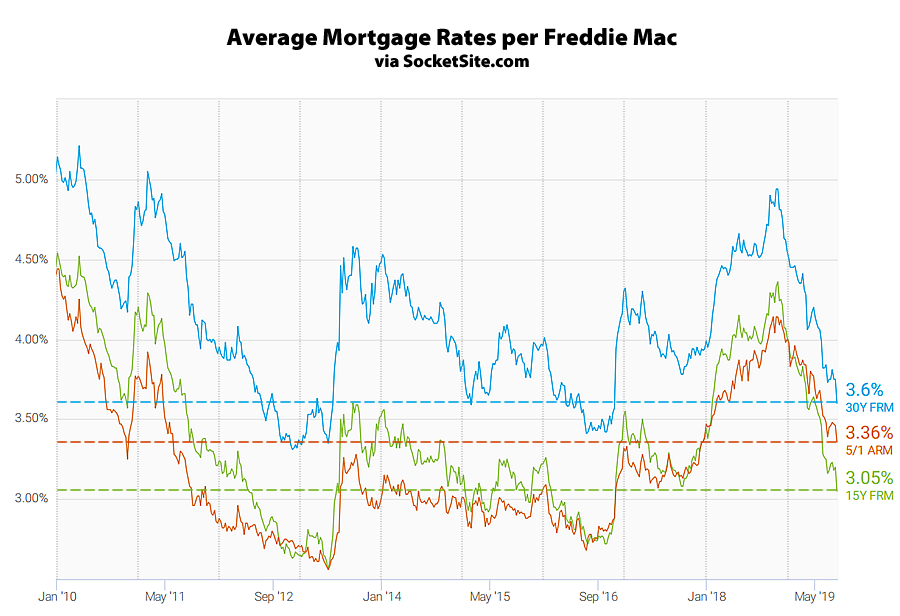

On the heels of the Fed having eased rates last week, the average rate for a 30-year mortgage has dropped 15 basis points to 3.60 percent, which is now 134 basis points (1.34 percentage points) below its mark in the fourth quarter of last year and within 18 basis points of a three-year low.

At the same time, the average rate for a 15-year fixed mortgage dropped 15 basis points to 3.05 percent, which is 100 basis points below its mark at the same time last year, and the average rate for a 5-year adjustable dropped 10 basis points to an inverted 3.36 percent, which is 54 basis point below its mark at the same time last year.

And according to an analysis of the futures market, the probability of the Fed easing rates for a second time this year is now up to 100 percent.

10 year Treasuries are the best predictor of US mortgage rates.

And then there’s this: 20-Year Mortgages Hit Zero for First Time in Danish Rate History. And this: Is Pimco Right That Negative Yields Make Sense?

And this: Greenspan says ‘there is no barrier’ to negative yields in the US and this: Investors Ponder Negative Bond Yields in the U.S.

Good ol’ Al: having helped to derail the economy early in the century, it looks like he’s still there to help keep it off the tracks for the rest of it.

He doesn’t matter.

Just wait until central banks start buying (more) equities.