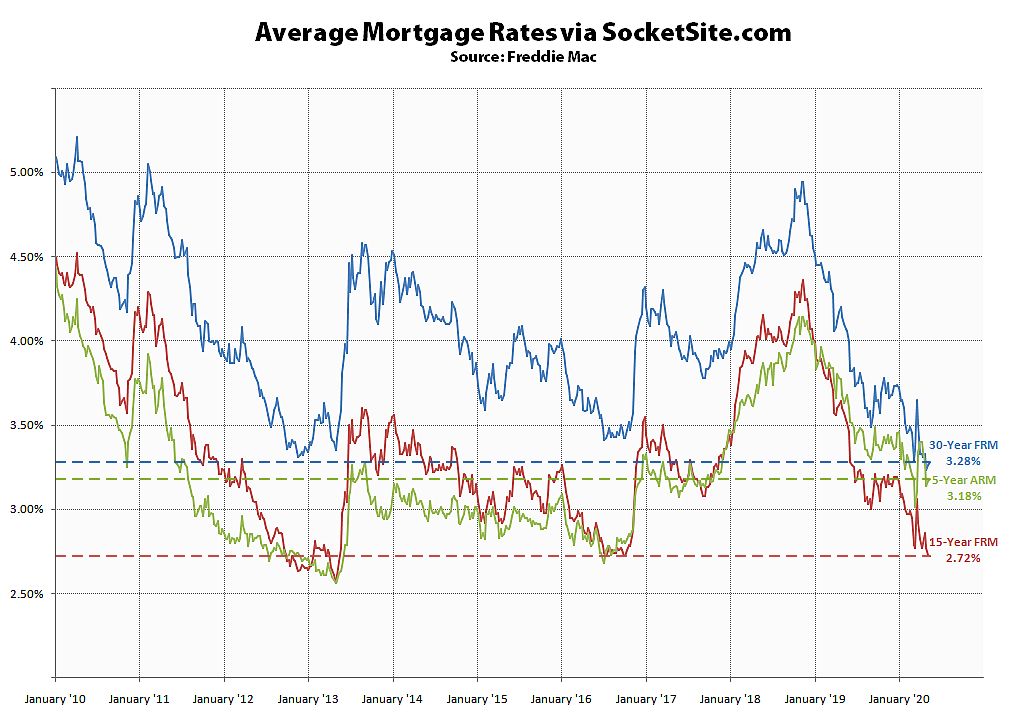

While the average rate for a benchmark 30-year mortgage has inched up 5 basis points (0.05 percentage points) over the past two weeks to 3.28 percent, it’s effectively holding around its all-time low of 3.23 percent and remains 79 basis points below its mark at the same time last year, according to Freddie Mac’s latest Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage has inched down another 5 basis points to 2.72 percent (which is 81 basis points below its mark at the same time last year and within 16 basis points of its all-time low) while the average rate for a 5-year adjustable has inched up 4 basis points to 3.18 percent (which is 48 basis points below its mark at the same time last year and 62 basis points above its all-time low of 2.56 percent).

And while mortgage market activity is still running around 200 percent higher than at the same time last year, it’s still being driven by applications to refinance versus buy but purchase mortgage activity, which remains down on a year-over-year basis, has started to rebound.

UPDATE: The average rate for a benchmark 30-year mortgage has inched down 4 basis points over the past week to 3.24 percent, which is 82 basis points below its mark at the same time last year and within 1 basis point (0.01 percentage points) of its all-time low.