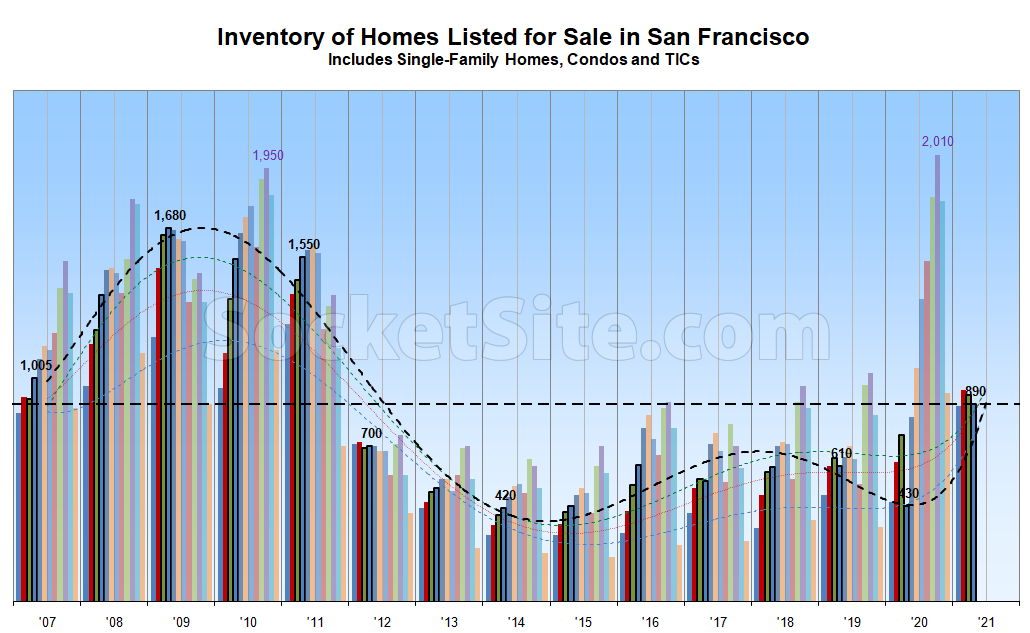

With the number of homes that were newly listed for sale in San Francisco over the past week matched by the number of new purchase contracts written, overall inventory levels effectively held at around 900 and a seasonal 10-year high.

And while the pandemic-driven exodus of listings in March of last year continues to skew the year-over-year numbers, current inventory levels are currently running around 50 percent higher than over the past ten years and over 100 percent higher than in 2015, driven by listings for condos but with the most single-family homes on the market for this time of the year since 2012, and over 40 percent more than in 2015, as well. But the typical spring spike in inventory levels has yet to materialize.

At the same time, the number of homes in contract across the city ticked up 7 percent over the past week to around 830 and the average list price per square foot of said homes ticked up around 2 percent to $978, while the average list price per square foot of the homes which remain on the market dropped 4 percent to just over $1,000 and the “expectation gap” between the homes which are in contract and those which remain on the market dropped to 2 percent having averaged around 6 percent since the beginning of the year.

By “hold” I assume “peaked” not unlike 2012’s chart…

It is pretty bad out there in general for buyers and am sure the data will catch up to this reality soon enough…

Is it? I am seeing frequent sales below 2015-2019 pricing. Inventory is only going to increase as the virus subsides. I am not sure demand is going to increase though.

Any thoughts if the spring spike will arrive but just late?

With fewer barriers to buying versus selling and typical turnover over the past year, we’re expecting a late spring spike in inventory, assuming the city continues to reopen and there isn’t a third wave.