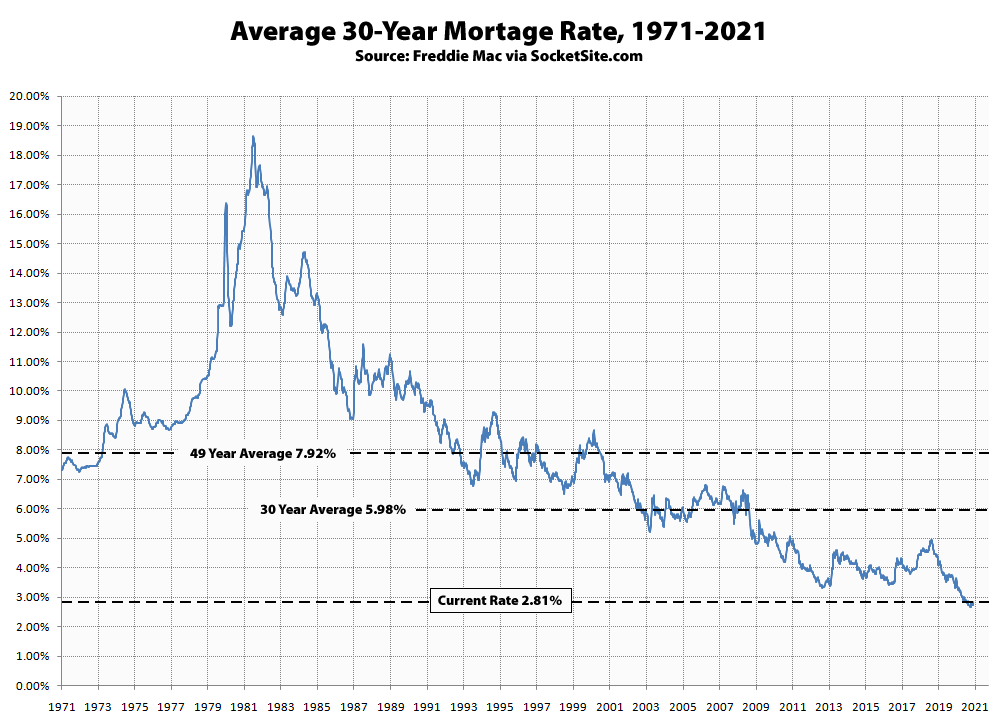

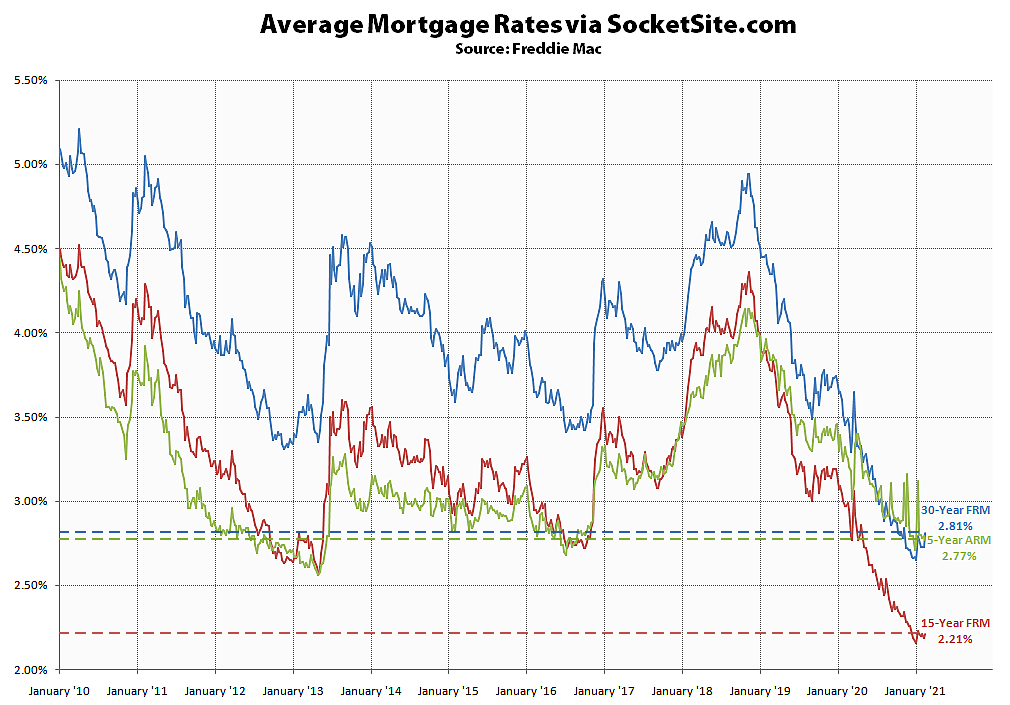

Having held at 2.73 percent for a couple of weeks, the average rate for a benchmark 30-year mortgage has since inched up 8 basis points to 2.81 percent. And while that’s the “highest average rate since mid-November,” it’s still 68 basis points below its mark at the same time last year, only 16 basis points above an all-time low of 2.65 percent last month and less than half the average 30-year rate over the past 30 years.

At the same time, the average rate for a 15-year fixed mortgage has inched up 2 basis points to 2.21 percent, which is only 5 basis points above its all-time low of 2.16 percent, and the average rate for a 5-year adjustable has slipped to 2.77 percent, ending a four month “inversion.”

Rates are weird now. I just closed on a cash-out refinance (45% LTV, excellent credit, condo in small building) and was happy to get 2.875% for 30 years. Strangely, rates for 30-year fixed mortgages were quite a bit cheaper than 5/1 and 7/1 ARMs, which is the opposite of “normal” and makes no sense to me — but hey, I’ll take it, it means I should never need to refinance again on this property.

But I ended up using a mortgage broker, because I got only lousy quotes from banks and direct lenders that I usually use. One prominent local bank which I’ve used in the past wanted me to deposit 15% of the loan amount in a checking account earning no interest (well, 0.02%!) and leave it there for the duration, in order to get a 3.25% rate. Um, no.

It always pays to do your homework when financing property, but right now I think that’s more true than ever.

I didn’t find any evidence that the benchmark rates quoted here are really very applicable to SF, they tend to apply to loans which are a lot smaller than the typical SF deal, and probably only to discrete single family homes. But I got close enough to feel good about my rate. But Chase, Wells, B of A, First Republic, and several others were not in the ballpark.

Very close to my experience. Large banks’ quotes are a mess, and many aren’t offering cash-out at all. My referrals from Bankrate were exceptionally heavy on points, but oddly enough a local broker (who sent me a snail mail promo of all things!) proactively locked me at 30yr / 60% LTV at 2.75 after fearing rates were ticking up. First time in my life a personal touch actually mattered to me in either finance or real estate.

Interestingly, the broker I ended up using (they’re out of Orange County) also found me via a snail mail solicitation. I was skeptical (I get those things all the time and throw them away) but they turned out to be a great find. One of the easiest application and documentation processes I’ve been through.

Glad it worked out for you too, I have always tried to avoid using brokers (figuring that it ended up costing more, in rate/fees, because the broker is another entity that needs to get paid) but I will be more open-minded in the future. And brokers have access to lenders that may be easier to deal with than most of the banks are.

The only downside is that I expect my loan will have been sold off to someone else before the first payment even comes due!

Similar experience here, Refi, small cash-out to cover previous HELOC. Big bank I was currently with had all sorts of hoops to jump through but my broker found a better rate with zero dumb stipulations elsewhere. FWIW it’s a smaller-than-average loan for SF since I originally bought in 2011.

higher lending standards keeping a lid on mortgage rates in spite of rising interest rates