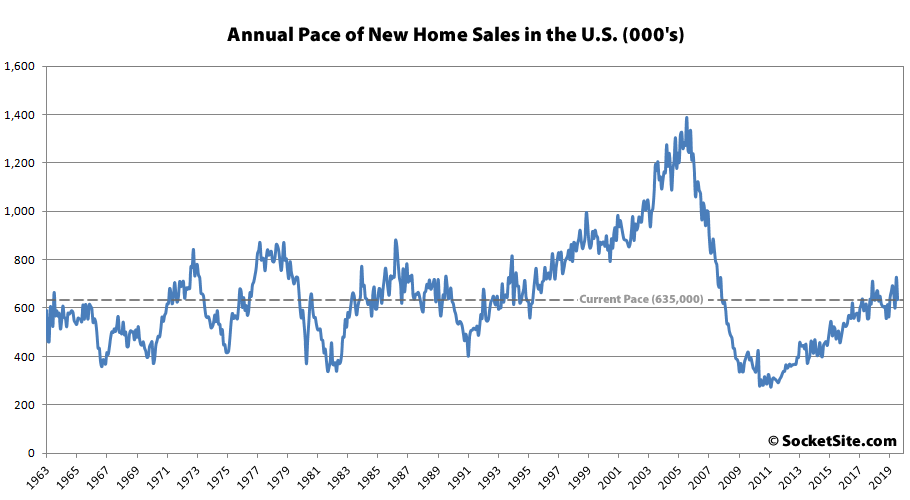

Having jumped an upwardly revised 20.9 percent in June, the pace of new single-family home sales in the U.S. dropped 12.8 percent in July to a seasonally adjusted rate of 635,000 sales, which is still 4.3 percent above the pace of sales at the same time last year.

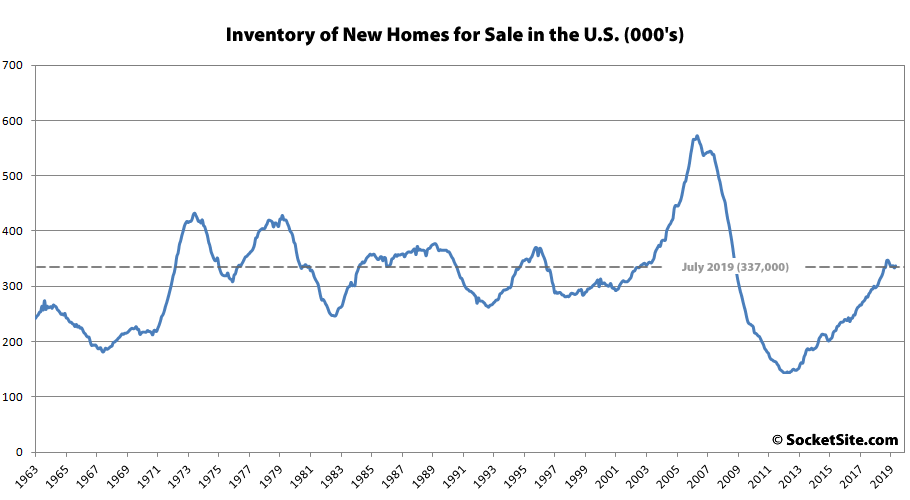

At the same time, the median price of those homes which sold last month was $312,800, down 4.5 percent versus the same time last year and representing the third straight month with a year-over-year drop, while the inventory of new single-family homes for sale across the county inched up another 1.2 percent to 337,000 (which is 7.3 percent higher than at the same time last year and represents 6.4 months of supply versus 6.2 months of supply at the same time last year).

And out West, the seasonally adjusted pace of new single-family home sales totaled 181,000 in July, which was down 14.2 percent from June but 8.4 percent higher on a year-over-year basis with 3.6 percent more new homes now on the market (86,000) than at the same time last year (83,000).

The June Case/Shiller price index is going to be a rocket ship when released this coming Tuesday. And this is before the mortgage rate collapse of the past month and the Uber IPO lockup expiration.

I am failing to see any 1-bedrooms in SF proper failing to sell in less then 2 weeks.

That’s weird. For as we noted last month when you made the same incorrect claim, “the average time on the market for said condos listed for sale in San Francisco, which haven’t yet gone into contract and of which there are around [80], is currently…30 days.”

0.2%?? That’s one tiny tiny rocket ship.